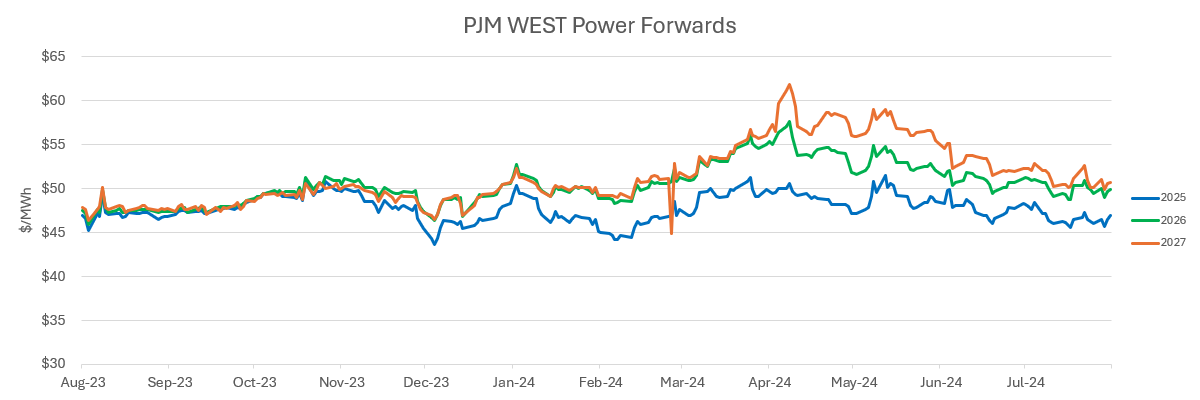

Two laws that one should never try and fight against are the law of gravity and the law of supply and demand. The recent PJM Base-Residual-Auction (BRA) results illustrate how the law of supply and demand can impact pricing outcomes in powerful ways as the RTO value increased from $28.92/MW-day for 2024/2025 to $269.92/MW-day for 2025/2026. This almost 10-fold increase was primarily driven by a forecasted increase in peak load of 3.2 GW and supply decrease through retirements of 5.7 GW off-set slightly by the addition of 1 GW of renewables. Regionally, both the BG&E and Dominion zones broke out and settled at their respective caps above $400/MW-day highlighting to the extreme the drivers of the higher system prices, with BG&E driven by retirements of local generating assets and Dominion driven by rapid load growth primarily from data centers and transmission constraints. While there are many additional parameters considered in this complex analysis, these prices are indicative of a significantly tightening market which is sending an urgent price signal for new generation.

While PJM should be applauded for having the courage to stand behind its auction results and the price signal being sent due to supply and demand fundamentals, load growth driven by the expansion of data center and electrification is only expected to continue and there are limited options for new baseload generation to come online to respond to the need for new resources. CPV’s carbon capture project currently in development in West Virginia, the CPV Shay Energy Center, for instance, is one of the only new combined-cycle facilities in the PJM interconnection queue. Meanwhile, this trend is expected to reverberate across the country as utilities and RTOs suddenly realize how tight the market is and that the path for building additional generation, particularly in light of the new EPA regulations, that is needed to maintain reliability and avoid sustained high prices will be extremely challenging.

