December 12, 2024

The Energy Professionals Association (TEPA) National Conference, held in Austin, Texas last month, brought industry experts together to discuss the evolving retail energy landscape.

Energy Market Update

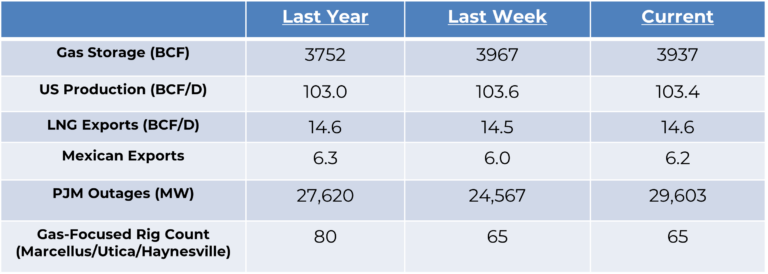

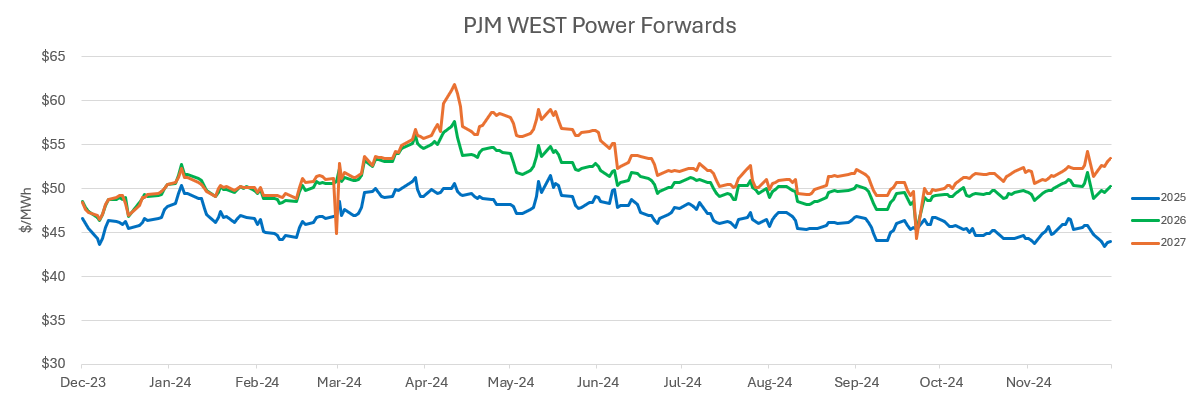

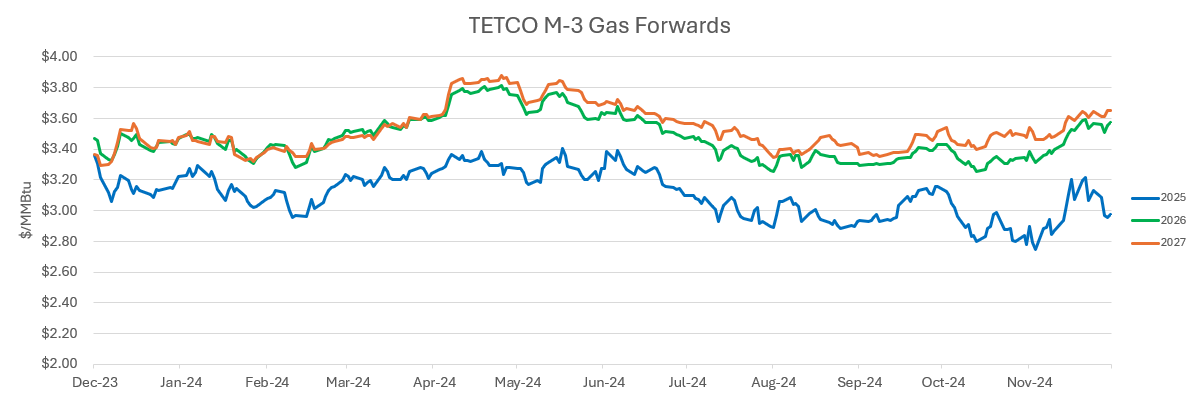

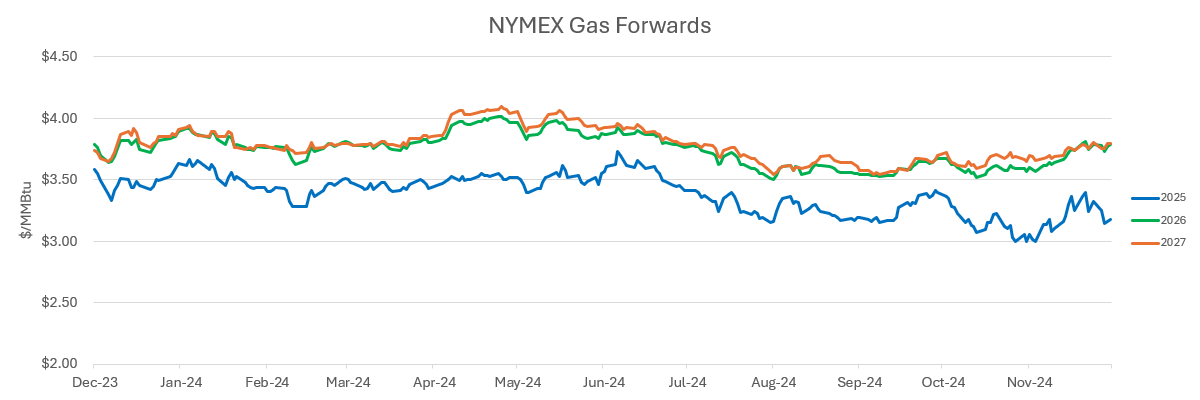

- The early December cold returned some bullishness to both power and gas prices as storage withdrawals have increased which will likely extinguish the inventory overhang from last year and help keep a bid under prices. With the delays in LNG export growth from 2025 to 2025, the market has significantly discounted the front end of the curve (2025 vs. 2026) and created a steep contango between the two years. This is also supported by the expectation of another warm winter which through December 12, 2024, appears to be in serious question with the just released 190 BCF storage withdrawal in today’s EIA report.

- Global LNG prices seem to have stabilized above $15.00/MMBtu as Asia and Europe continue to experience strong spot demand. European storage has already seen significant withdrawals for this early in the season which should help support summer prices.

- Solar cell manufacturing in the United States has resumed in Q3/2024 for the first time since 2019 as US production capabilities improve.

- President-Elect Donald Trump’s oil production goals will be difficult to achieve given the current pricing environment and producers’ reluctance to drill into weakness. Current US oil production is at a record 13.5 million B/D while natural gas production sits at 103 BCF/D.

- Data center demand for power continues unabated as developers look to partner with entities with proven successful development capabilities and/or those companies with a clear line of site for resources that can be ready the soonest.