October 3, 2025

Perspectives from Energy Management on the Growing Data Center Demand and Energy Supply

Recent FERC discussions and PJM capacity auction results spotlight the mounting strain data-center growth is placing on the U.S. grid. In this blog, we highlight some of the factors at play.

By: Bob Barron, VP, Energy Management at CPV

Market Drivers

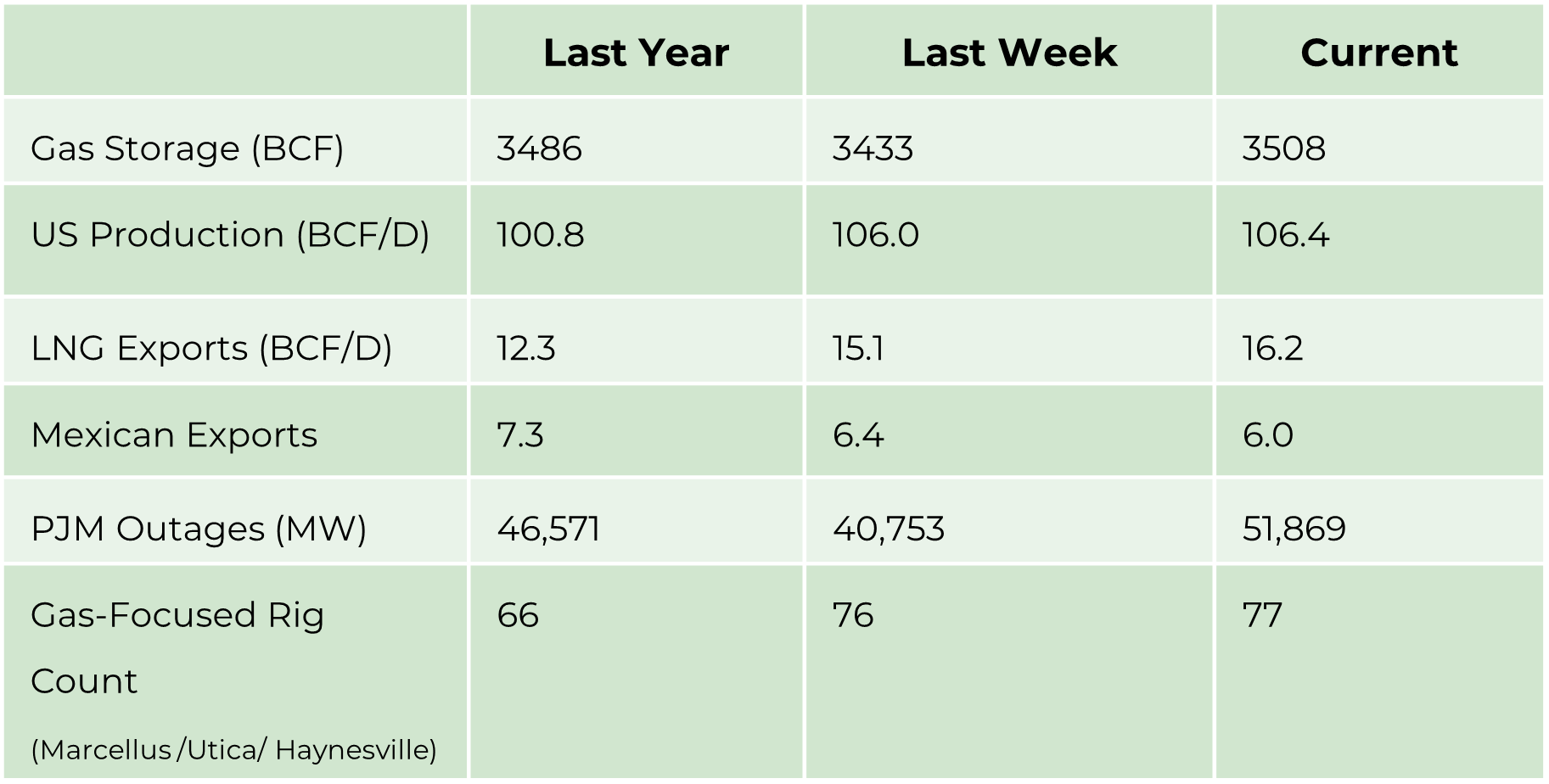

- Gas Storage/Year over year difference. A positive number is bearish, and a negative number is bullish.

- Production /Year over year growth/trend is important in the context of demand growth.

- LNG Exports/Year over year growth means demand is growing and should be looked at in comparison to production trend.

- Mexican Exports/Add to LNG Exports to show a trend in exports compared to the production trend.

- PJM Outages- generally seasonal in Spring or Fall/Can support short-term prices.

