August 4, 2025

An Analysis of the 2026/2027 pJM Base Residual auction Results

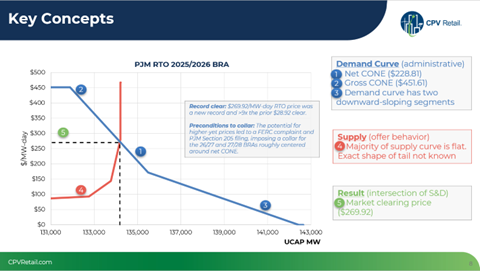

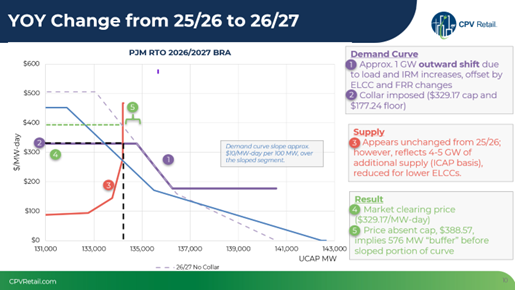

Following the recent release of the PJM BRA Results for 2026/2027, CPV Retail held a webinar to provide a detailed analysis of the outcomes and the factors that led to these results. Below is a brief summary of the key points discussed during the session.

Market Drivers

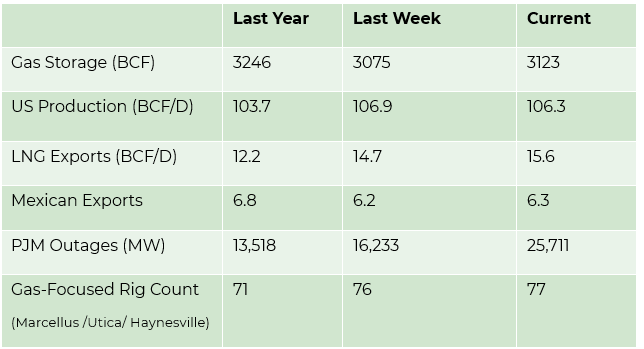

- Gas Storage/Year over year difference. A positive number is bearish, and a negative number is bullish.

- Production /Year over year growth/trend is important in the context of demand growth.

- LNG Exports/Year over year growth means demand is growing and should be looked at in comparison to production trend.

- Mexican Exports/Add to LNG Exports to show a trend in exports compared to the production trend.

- PJM Outages- generally seasonal in Spring or Fall/Can support short-term prices.

- Gas Focused Rig Count/Is drilling increasing to grow production versus demand growth. This can be seen as impacting price in the future based on expected load growth.

