September 19, 2024

Thank you to those that participated in CPV Retail’s webinar on Navigating the Impacts of PJM’s Base Residual Auction.

Energy Market Update

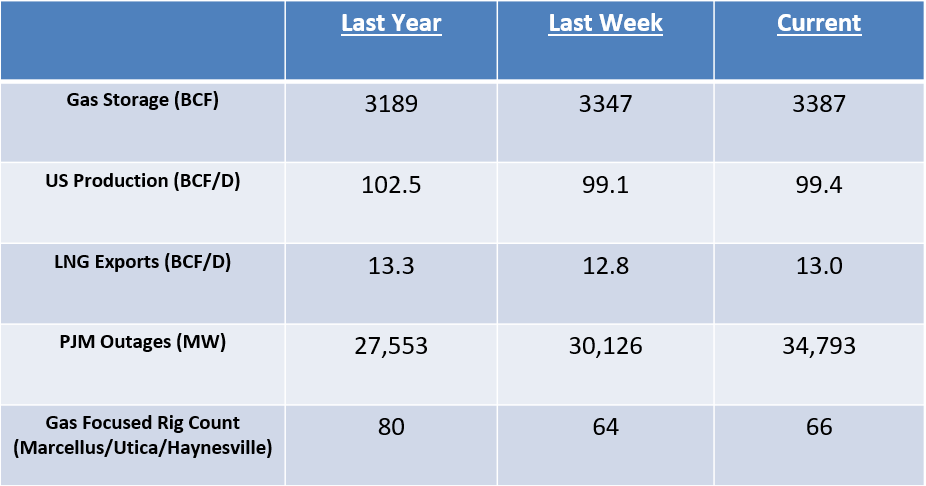

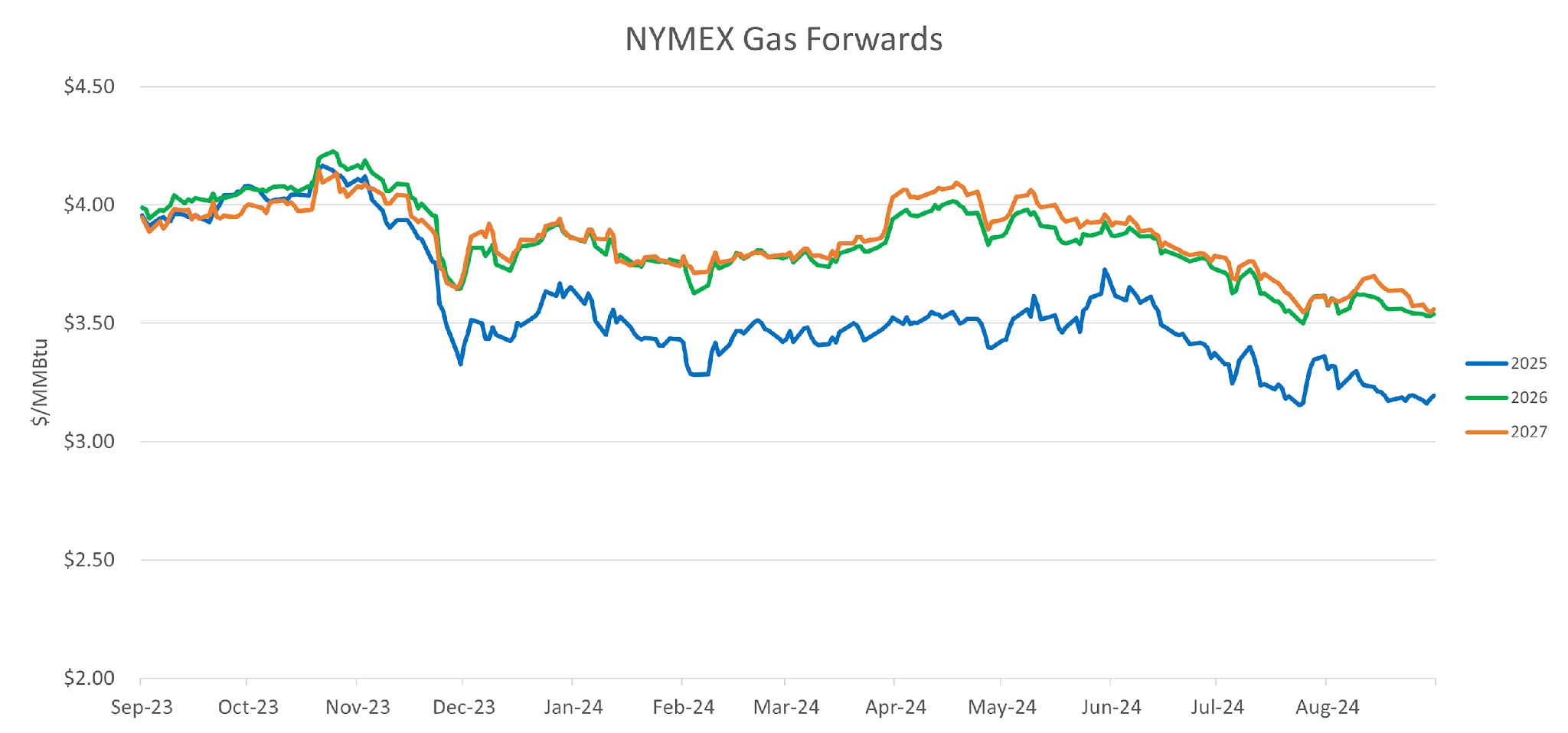

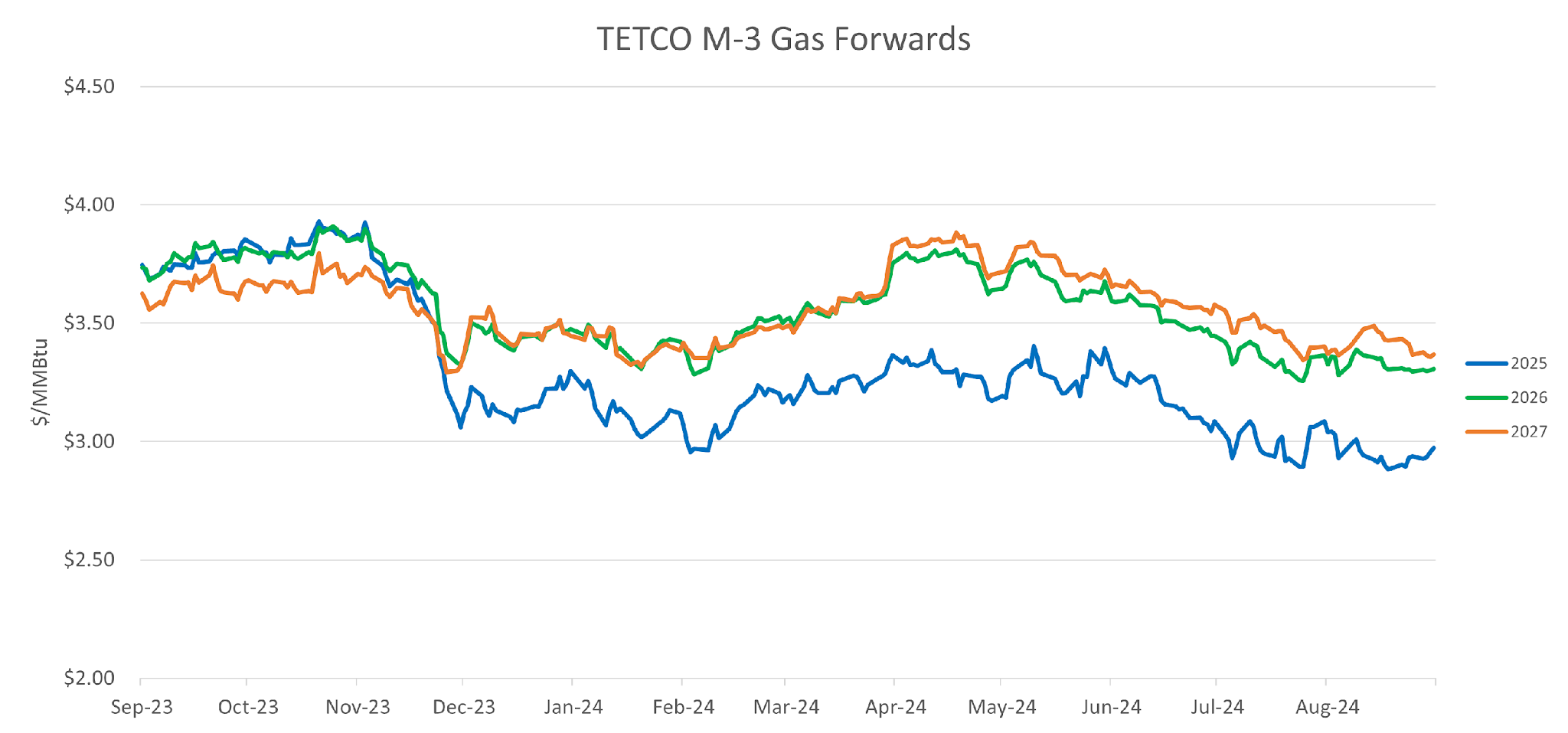

- Natural gas production has declined below 100 BCF/D over the past week as hurricane-related shut-ins from offshore production coupled with economic reductions have allowed the storage excess to decline below 200 BCF for the first time this season. When the injection cycle started in April the excess was over 500 BCF.

