january 14, 2026

Looking Back and moving Forward: Highlights from 2025

Reflecting on 2025 and Preparing for the Year Ahead

Market Drivers

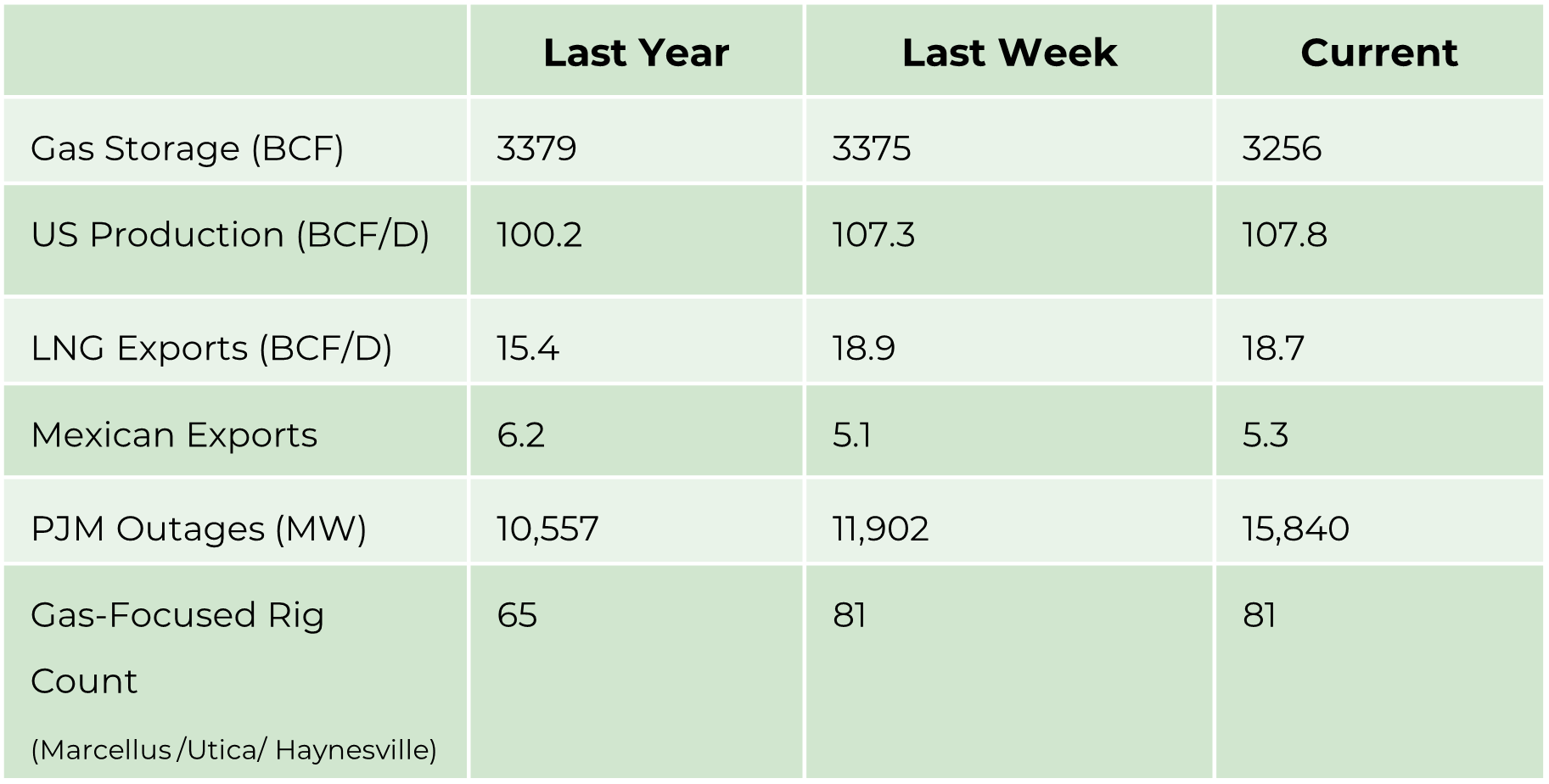

- Gas Storage/Year over year difference. A positive number is bearish, and a negative number is bullish.

- Production /Year over year growth/trend is important in the context of demand growth.

- LNG Exports/Year over year growth means demand is growing and should be looked at in comparison to production trend.

- Mexican Exports/Add to LNG Exports to show a trend in exports compared to the production trend.

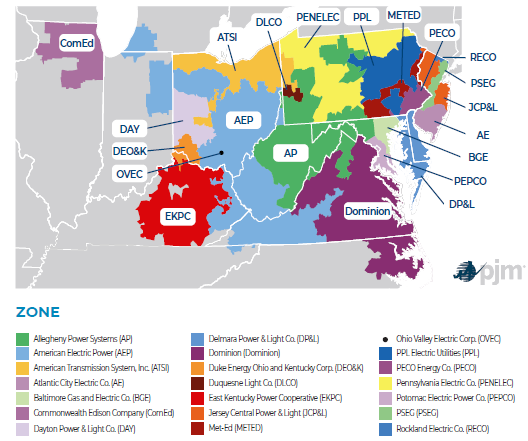

- PJM Outages- generally seasonal in Spring or Fall/Can support short-term prices.

