April 29, 2025

Tracking PJM’s Cap and Floor Approval

By Bob Barron, Vice President of Energy Management, CPV

Tracking the chronology of key events that have led to the recent FERC approval of a cap and a floor for the next two Base Residual Auctions run by PJM.

Market Drivers

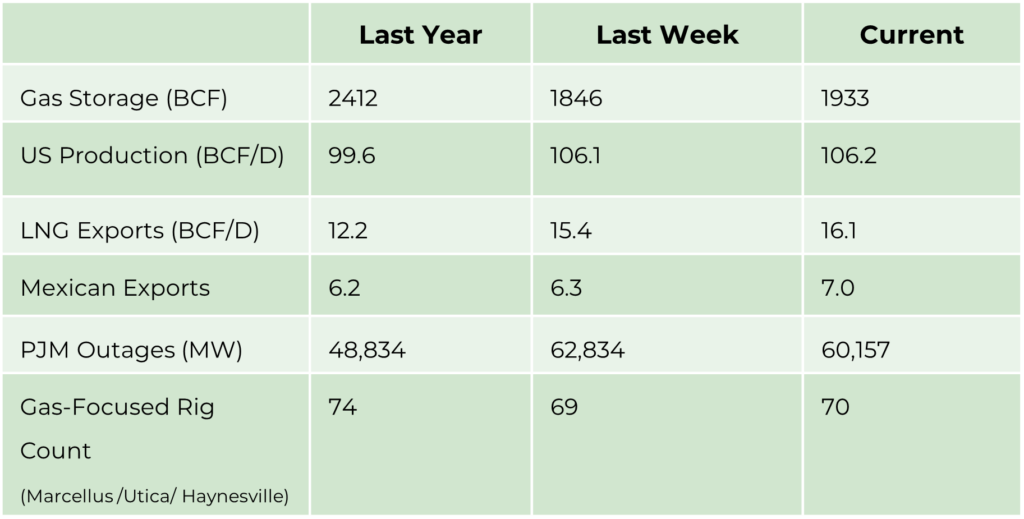

- Gas Storage/Year over year difference. A positive number is bearish, and a negative number is bullish.

- Production /Year over year growth/trend is important in the context of demand growth.

- LNG Exports/Year over year growth means demand is growing and should be looked at in comparison to production trend.

- Mexican Exports/Add to LNG Exports to show a trend in exports compared to the production trend.

- PJM Outages- generally seasonal in Spring or Fall/Can support short-term prices.

- Gas Focused Rig Count/Is drilling increasing to grow production versus demand growth. This can be seen as impacting price in the future based on expected load growth.

Energy Market Update

- PJM outages remain seasonably high with over 60 GW still out on scheduled maintenance, while the first real hint of heat has snuck into the recent forecast with mid-80-degree temperatures expected in the Washington, D.C. area.

