June 20, 2024

Renewable Energy has come a long way from the 1970’s when solar panels and wind turbines were harnessing electric energy for folks wanting to live off of the land and off the grid. Long gone are the solar panels that President Carter installed on the White House in 1979 in response to the 70’s oil crisis.

Energy Market Update

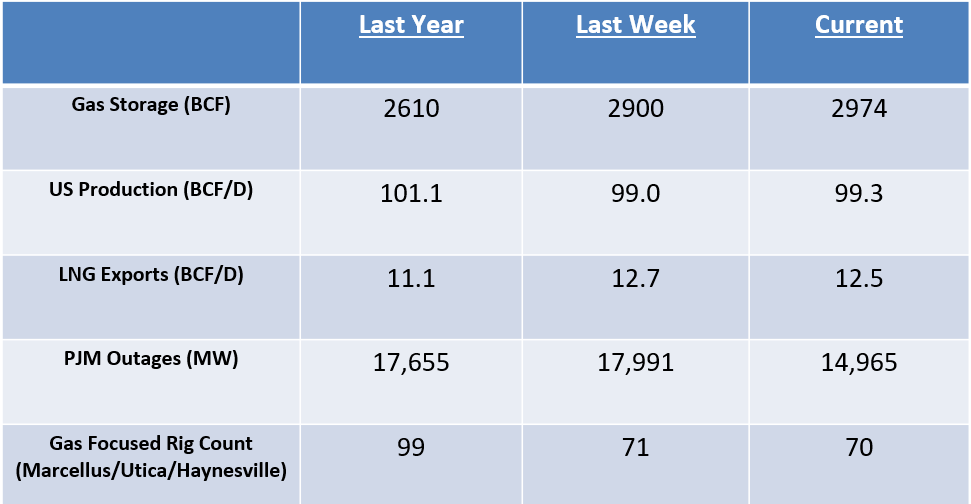

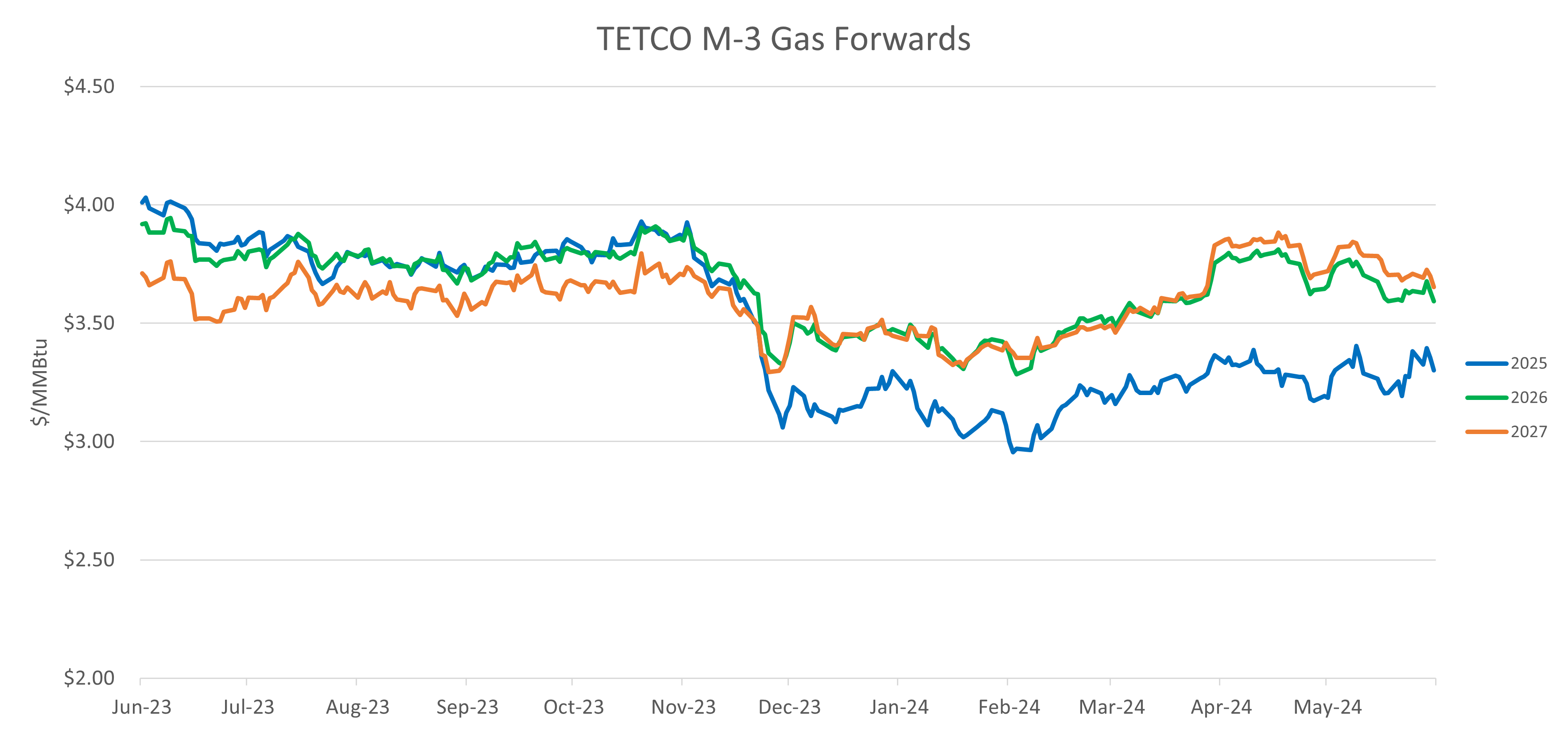

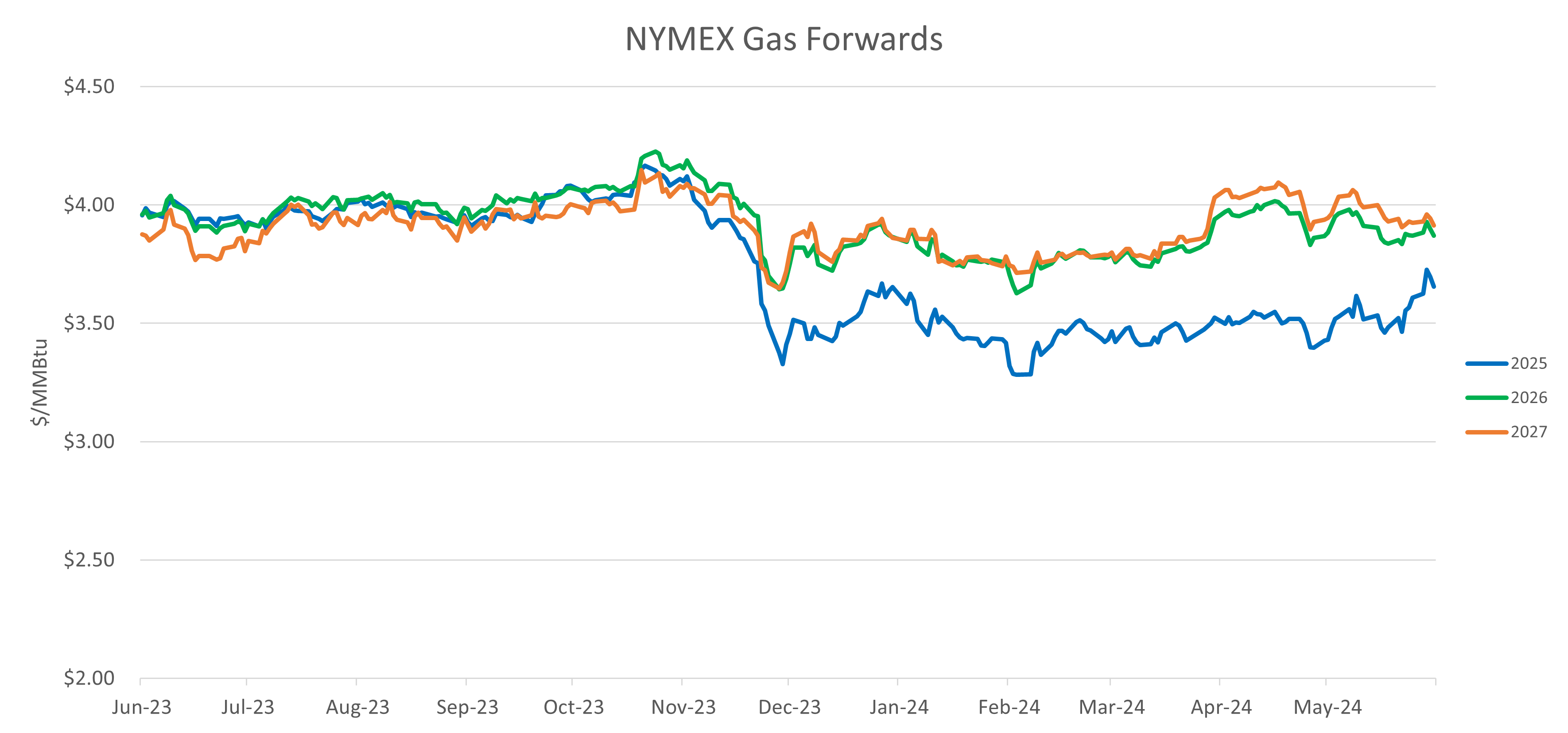

- Natural gas prices for the Jule NYMEX contract made another run back up to $3.15/MMBTU after a hot forecast was published only to attract more sellers. Heat is here and cash prices remain weak, but storage balances should start to tighten again.

