“PJM Capacity prices hit record highs, sending build signal to generators” – Utility Dive article July 31, 2024

“Pennsylvania asks FERC to lower PJM capacity price cap to prevent ‘runaway’ costs” – Utility Dive, January 2, 2025

“Mid-Atlantic States, PJM Agree to Price Cap for Capacity Auction, Temporarily Easing Energy Affordability Concerns” – Inside Climate News, January 30, 2025

“PJM’s capacity ‘price collar’ proposal sparks market confidence concerns” – Yahoo Finance via Utility Dive, March 8, 2025

These are just some of the headlines in the news from the past nine months focused on the PJM Interconnection and fluctuating capacity prices. There’s a lot of coverage of this topic, and speculation is rampant, so how do we provide tangible information to brokers and customers to ensure end-users can make informed decisions?

At the TEPA meeting in Philadelphia, not far from the headquarters of PJM, on March 20, Matt Litchfield, Vice President of External and Regulatory Affairs for Competitive Power Ventures (CPV), represented CPV Retail on the PJM Capacity Shake Up: What it Means for Retail Energy panel.

While the panel represented multiple points of view from industry leaders, there were some ‘hot takes’ – but we’re going to break things down.

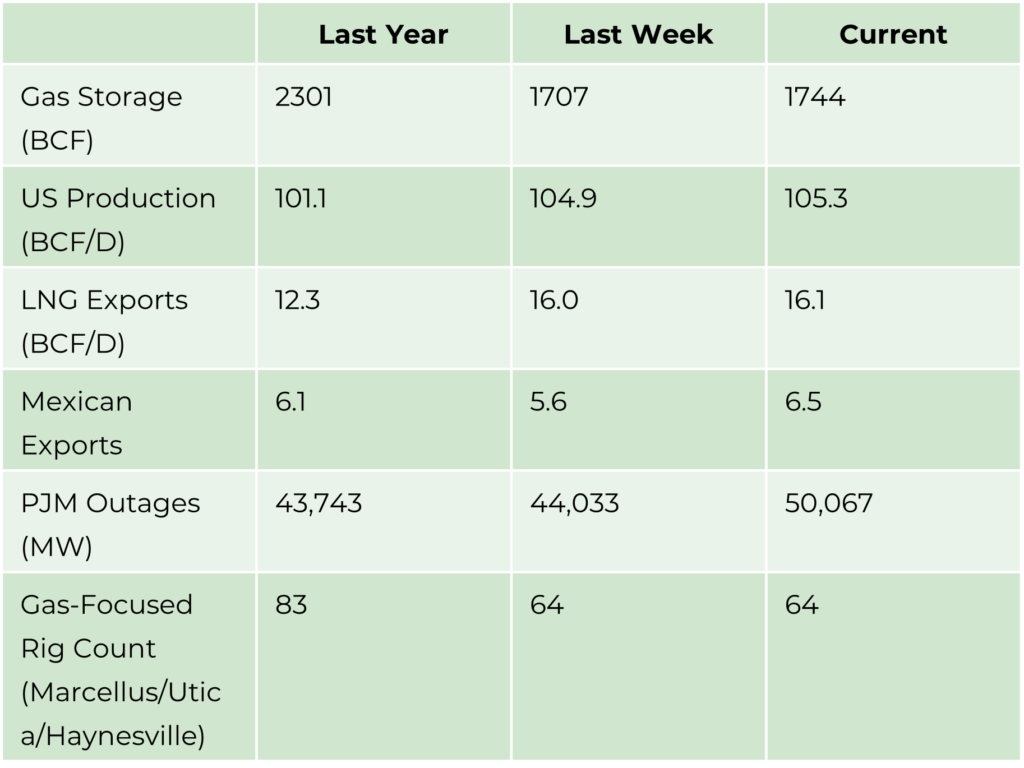

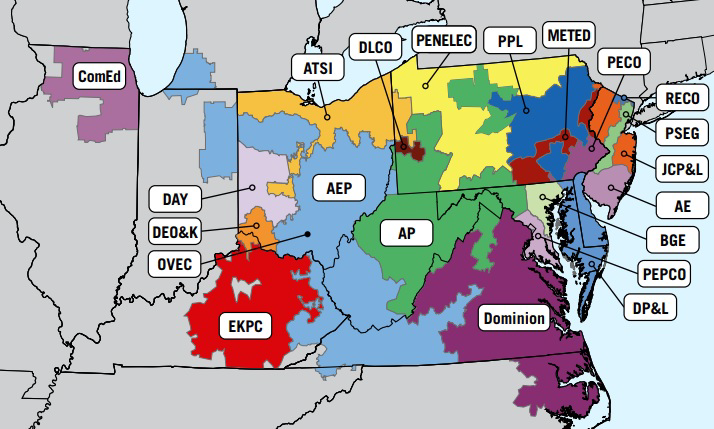

At the heart of the conversation is PJM’s role in coordinating the flow of electricity and ensuring reliability across parts or all of 13 states and the District of Columbia. Through long-term planning and the operation of competitive wholesale markets, PJM and its stakeholders make decisions on how best to maintain reliability in a cost-effective manner, which ultimately influences what consumers pay for electricity. As the region faces tightening supply and demand driven by an increased demand for power, looming retirements, and the slow pace of new development, rising capacity prices are making affordability a growing concern.

