October 16, 2024

To BRA or not to BRA… That is the Question

Read the blog to explore the current landscape surrounding the impending delay of the PJM Base Residual Auction (BRA) and its implications for stakeholders..

By: Bob Barron, Vice President of Energy Management, CPV

To BRA or not to BRA… That is the Question

The significant increase in capacity prices from the latest PJM Base Residual Auction (BRA) has certainly raised stakeholder alarms. A tenfold jump in the Regional Transmission Organization (RTO) can drastically impact consumers, businesses, and the overall energy market dynamics.

Consumer advocates and environmental organizations quickly condemned the situation, expressing widespread outrage and complaints. The filing of a 206 Complaint by the Sierra Club against PJM at the Federal Energy Regulatory Commission (FERC) underscores the seriousness of the situation. A 206 Complaint can be a significant legal tool, as it requests FERC to investigate and potentially modify rates, terms, or conditions of service.

Their argument is focused on PJM’s treatment of Reliability Must Run (RMR) units, which they contend added roughly $5 billion to overall capacity prices. As such, the auction scheduled for December (2026/2027) should be delayed. PJM’s pending October 17th response to the FERC will support the delay and vociferously defend existing market rules.

Other critical parameters besides RMR treatment, that will likely be scrutinized during the proposed delay, are the following: load forecast revisions/updates, effective-load-carrying-capacity (ELCC) modified calculations, and reference unit reversion. Addressing only the RMR concerns in isolation from other key market design parameters should give the FERC pause given all that is at stake. With the BRA schedule already compressed due to previous delays, PJM’s support of another delay indicates how serious it views obtaining clarity and a sustainable path forward from FERC.

It is already difficult enough to get new thermal projects developed and built in a time frame that will support the almost immediate needs of data centers, so the questions raised in the complaints must be answered with appropriate specificity. Thermal development cannot proceed with so much uncertainty, especially when capital costs of new combined cycles have risen by roughly 50% since the last boom in gas plants.

With the BRA now likely to be delayed, and the continued debate around co-location (FERC Technical Conference scheduled on November 1), data centers are likely to continue to look for alternatives for power supply needs. This result could include physical placement in jurisdictions more amenable to rapid generation development as speed to market remains their highest priority. PJM faces significant challenges as rapid load growth and reliability are at cross-currents, complicating the equation to solve with too many unknowns.

CPV Retail is focused on not only providing the most competitive prices for our clients but also staying on top of key regulatory frameworks that will influence short and long-term prices. Working collaboratively with all impacted stakeholders through the entire value chain gives CPV Retail customers access to what is certainly the most valuable commodity in the world – information. We may not have all the answers today, but we will always give you a unique perspective and options to help you better manage your respective exposure.

