March 19, 2024

Flexibility and optionality are critical parameters to focus on when building a portfolio whether you are on the buy side or the sell side. If you were not a believer of this prior to February 24, 2022, you certainly are now that the war in the Ukraine is entering its 3rd year. (Some would argue that the war started more than a decade ago but let’s stick with the narrative.)

Market Drivers

Energy Market Update

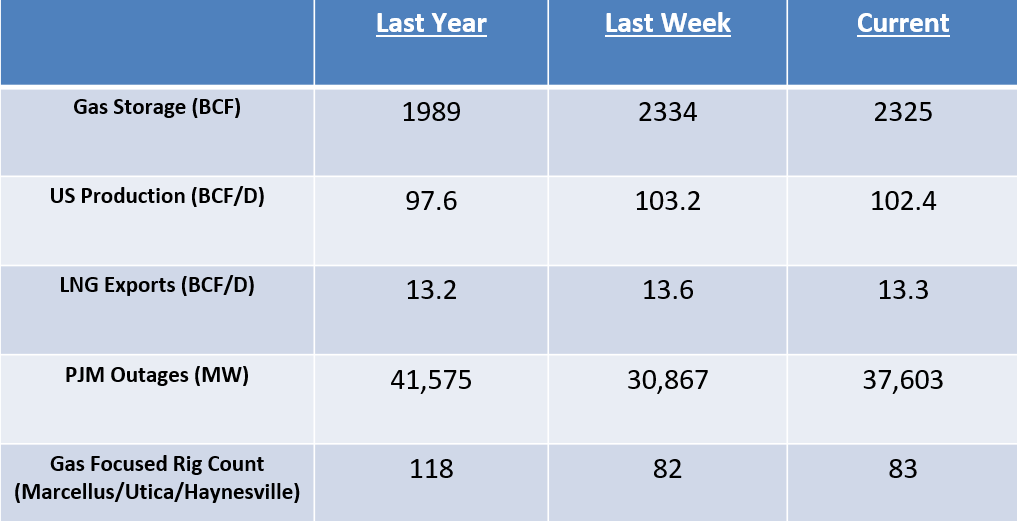

- Domestic natural gas producers continue to throttle back current production and reduce future drilling and/or delay completions which has helped lower production by about 3.5 BCF/D to its current average of approximately 102.5 BCF/D. Haynesville production in particular looks to be declining a bit more rapidly than originally expected. This is down from December’s all time high of 106 BCF/D and will help reduce the possibility of storage congestion later in the year if maintained.

- Oil prices have rallied back above $80/BBL as strong global demand, tensions in the Middle East and no US Strategic Petroleum Reserve releases have helped keep the market biased to the upside.

- Weather-adjusted natural gas fired power demand is expected to remain robust throughout the balance of the year supported by low prices.

- Freeport LNG has extended the outage at one of its liquefaction trains as it continues to investigate the on-going operational issues that has plagued the terminal. Train 3 was expected to re-start in March, but this has now been pushed out at least one month thus leaving more supply available in an already over-supplied market.

- Plaquemines LNG is still targeting Q3/2024 for the initial phase of commercialization and perhaps the first cargo of the super-chilled gas to be exported. The timing could help mitigate the possibility of storage congestion which could be an issue in late Q3 given current inventory balances.