June 3, 2025

A Deeper Look at TEPA Ohio Conference: Highlighting Market Shifts, Legislative Impacts, and strategic Opportunities

At the TEPA Ohio Conference in Columbus last month, energy professionals gathered to discuss how legislative updates are transforming Ohio’s electricity market. To help you stay ahead of the evolving markets and provide real-time insights, this blog provides an overview of the key points discussed during the daylong conference, as well as updates on recent developments in Ohio.

Market Drivers

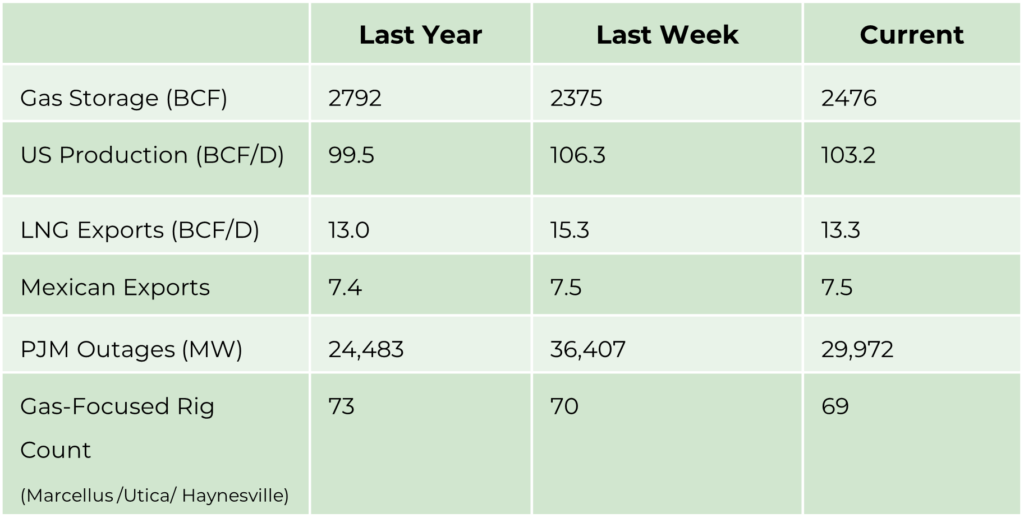

- Gas Storage/Year over year difference. A positive number is bearish, and a negative number is bullish.

- Production /Year over year growth/trend is important in the context of demand growth.

- LNG Exports/Year over year growth means demand is growing and should be looked at in comparison to production trend.

- Mexican Exports/Add to LNG Exports to show a trend in exports compared to the production trend.

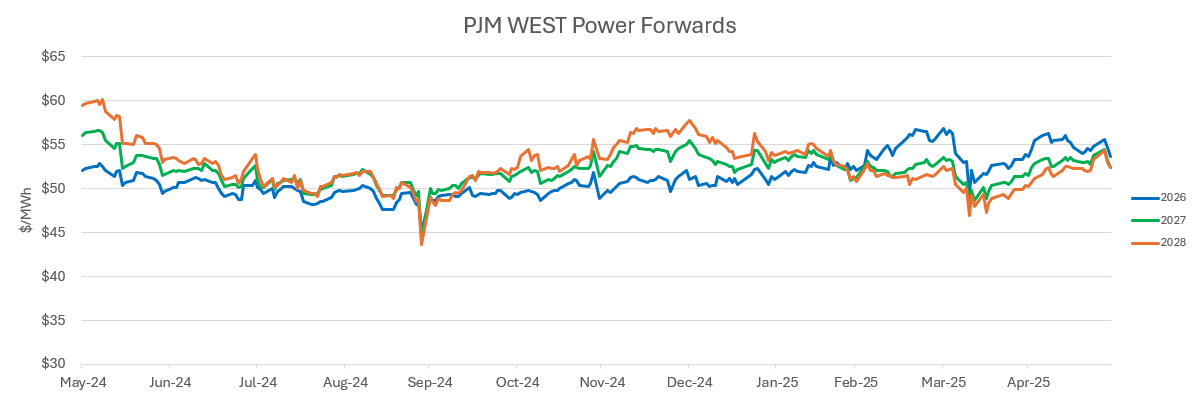

- PJM Outages- generally seasonal in Spring or Fall/Can support short-term prices.