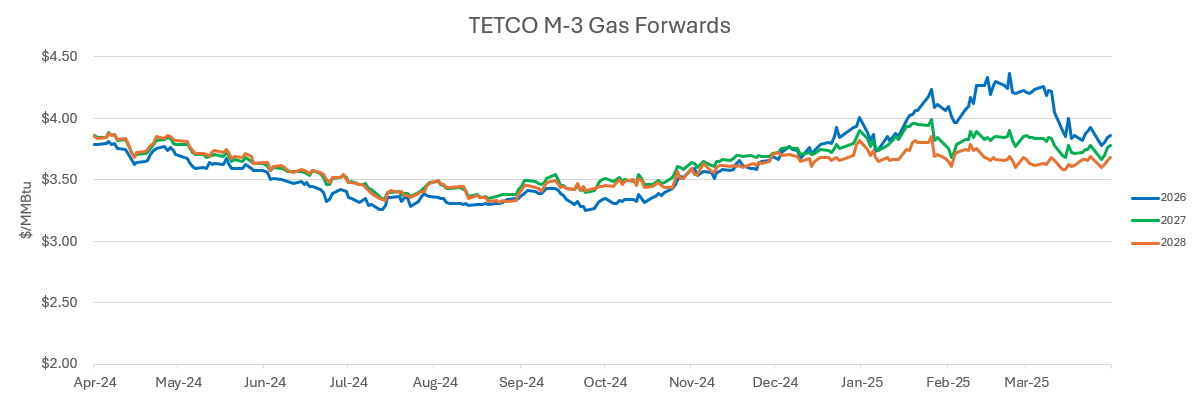

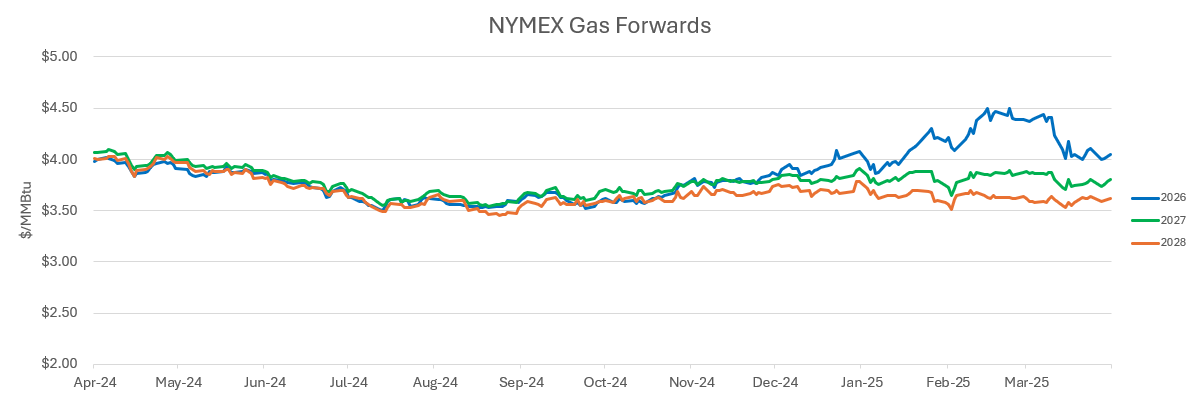

- Natural gas prices have declined dramatically into today’s close of the May NYMEX futures contract. After rallying to almost $5.00/MMBtu on March 10, the May contract traded down below $2.90/MMBtu as of last Friday and is expected to settle today somewhere around $3.0-$3.15/MMBtu.

- US LNG exports remain above 16 BCF/D, with the majority of cargoes destined for Europe as Chinese buyers are basically on strike given the in excess of 100% tariff on US imports.

- Storage balances continue to build rapidly as robust production and shoulder season demand have allowed the gap between current inventories and the 5-year average to shrink by 200 BCF, which almost fully eradicates that gap.

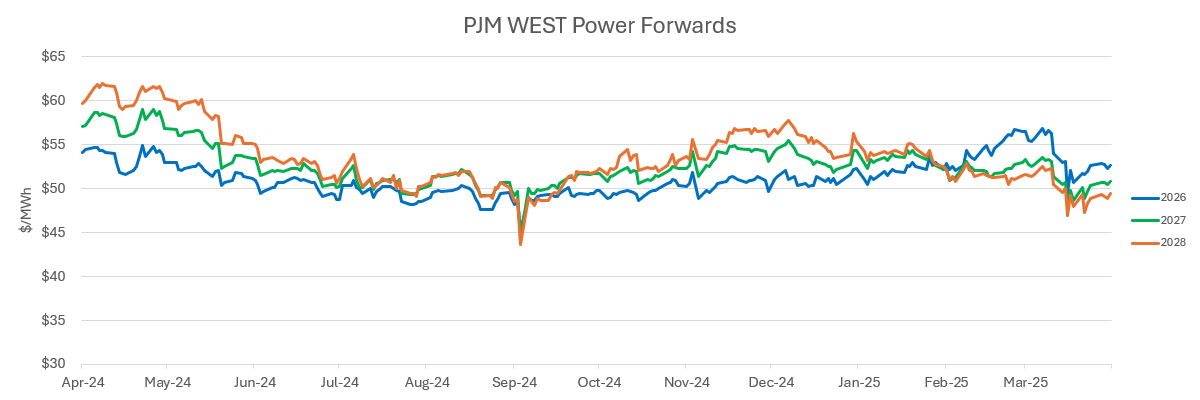

- Summer power prices continue to be bid as manifested by the July/August sparks, as the gas price decline has now mitigated any gas-to-coal switching possibilities.