How Did We Get Here and What Now?

To focus on the CPV Retail takeaways from the panel, we’ve distilled it down for you in answering the main panel questions:

1. What’s driving the chaos?

2. What do these changes have in store for us?

3. What does the new normal look like?

1. The Drivers of Chaos

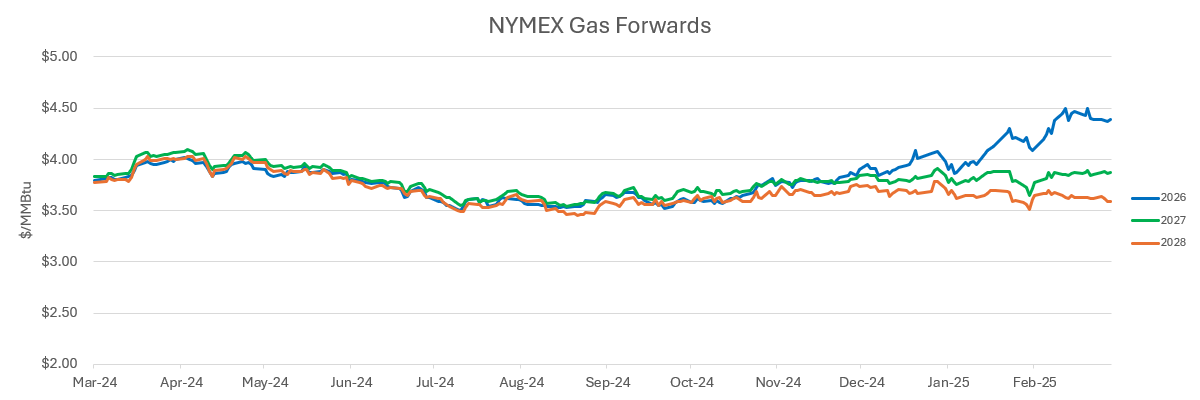

There’s been a dramatic shift in the supply and demand equation in PJM, causing a perfect storm for resource adequacy and capacity prices. On the one hand, years of historically low-capacity prices coupled with new state environmental regulations have resulted in increasing generation retirements. Next, data centers and AI-driven demand continue to increase load forecasts beyond anything we’ve seen before. Lastly, the pace of development for new resources has been slow due to interconnection backlogs and price signals that were not incentivizing new dispatchable generation.

This supply and demand conundrum also coincides with an evolution in how resource adequacy planning is done. Historically, resource adequacy planning ensured that there would be enough generation resources to meet the annual peak load, which occurs in the summer. Recent analysis in the wake of Winter Storm Elliott, however, has shown that the reliability risk is even greater during the winter due to the potential for correlated outages and lower performance from certain resource types. As a result, target reserve margins have to increase to ensure there are sufficient resources to cover winter contingencies.

In the face of these tightening supply and demand conditions, the capacity market is doing exactly what it was designed to do, which is signal the need for investment in new resources when needed. The rapid pace of the price increase and the potential for significant volatility, however, has led to growing concerns from stakeholders on all sides.