- Gas Focused Rig Count/Is drilling increasing to grow production versus demand growth. This can be seen as impacting price in the future based on expected load growth.

Energy Market Update

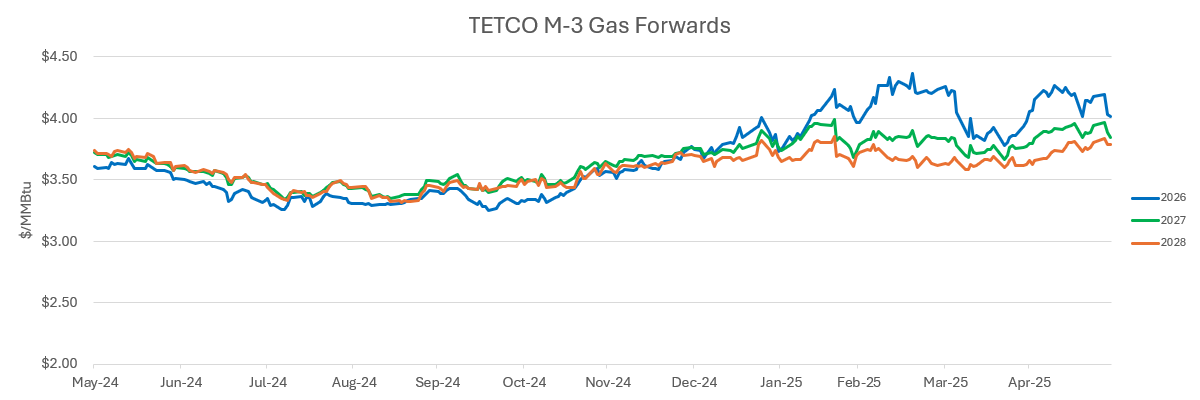

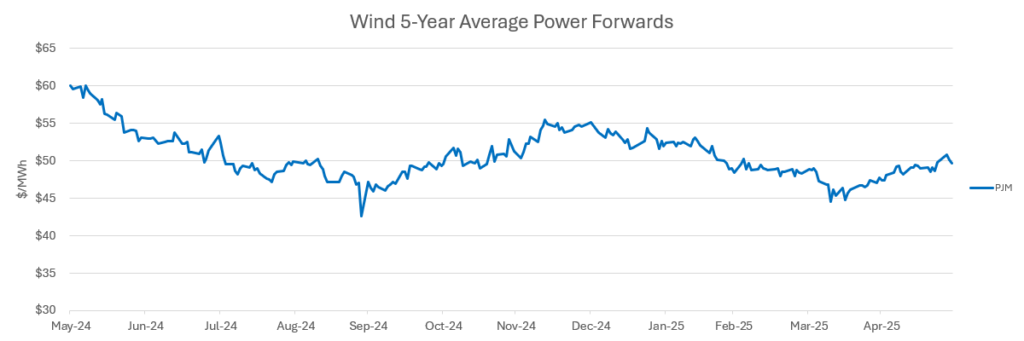

- Mild weather has gripped the northeast areas, leading to extremely low demand and correspondingly low prices for both gas and power while simultaneously allowing for continued triple-digit injections.

- Recent strength in the July NYMEX contract seems at odds with the relentlessly weak cash prices being realized in the Northeast, where prices have dipped below $2.0/MMBtu primarily due to low power demand.

- US LNG exports have declined recently due to scheduled maintenance at several projects, which has also contributed to the strong weekly injections as reported by the EIA. This trend is expected to continue, and we could easily experience a record 7 consecutive weeks of triple-digit injections.

- Wildfires in northern Alberta have caused Canadian producers to shut in several oil sands projects, which have reduced Canadian production by almost 10% (400,000 BBL/D).

- Floundering oil prices are expected to continue with Brent trading around $65/BBL and West Texas Intermediate straddling $62/BBL, which is causing producers to review capital requirements for the balance of the year, which could lead to production declines heading into 2026.

- LNG demand remains robust in Europe as various European Union (EU) members aggressively maneuver to refill storage after the first cold winter since the invasion of Ukraine depleted inventories below historical levels. Pipeline supplies originating from Russia continue to be shunned by most EU members.