April 10, 2024

A recent quote at the Bloomberg Intelligence Summit from a cloud-computing executive supported the view that electricity demand is and will continue to increase rapidly. This executive stated that the world is “grossly” underestimating how much AI will expand the need for data centers and that they have received an “absurd” amount of data center requests over the last several quarters...

Energy Market Update

- Recent weekend cash prices continue to show weakness as the shoulder season is upon us and the system transitions to injections. Prices at WAHA continue to be negative while Houston Ship Channel prices are at lows not seen in a decade below $1.00/MMBTU.

- Oil prices continue to rally as global demand continues to surprise to the upside and product inventories continue to draw down due to refinery availability issues. With Brent now above $90/BBL lower priced LNG is now a more compelling value for many Asian buyers and it is showing up as incremental sets a record for March deliveries.

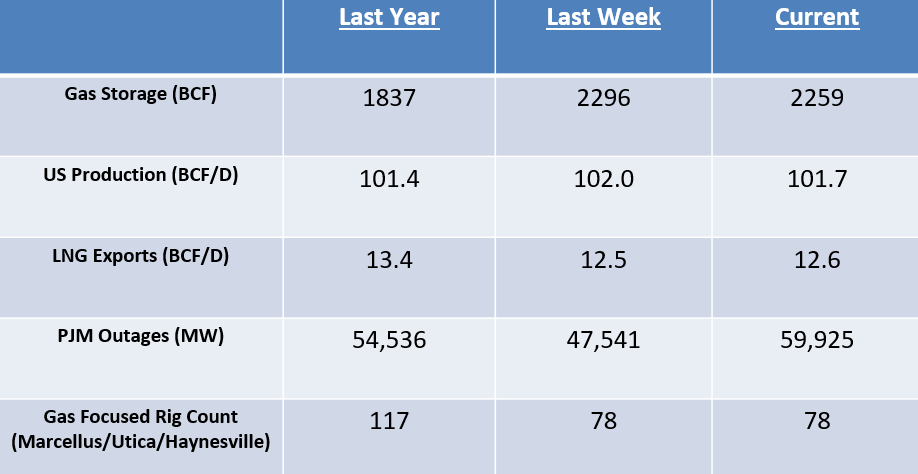

- US production has settled in around 101-102 BCF/D as gas-focused drilling reductions and natural shale-driven declines help keep production in check which will mitigate the likelihood of late injection season congestion.

- Smaller wind and solar generators may become subject to NERC reliability standards if approval from FERC is received as is sought in the recent March 19 filing.