Energy Market Update

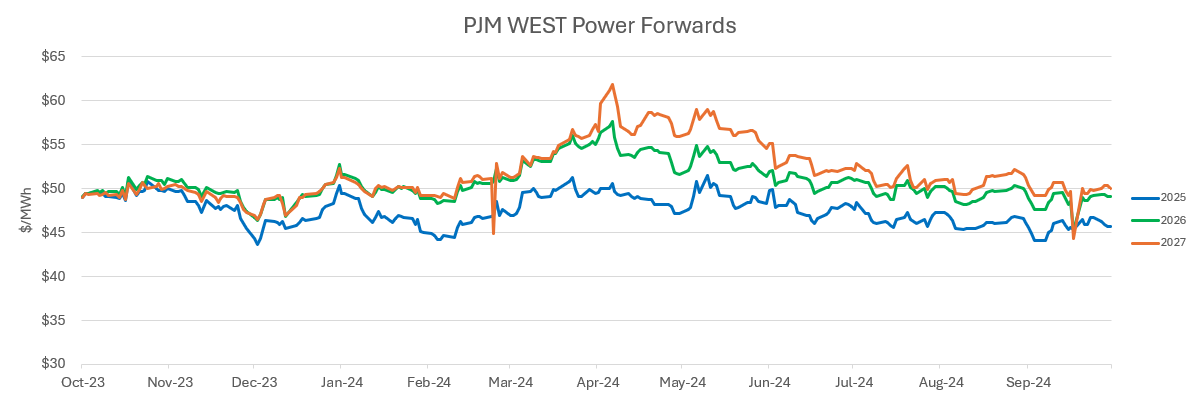

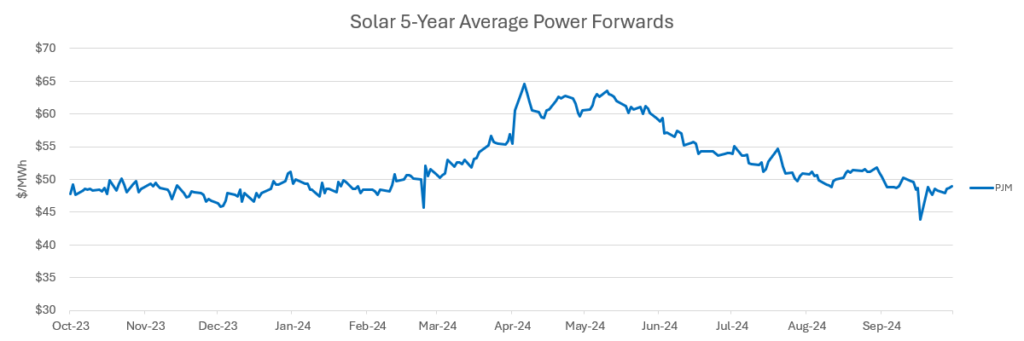

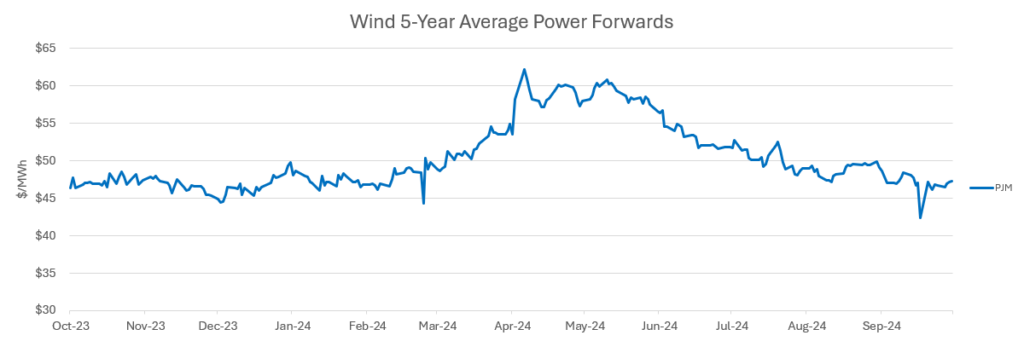

- Shoulder season is upon us as maintenance outages in PJM approach 70,000 MW, which adds volatility to power prices during even lower demand days.

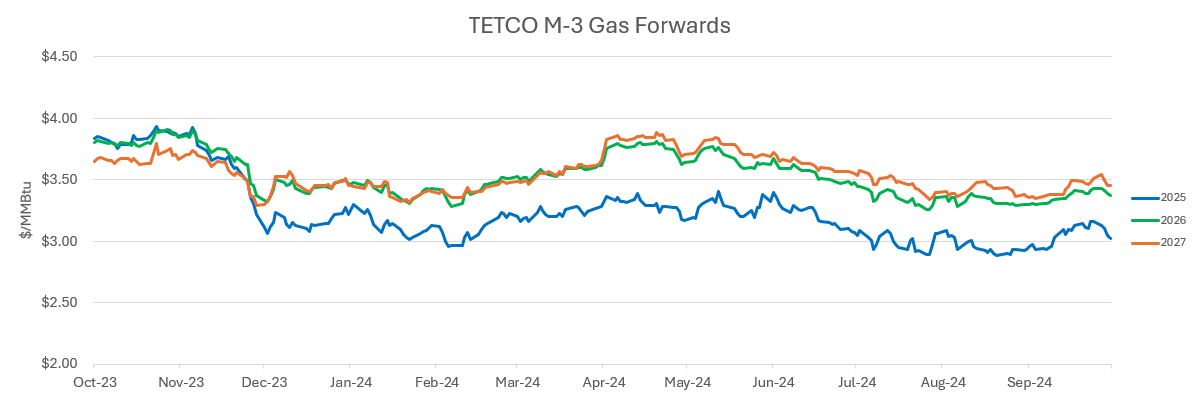

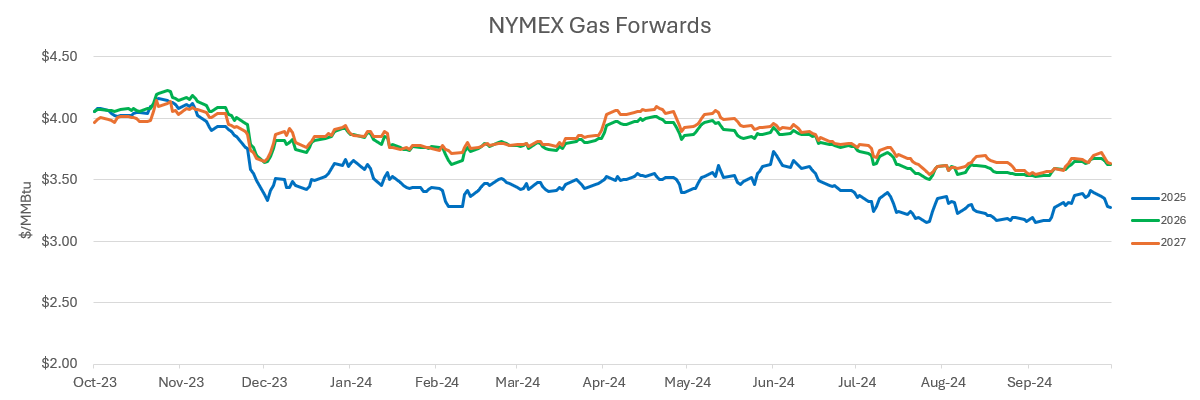

- After rallying back to $3.0/MMBTU November NYMEX, along with the whole winter strip, has sold off about $0.40/MMBtu as mild weather and healthier storage balances weigh on prices.

- Plaquemines LNG has initiated testing and could see its first commercial cargo in Q1/2025 as it begins ramping up to its ultimate capacity of about 2 BCF/D.

- Delaying its startup, it’s estimated that LNG Canada operations will slowly grow into Q2/2025, which is keeping Western Canadian prices (AECO) under pressure.

- Hurricane Milton has caused between 3-4 million power outages in Florida, as damage assessments will take quite some time to complete at the same time customers in North Carolina still await power restoration from Hurricane Helene.