CPV Retail Blog January 16, 2025

In this edition, Bob Barron summarizes recent stories in which President-Elect Trump promises to deliver changes to energy policies and what to consider moving into this new year and beyond.

Energy Market Update

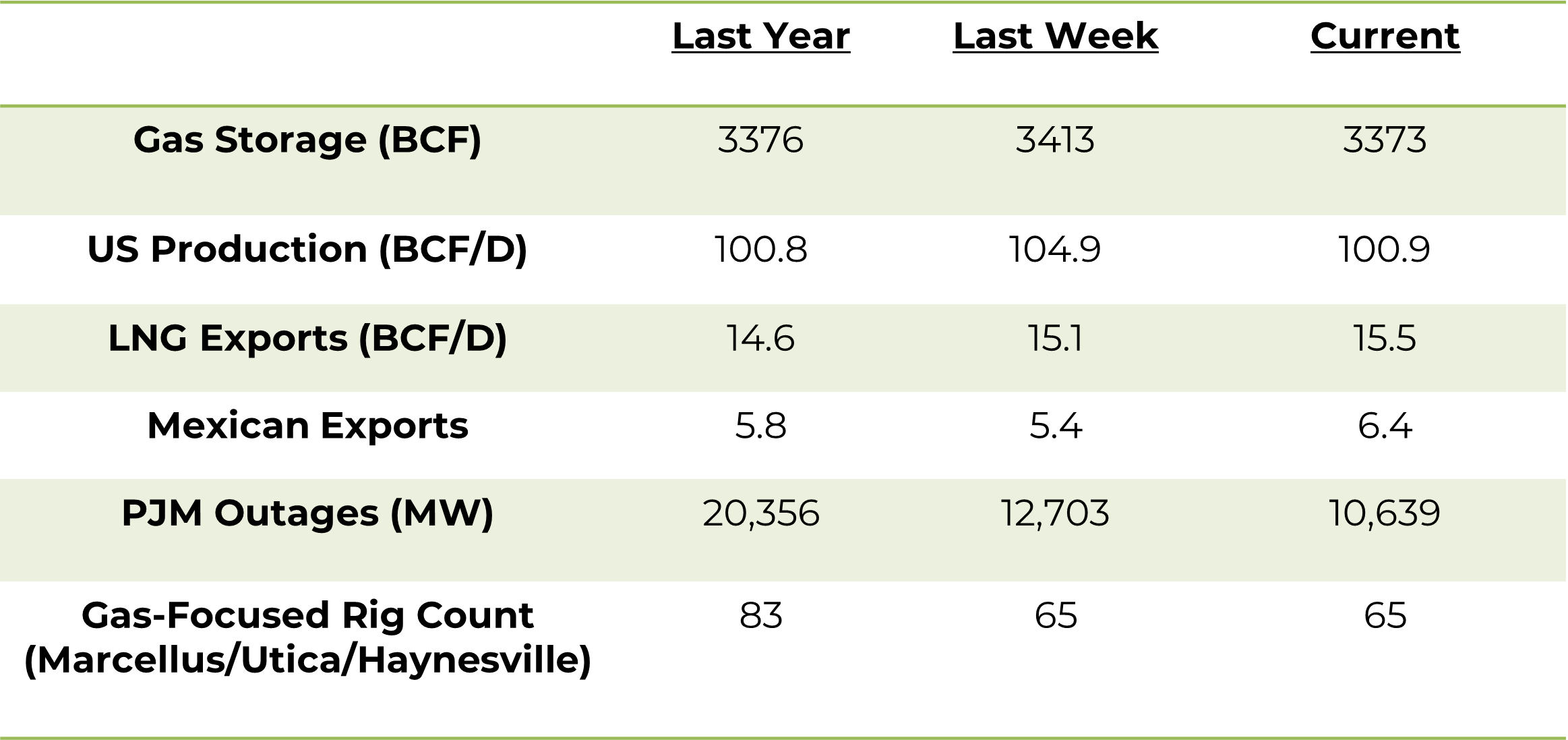

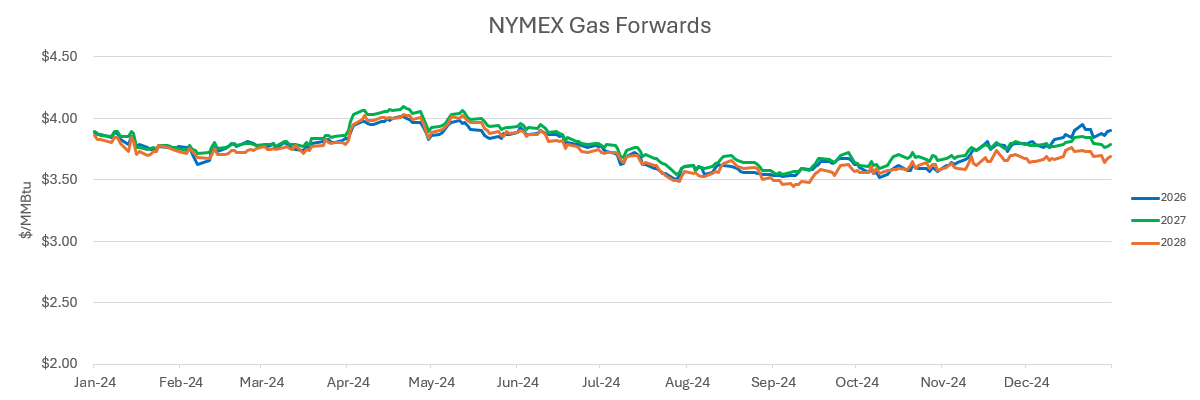

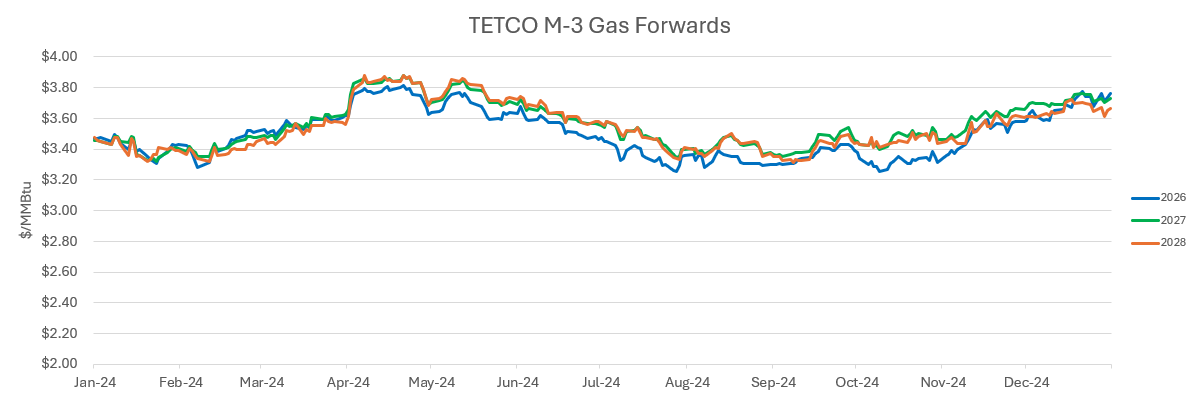

- The story right now is the protracted cold moving spot prices up dramatically as well as NYMEX prices across the strip catching bids. The prompt February contract had traded down to $2.80/MMBTU just a few weeks ago where it is now trading closer to $4.0/MMBTU with northeast and New England cash prices trading above $10/MMBTU.

- The severe contango between Cal/2025 and Cal/2026 has compressed significantly as the prompt year has moved up faster than Cal/2026 given what is expected to be a strong storage