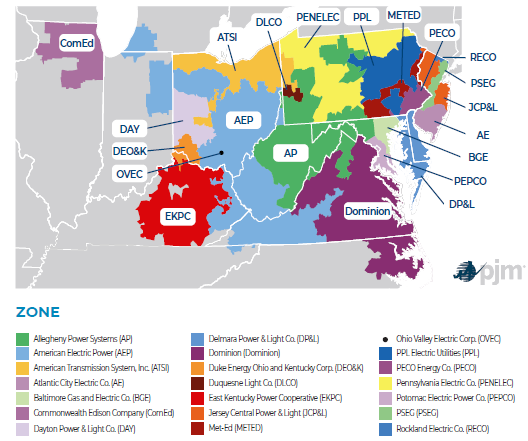

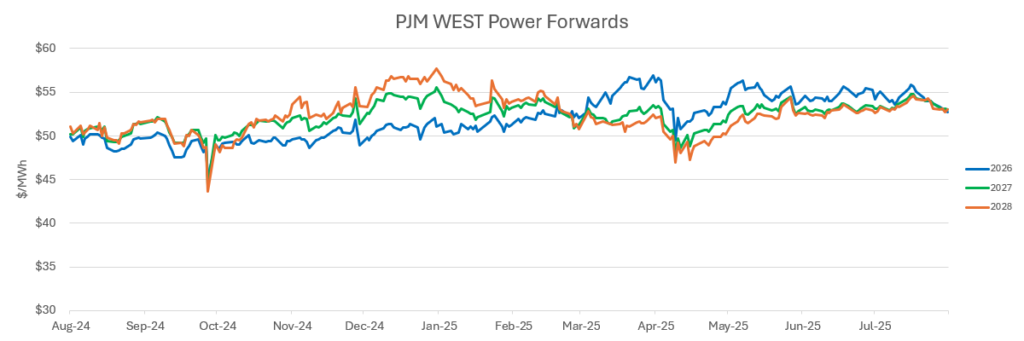

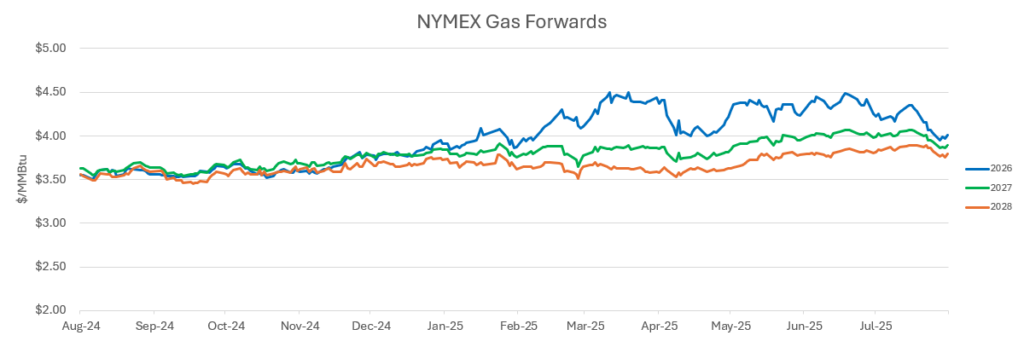

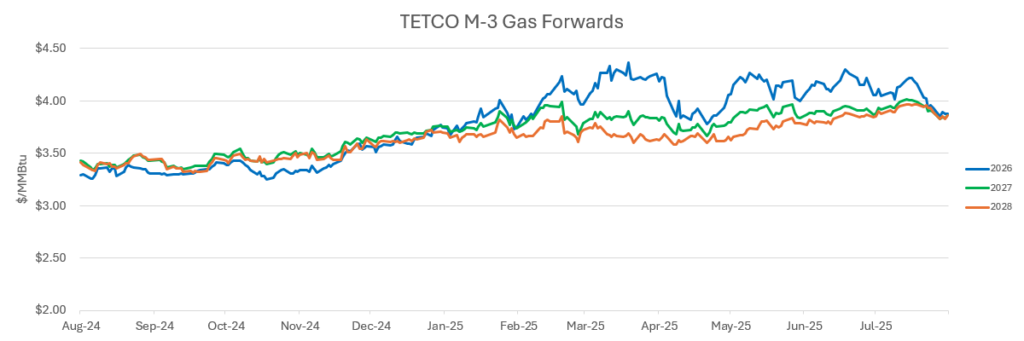

Energy Market Update

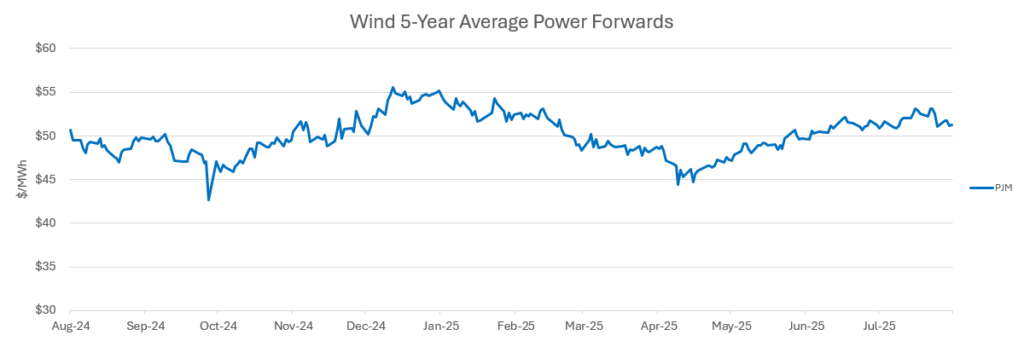

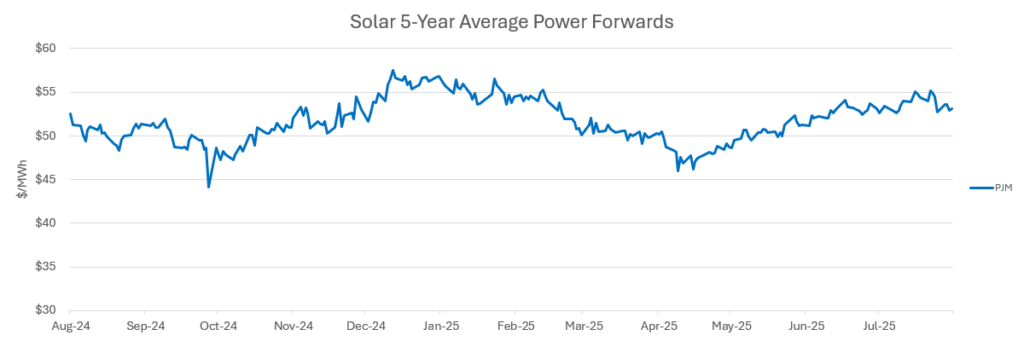

- Another heat wave last week concentrated along the population centers in PJM and the southeast induced more volatility into the power markets with day-ahead prices approaching $300/MWH and strong sparks across the grid.

- PJM loads increased and pushed available reserves to extremely low levels as total demand across the footprint exceeded 155,000 MW for several consecutive days, as the ISO went to MaxGen conditions.

- Natural gas-fired generation demand hit a 2025 summer peak last week above 56 BCF/D, with delivered prices in New England exceeding $5.0/MMBTU for several days.

- Strong US production, which averaged close to 107 BCF/D during the recent heat wave, has ensured storage injections remain seasonally elevated and further reduced the differential to last year. Given this pattern, it is expected that total inventories heading into the upcoming winter could exceed last year’s level and possibly reach 4.0 TCF.