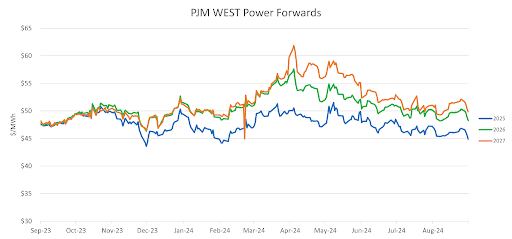

- Mountain Valley Pipeline flows continue to impact prices in the Mid-Atlantic as Transco Zone 5 in particular has seen both cash and forward basis prices decline.

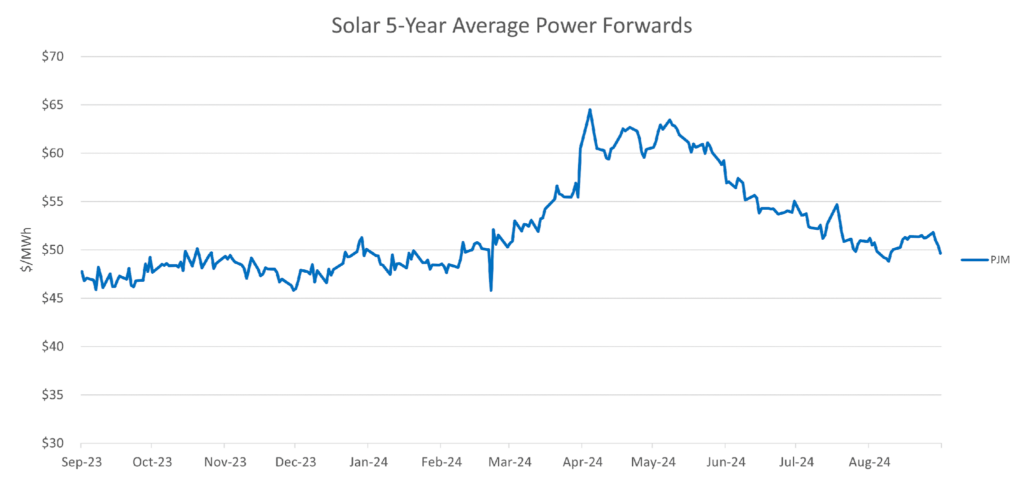

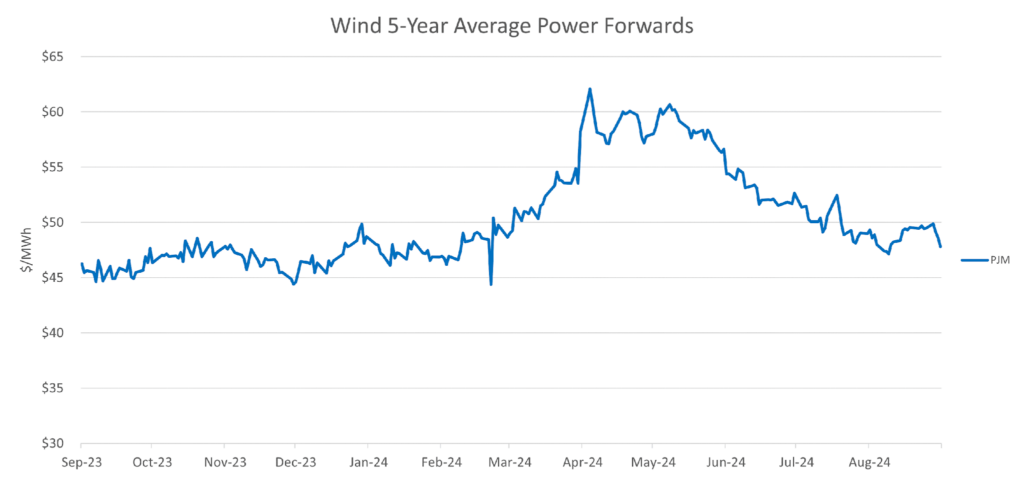

- Data center demand continues to dominate the headlines as developers seek immediate solutions to a long-term challenge. With the need for power escalating, new gas generation is necessary but lead times will prevent meaningful additions before 2030. Balancing short-term solutions with sustainable practices will be crucial as the industry navigates this complex landscape.

- Permian Basin production is now approaching 20 BCF/D with the start-up of Matterhorn Express Pipeline which unfortunately has not yet done much for the negative price trend at WAHA.

- Oil prices briefly dipped below $70/BBL as the rate of growth in demand in China is called into question due to the widespread adoption of electric vehicles and diesel trucks now running on LNG.

- Asian LNG demand remains robust which has kept the premium to Europe’s TTF market by $1.0-$1.50/MMBTU and displaced cargoes from Europe to JKM priced Asia.