April 16, 2025

Talking Tariffs: Breaking Down the Potential Implications on the Energy Sector

By Bob Barron, Vice President of Energy Management, CPV

In this blog, Bob Barron digs into the ever-shifting tariff landscape, highlighting some of the varying perspectives to think about in the energy sector and how, amidst the uncertainty, there’s an opportunity to think strategically by working with a flexible partner who understands the market.

Market Drivers

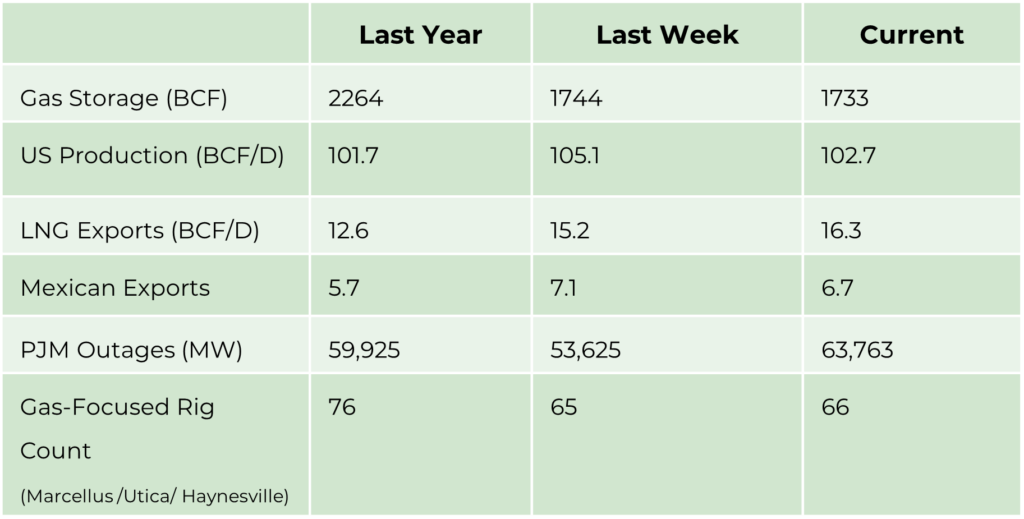

- Gas Storage/Year over year difference. A positive number is bearish, and a negative number is bullish.

- Production /Year over year growth/trend is important in the context of demand growth.

- LNG Exports/Year over year growth means demand is growing and should be looked at in comparison to production trend.

- Mexican Exports/Add to LNG Exports to show a trend in exports compared to the production trend.

- PJM Outages- generally seasonal in Spring or Fall/Can support short-term prices.

- Gas Focused Rig Count/Is drilling increasing to grow production versus demand growth. This can be seen as impacting price in the future based on expected load growth.

Energy Market Update

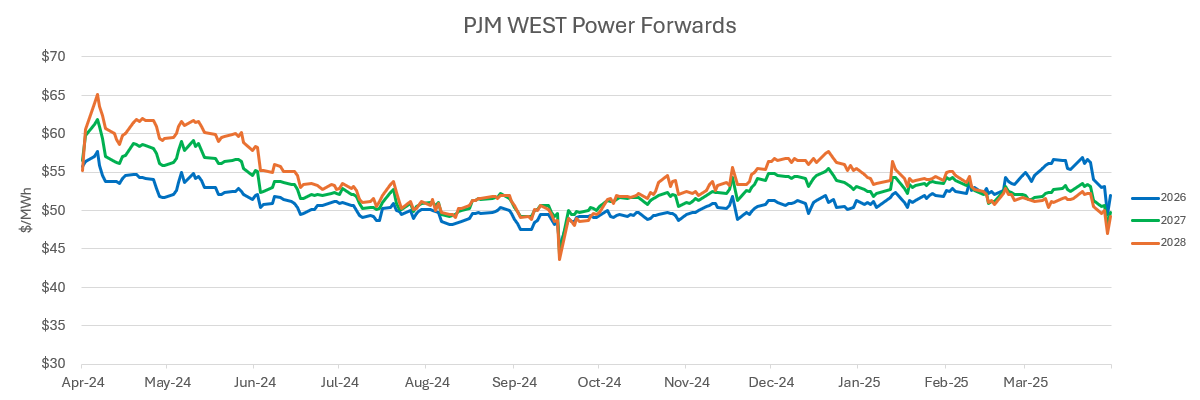

- PJM spot prices remain strong as colder than normal temperatures this week, which has coincided with close to peak maintenance season (current PJM outages>60,000 MW), bely the drop in natural gas prices.