2. What Does This Mean for Retail Energy Markets? What’s in Store For us?

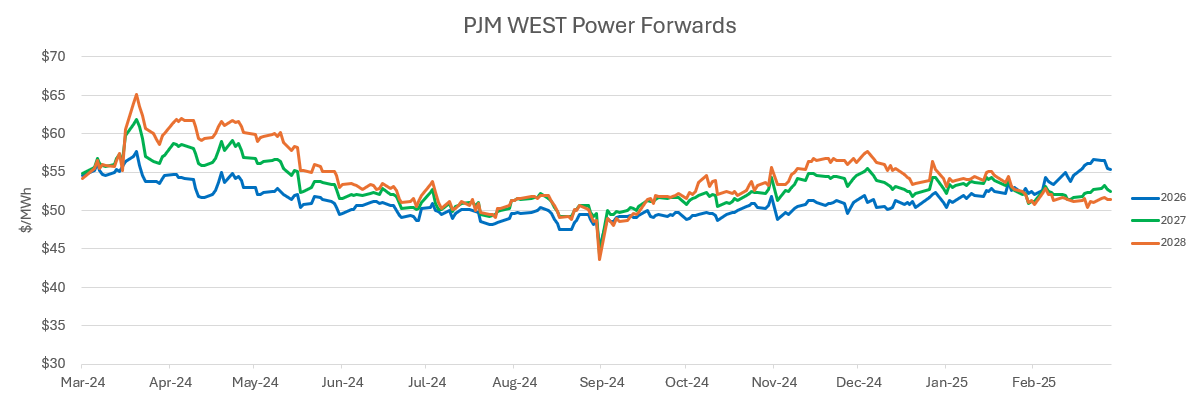

The impact of this “capacity shake-up” will be felt across the board, from brokers to end consumers. As prices rise, brokers are grappling with how to manage customer contracts and the need to be innovative to help cater to customers’ risk appetites, particularly in light of the pending filing at FERC that would put a price collar on capacity prices for the 2026/2027 and 2027/2028 delivery years. At TEPA, panelists discussed a wide range of potential solutions for suppliers: offering fixed-price contracts at or near the price cap or variable-priced contracts that pass the cost through to consumers. Panelists were unanimous that either way, customers must be educated on the changes ahead. There’s no way to escape the ‘fire storm,’ a panelist added – we will see price increases beginning in June/July in the range of 10-20% when capacity prices for the 2025/2026 delivery year begin to be included in customers’ rates.

PJM’s proposal to introduce a new price cap and floor or “collar” for the next two auctions, which is currently pending at FERC, is an attempt to offer stability to both suppliers and consumers and protect against extreme pricing outcomes. With volatility expected to persist, educating consumers and adjusting contracts will be key. CPV Retail, represented by Matt Litchfield, emphasized the need for careful planning and open communication with customers to navigate the volatility. “Find a partner that really understands these markets and can help customers balance their risk appetites with potential price fluctuations,” said Litchfield. “At CPV Retail, we are willing to have these conversations and discuss options where we share some of the risk with customers.”

Additional information from PJM on the auction parameters is set to be released on March 31 and will give further insight into potential outcomes for the 2026/27 auction set for July of this year.