- Gas Focused Rig Count/Is drilling increasing to grow production versus demand growth. This can be seen as impacting price in the future based on expected load growth.

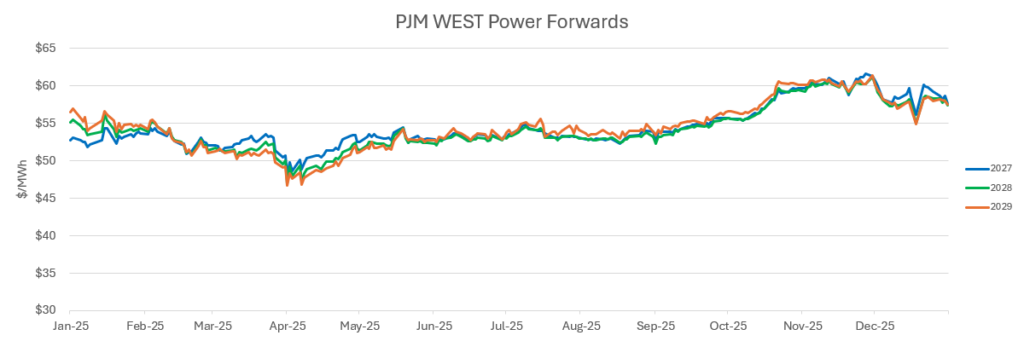

Energy Market Update

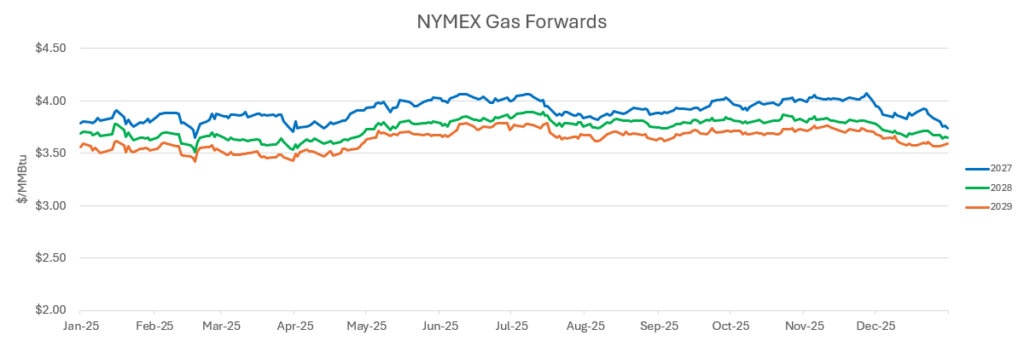

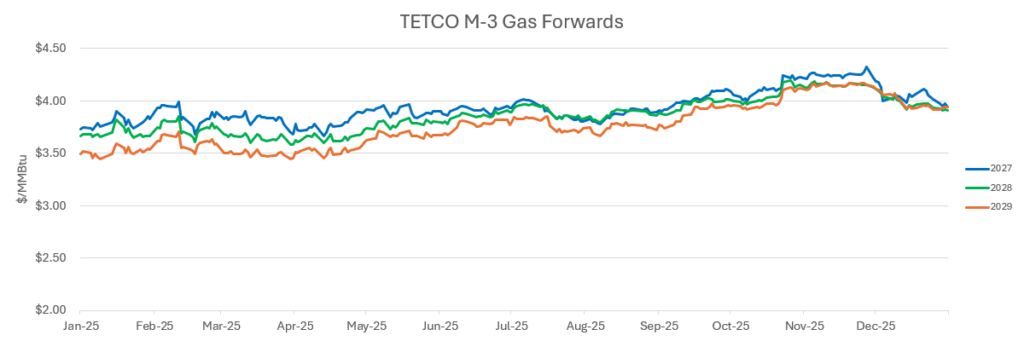

- Traders expected cold winter weather to drive strong natural gas demand and higher prices. January prices reflected that optimism, with prices around $4.70/MMBTU. But warmer-than-normal weather arrived, cutting heating demand. As a result, February futures and spot prices fell sharply (February NYMEX prices have sold off along with daily cash prices with Eastern Gas South trading as low as $2.05/MMBTU on January 8, and storage withdrawals were much smaller than expected — leading traders to ask, “where is the cold?”

- The weekly storage withdrawal comparisons will certainly add to the bearish mindset of the market as expectations of large weekly drawdowns will prove disappointing when compared to recent history.

- Oil prices continue to languish below $60/BBL calling into question how fast Permian Basin associated gas production will increase as newly built egress out of West Texas looks to debottleneck the basin while raising prices. Negative prices continue to plague producers’ growth plans.

- PJM was unable to procure sufficient capacity in its most recent Base Residual Auction as forecasted demand continues to increase and new thermal dispatchable generation is still years away.

- News out of Venezuela has added another source of volatility to the oil markets. Traders remain cautious about the prospect of additional supply hitting the market short term and the longer term implications for Venezuelan oil production remains uncertain.

- European LNG prices are at multi-year lows even as storage balances remain well below normal levels and pipeline flows out of Russia remain at a trickle. Prices in Asia have also been under pressure as China has increased pipeline takes from Russia as well as increased domestic production.