CPV Retail Blog February 4, 2025

In this edition, Bob Barron, VP of Energy Management at CPV, sheds light on the shifting paradigms on AI power demand forecasts.

Energy Market Update

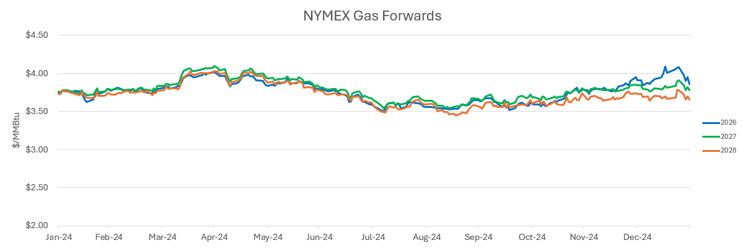

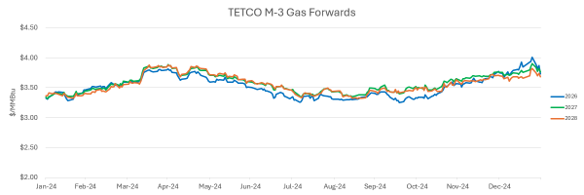

- The cold weather that led to a massive 320 BCF storage withdrawal last week has retreated north, resulting in widespread above-normal temperatures along the major cities on the East Coast. For the first time in two years, seasonal storage differentials are now in a deficit, which has helped support NYMEX prices above $3.00/MMBtu.

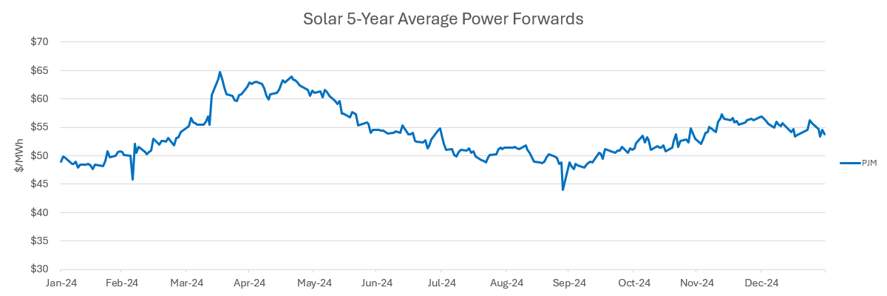

- Off-peak power prices have been particularly strong during the recent cold snap, with several days showing off-peak settlements exceeding on-peak prices in PJM, NYISO and NEPOOL.

- China’s announcement regarding the capabilities, costs, and energy consumption of its Deep Seek AI open-source system triggered widespread selling of energy stocks, as well as the technology firms associated with data center expansions. The lack of transparency caused a “sell first, ask questions later” response from the market.

- European storage balances continue to decline as pipeline flows from Russia remain constrained, and weather-related demand accelerated withdrawals, creating re-fill risk over the summer. US LNG will be critical in supporting our European allies.

- The impact of President Trump’s tariff policy on the market is still being evaluated, as Canadian energy imports of $100 billion/year will be the first big test moving forward.