Regarding the regulatory complexities surrounding the Amazon Web Services (AWS) deal with Constellation’s Susquehanna Nuclear Plant, diving deep into the details could fill a novel. At first glance, the partnership between a tech giant like AWS and a nuclear energy provider might seem straightforward, but the layers of regulations and compliance issues involved are anything but simple. From environmental considerations to energy market dynamics, the implications of this deal ripple across various sectors and regulatory bodies. In this post, we’ll skim the surface of these intricate issues, providing a clearer picture of what’s at stake without sending you into a slumber.

The recent agreement allowing AWS to co-locate with Constellation’s Susquehanna Nuclear Plant has sparked significant regulatory discussions, leading to an application for an amended Interconnection Service Agreement (ISA) with the Federal Energy Regulatory Commission (FERC). This move has not been without controversy, resulting in several appeals and the opening of three dockets at FERC. At the heart of these dockets are key questions about regulating co-located loads: Should the oversight fall to state regulators or federal authorities? Will the reliability of the service be affected? And who bears the financial responsibility—transmission owners or system operators?

Intervenors argue that the stakes are high enough to warrant a more thorough examination. They believe that the outcome of this decision could set a precedent for future agreements and thus advocate for a comprehensive review process, including a formal hearing.

As we approach the early November deadline for the decision on the Interconnection Service Agreement (ISA) application, it’s becoming clear that FERC is likely to extend the timeline given the significance of this ruling. The agency is expected to hold a technical conference and conduct additional reviews, a process that could stretch for months. Once FERC reaches a decision, the parameters will be sent back to the affected Independent System Operators (ISOs) and state regulatory bodies for approval.

The timing of this process contrasts with the urgent demands from the data center industry, which is increasingly vocal about its need for reliable power. Many stakeholders are realizing just how much control regulatory bodies have over their access to energy. In an era where speed to market is crucial, the delays in establishing clear regulations around co-located loads could hinder growth and innovation in the sector.

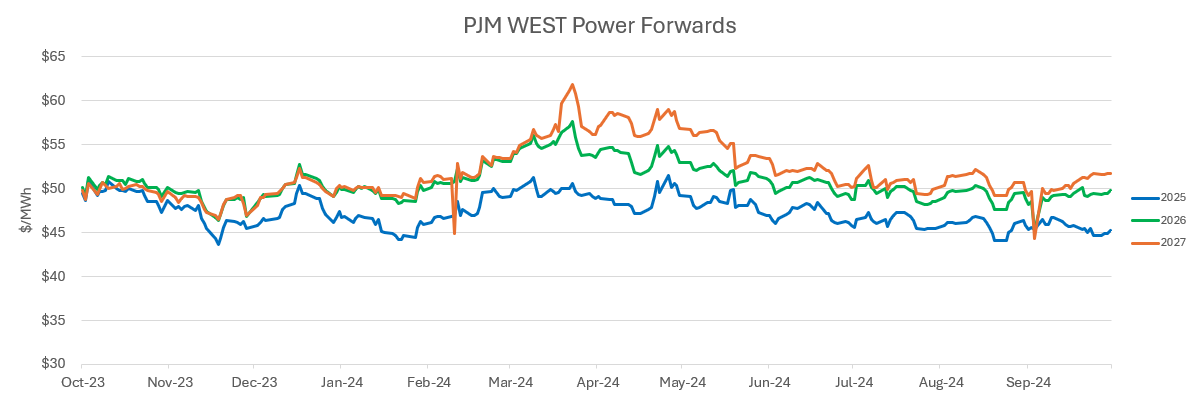

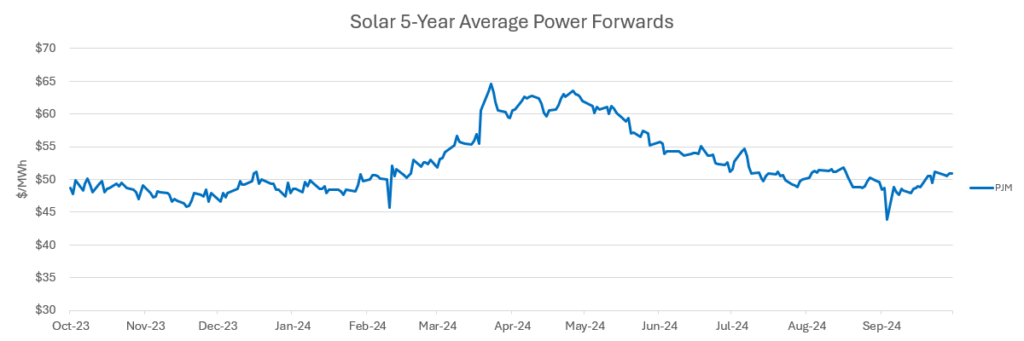

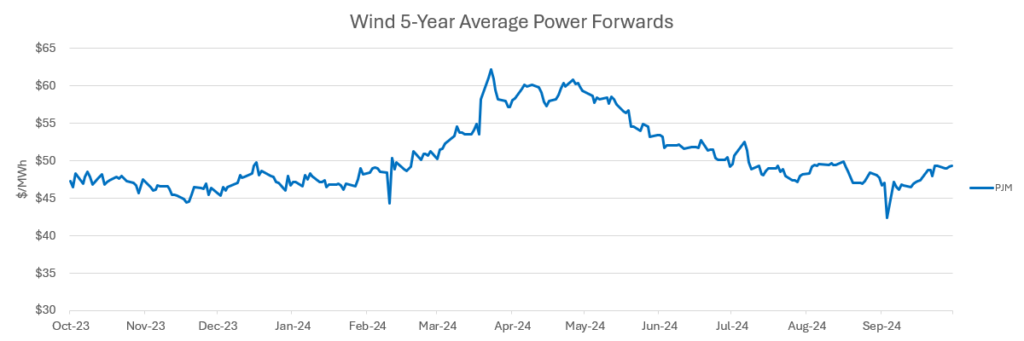

The energy market is anything but static, and as discussions around co-location continue, we’re seeing a dramatic spike in capacity prices within the PJM region. These prices are projected to remain high during the potential upcoming December Base Residual Auction (BRA). However, PJM isn’t the only ISO where data centers are exploring expansion opportunities.

If regulatory delays persist, operators may look to alternative geographic locations to meet their power needs more efficiently – as cost and speed are critical factors for data center operators. The implications of this decision will be felt far beyond just the AWS and Constellation partnership. The intersection of technology and energy regulation will continue to be a hot topic, with implications that could resonate across the industry for years to come. For PJM to maximize opportunities on the burgeoning demand from data centers, clarity on the co-location issue is essential. The swift resolution will not only enhance operational opportunities but also ensure that the region remains competitive in attracting new investments. As this situation unfolds, the urgency for decisive action has never been greater.

Let CPV Retail help you and your business retain a competitive edge in these uncertain and volatile times. We take pride in assessing global issues like co-location and delivering client-specific solutions that incorporate your input and our understanding of extraneous events. While these regulations will take time to play out, CPV Retail has both short-term and long-term ideas for your consideration to keep you moving forward.