3. Looking Ahead: The New Normal?

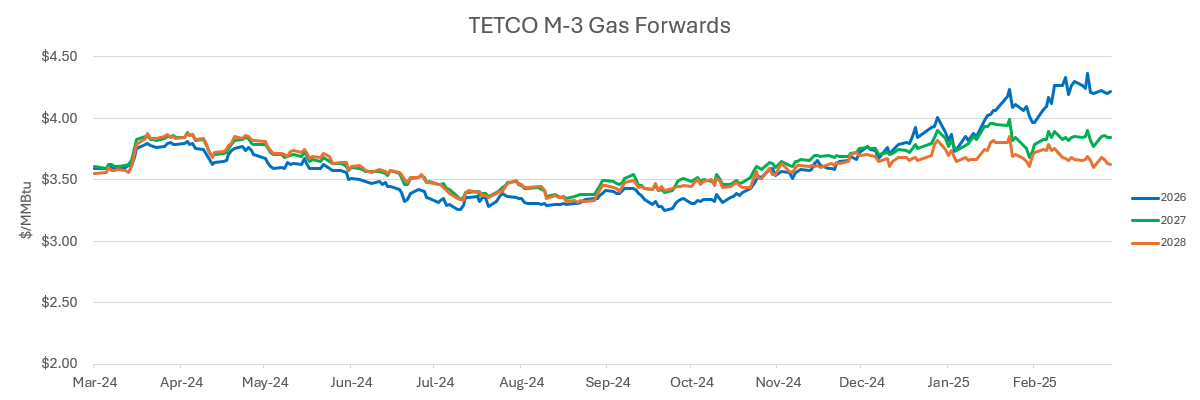

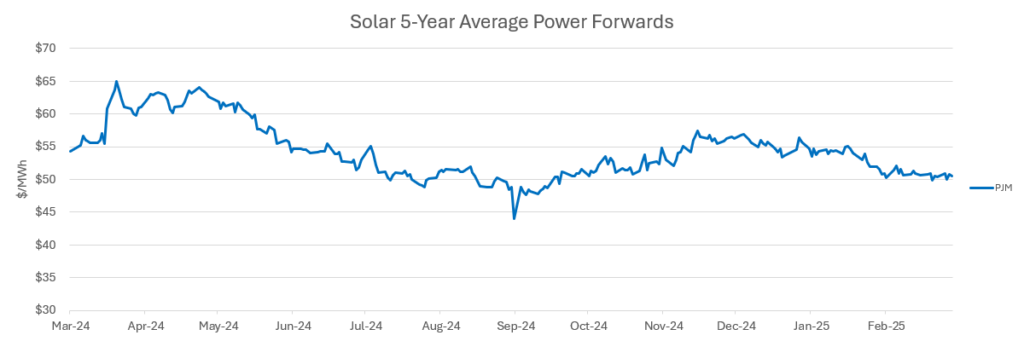

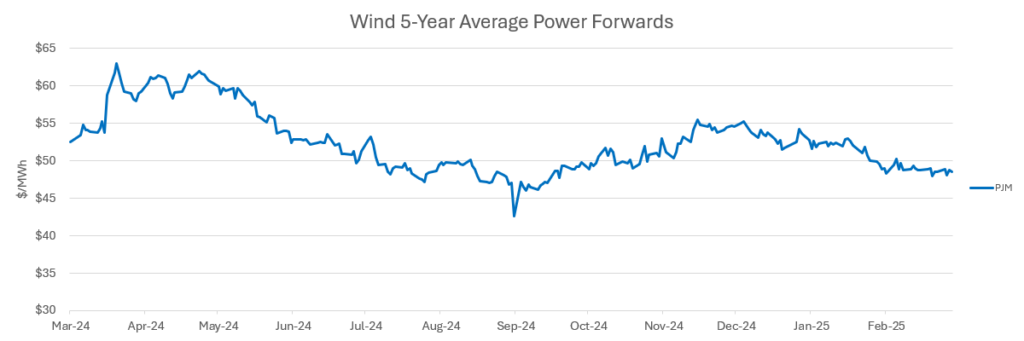

With PJM facing regulatory changes, significant transmission upgrades needed to interconnect new resources, and growing pressure from states and environmental groups, the energy landscape is evolving. The deployment of renewable energy sources, like solar and wind, is ongoing and will help modernize our grid, but these resources are not yet capable of meeting demand in the same way natural gas can. The result? A tight energy market with prices that are likely to remain elevated for the foreseeable future.

Asked what can be expected in the short-term, Litchfield noted, “It depends on what your idea of the short-term looks like. If your short-term is 2-3 years, it is likely to be more of the same. But when looking out five to six years, bringing us to the early 2030s, we should see the queue working more efficiently and new dispatchable resources that have responded to these price signals starting to come online. At that point, prices should start to stabilize and decline over time as supply catches up to demand.

While demand growth is expected to persist, the response from the market to price signals already has been resounding. Project developers recently submitted 94 applications, representing 26,600 MW, to PJM’s Reliability Resource Initiative, which aims to accelerate the interconnection of resources with high-capacity contributions. The applications, which consist of new and uprated natural gas, nuclear, storage, and wind, represent a significant step in adding much-needed capacity to the system and gaining relief for customers.

For brokers and consumers alike, understanding these dynamics and planning for future price increases is crucial. PJM’s current trajectory suggests that high prices may become the new norm at least into the early 2030s, and the best way to weather the storm will be through strategic planning and continued education.

CPV Retail is here to help with these challenging conversations and is ready to customize a solution that suits your needs.