- Gas Focused Rig Count/Is drilling increasing to grow production versus demand growth. This can be seen as impacting price in the future based on expected load growth.

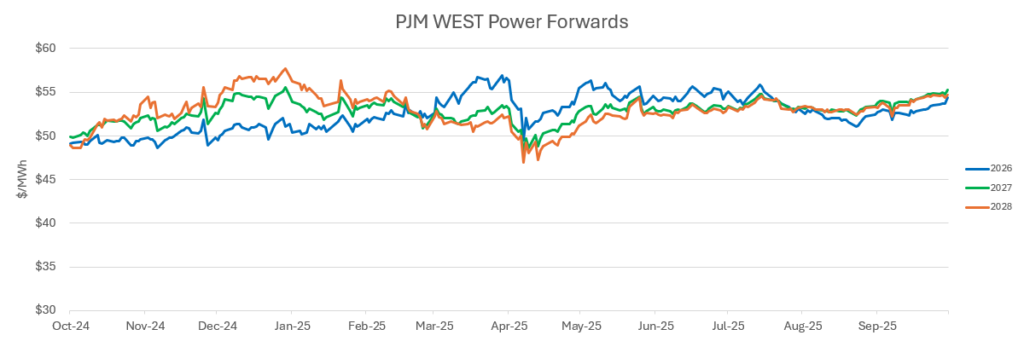

Energy Market Update

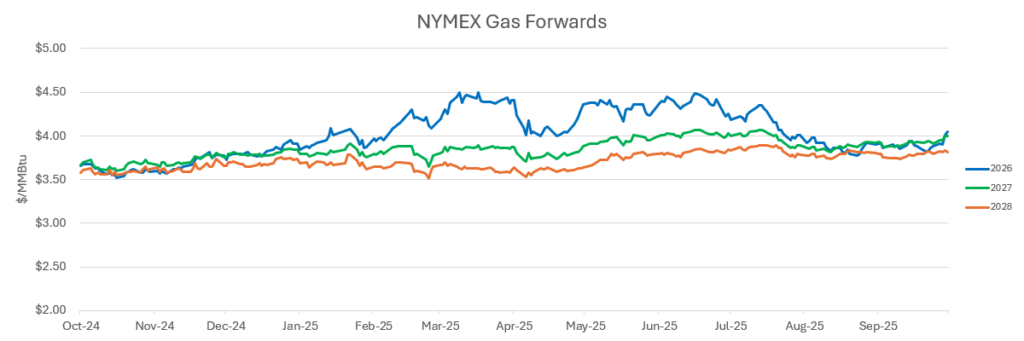

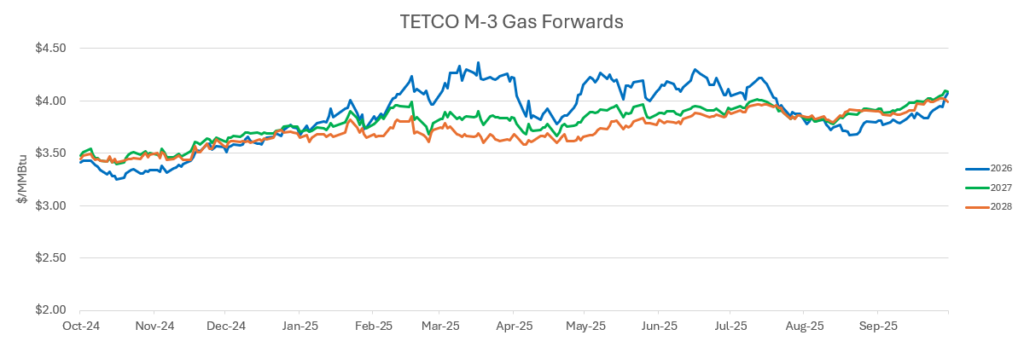

- Mild weather along with continued robust domestic production has allowed storage injections to increase at seasonally higher levels and pushed spot cash and NYMEX prices lower. With November now the prompt month it becomes a battle between the pre-winter buying and the bearish cash market while everyone awaits the first hint of cold weather.

- Even with Cove Point LNG down for its seasonal maintenance, aggregate US LNG exports remain strong as both Plaquemines and Corpus Christie add capacity while Golden Pass initiates its commercialization process. US exports could hit 20 BCF/D by the end of Q1/2026.

- US storage inventories are likely to surpass last year’s level of 3.9 TCF with 6 more weeks of injections expected under normal conditions. In the past injections have continued beyond the normal end of the season (April through October) which has amplified early season bearishness.

- Recent pipeline outages in West Texas and Alberta have pushed WAHA and AECO prices negative. Several Canadian producers have decided to shut-in about 1 BCF/D in order to avoid the calamity of paying counterparties to take their gas.