- Mountain Valley Pipeline finally was able to initiate service this week after almost 10 years and over $7 billion in construction costs. It remains to be seen what the overall impact will be and how local gas supplies will be reallocated based on economics.

- Oil prices have rebounded quickly from the recent sell-off caused by bearish demand forecasts and look to be well-supported at $80/BBL. Showing confidence in the future of oil motivated Berkshire to add to its holding in Occidental Petroleum which is now up to almost 30%.

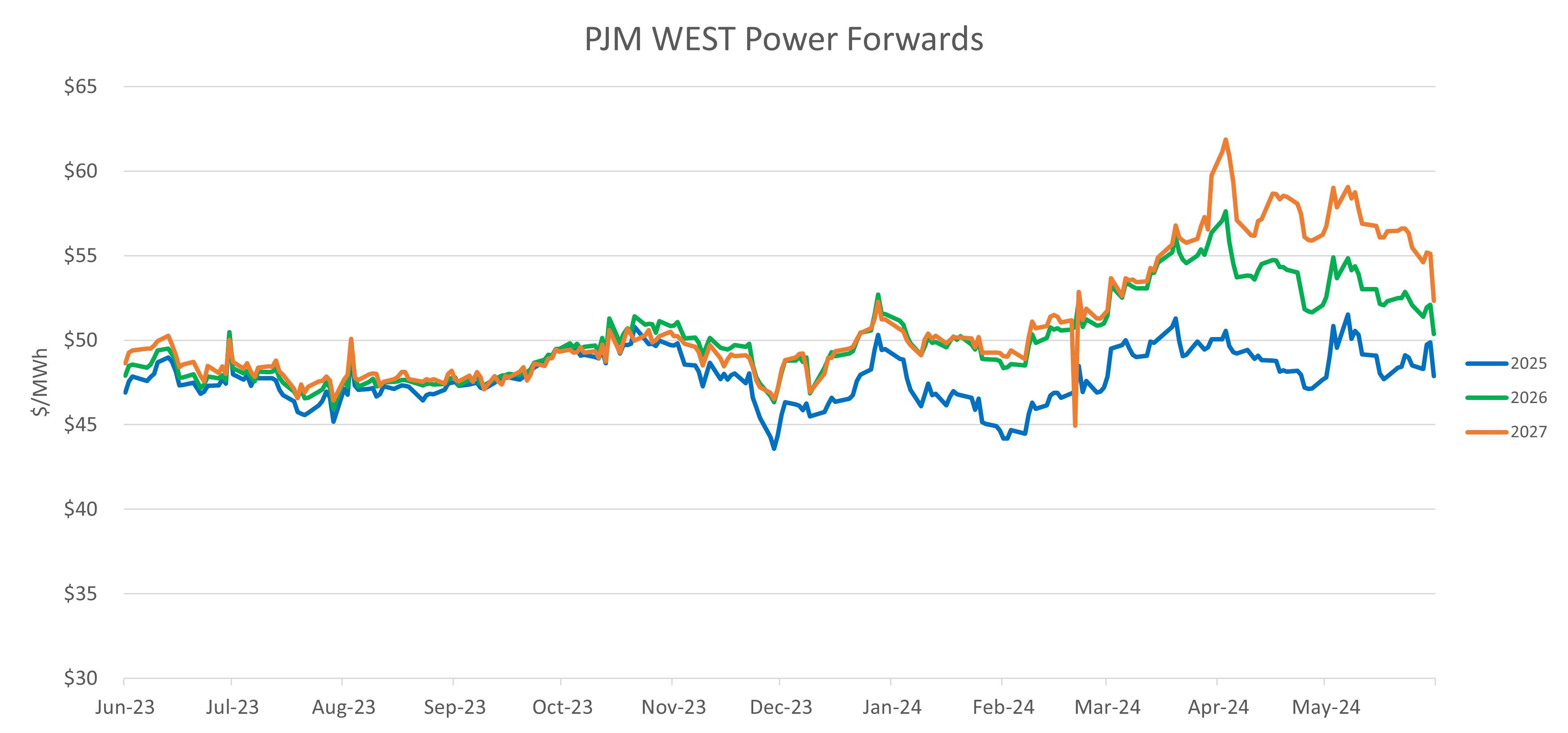

- The heat wave along the eastern seaboard pushed PJM’s load forecast above 150 GW with many consecutive days above 140 GW.

- The impact of Artificial Intelligence and Data Centers continues to be the topic du jour as large corporate buyers struggle to obtain enough de-carbonized power and the power demand growth forecasts continue to increase.

- Global LNG demand remains robust as heat in Asia sparked a lot of spot buying and supplies tightened reducing deliveries into Europe thus supporting prices around $11/MMBTU.

- PJM’s load forecast for this upcoming heat wave has demand reaching up to 150,000 MW for this Friday.