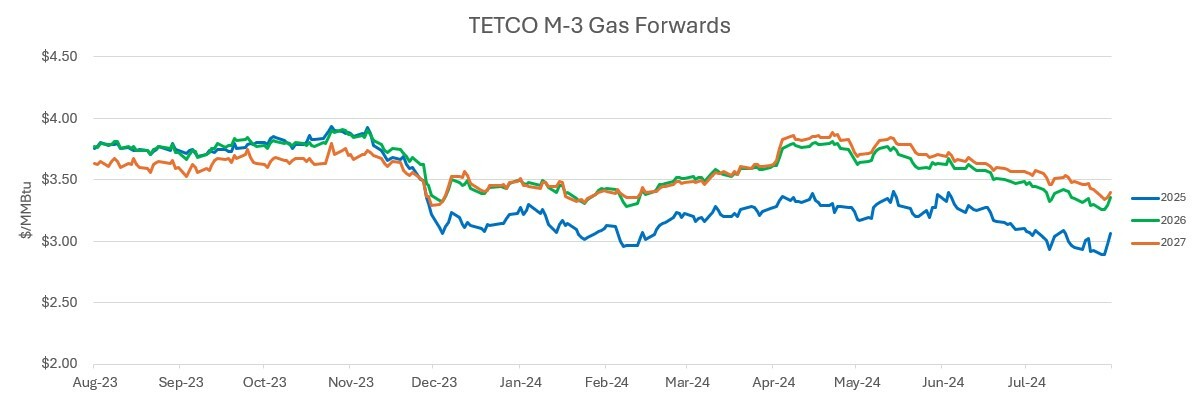

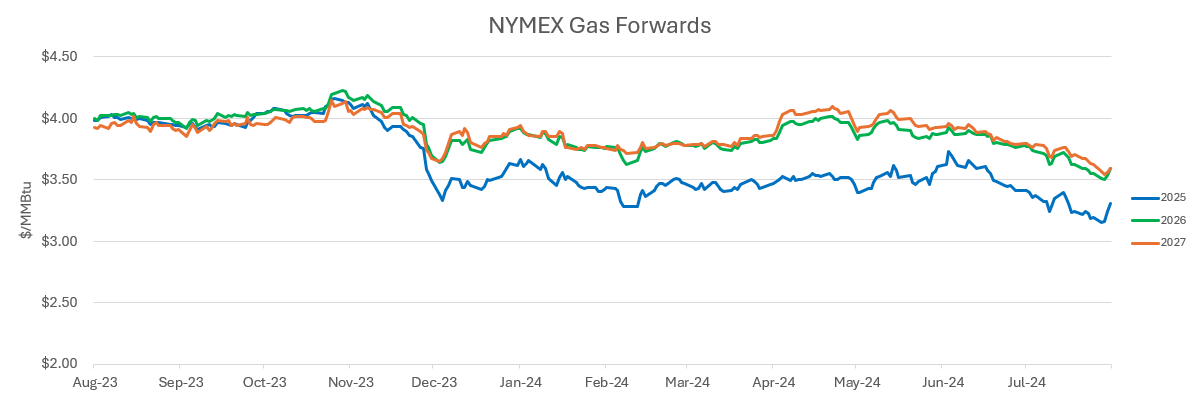

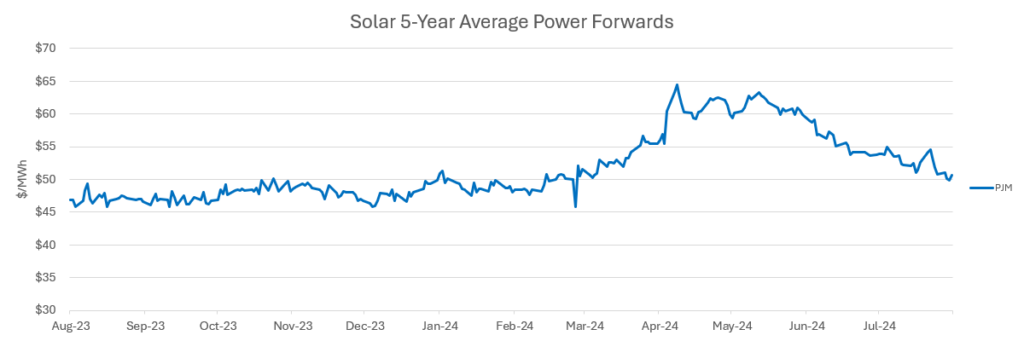

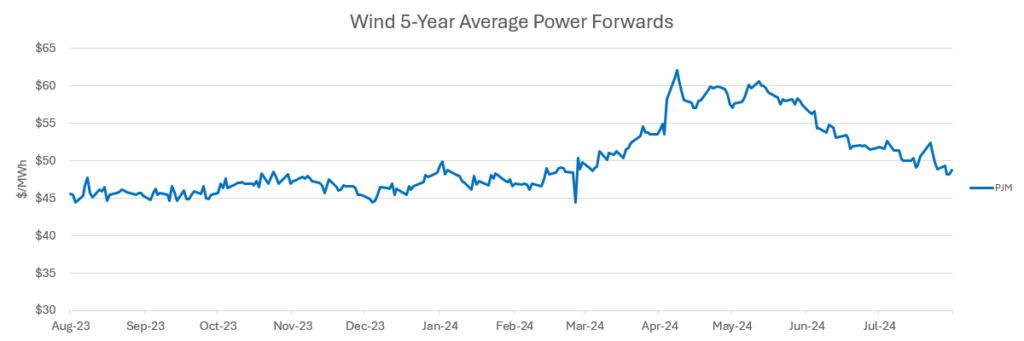

Market implications will almost certainly be substantial, as the cost increase across the PJM footprint for 2025/2026 alone amounts to an incremental ~$13 billion. Ultimately customers will experience a substantial increase in cost when these capacity prices become effective, especially when compared to the record low capacity price of $28.92/MW-day from the prior auction. While fortunate that natural gas prices remain subdued which helps keep energy prices in check, with growing LNG exports as new terminals commercialize in 2025, customers must ask themselves how long that will last.

With years of experience navigating volatile capacity markets, CPV Retail is uniquely positioned to provide valuable market insight to our customers and offer a variety of energy and sustainability products designed to help transparently manage these risks. CPV Retail affiliates also operate some of the newest combined cycle and renewable assets in PJM that provide integrated advantages that non-affiliated competitors lack. With capacity and energy prices expected to remain volatile over the next several years as the market adjusts to this new supply and demand reality, suppliers that made contractual commitments relying on historical capacity prices will be tested on those commitments.

Contact your CPV Retail representative today to discuss how our energy and sustainability products, in-house technical expertise and robust portfolio of efficient thermal and renewable assets can help mitigate these exposures for commercial and industrial clients.

In the coming weeks we will be sending out an invitation to join our upcoming webinar where our CPV Retail experts will dive into this topic and answer your questions.