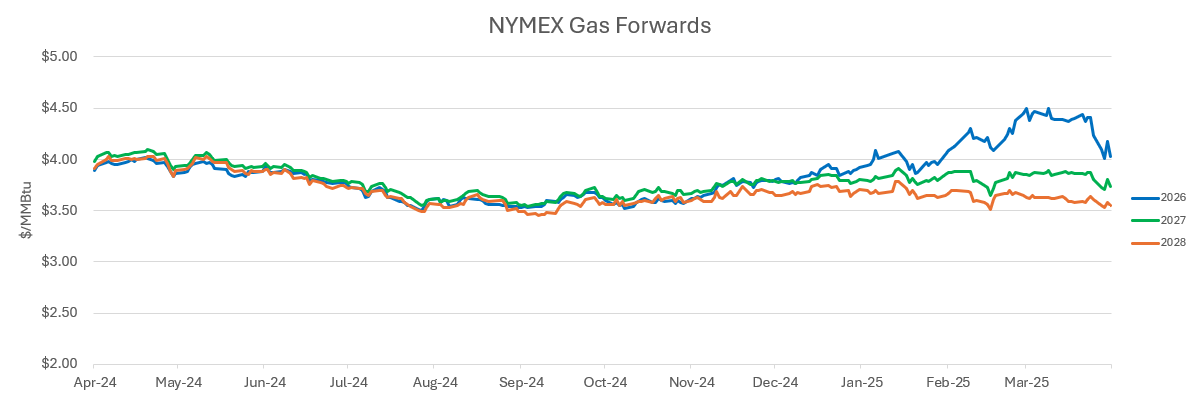

- The tariff implementation mayhem continues to impact the energy commodities across the board, as oil in particular has been sold extremely hard. Prompt West Texas Intermediate has now dropped by $17/BBL in just a week of trading.

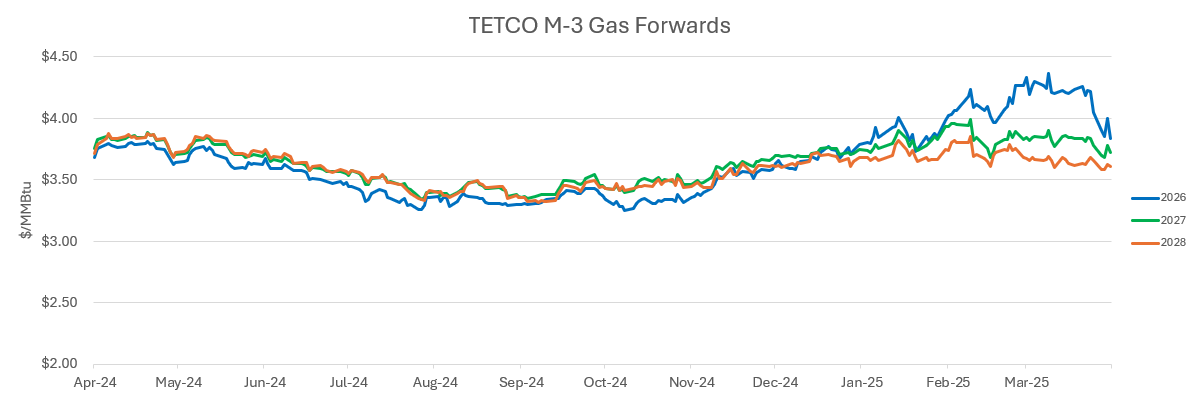

- Natural gas prices have not been spared in the tariff-driven sell-off as May futures are now trading around $3.35/MMBTU after peaking at $4.89 just one month ago. The longer-term pricing structure has also been sold, although the sell-off has not been as severe as the front end of the curve. For strategically focused buyers, this could be an opportunity to do some buying, given that the fundamental picture of growing LNG exports has not really changed.

- The U.S. Energy Information Administration (EIA) released the Weekly Natural Gas Storage Report on April 10, where a larger-than-normal storage injection was expected as mild weather at the end of March kept heating demand in check. Estimates were for a 50-60 BCF injection, which will compress the difference to the 5-year average significantly and reduce concerns about entering next winter with lower inventories. See the report here.