re-fill market this summer as storage inventories continue to draw down rapidly. • Microsoft announced an $80 billion capital budget in 2025 for data center growth the majority of which will be spent in the United States as it continues to build out its AI capabilities.

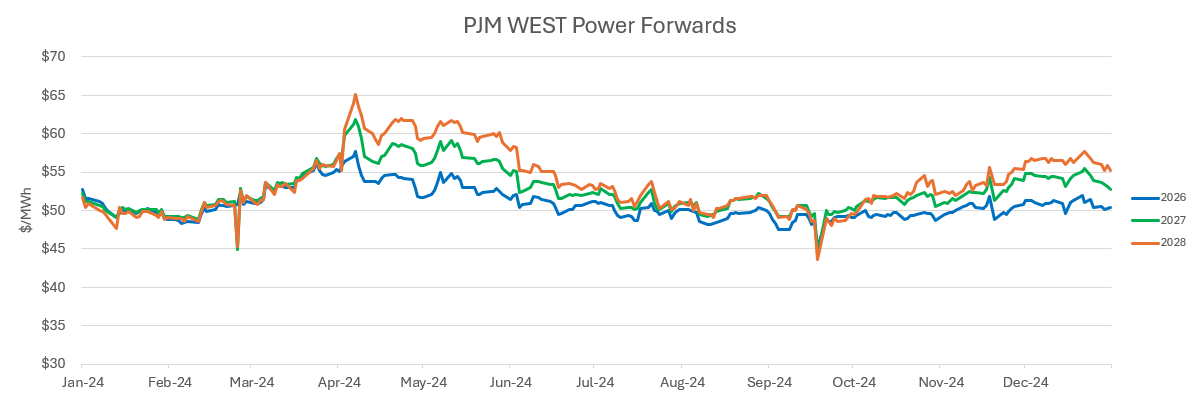

- The recent cold weather over the PJM footprint has increased loads – although prices relative to where natural gas prices are trading have been less than expected. With 25% of PJM’s winter load currently covered by coal generators, some gas generators could not clear the market with double-digit gas prices.

- US LNG exports hit an all-time of 15.5 BCF/D as Plaquemines LNG Export Terminal begins commercialization and Corpus Christie 3 begins testing. Both facilities are expected to be fully operational by the end of 2025.

Forward Pricing

As of January 10, 2025