September 30, 2024

Embracing the Chill and Preparing for Winter Amidst Energy Possibilities

Read the blog to learn about the landscape and the current market as we prepare for winter planning in the energy market.

By: Bob Barron, Vice President of Energy Management, CPV

Today, the October NYMEX contract settles, and November becomes a prompt month, signaling the transition to cold weather focus mode for market participants. This is when everyone turns their attention to winter planning and wonders if this will be the year that The Farmer’s Almanac delivers its never-ending prognostications of expected cold. The hopes and dreams of hyper-volatility are dancing in traders’ minds notwithstanding the disappointment of the prior two seasons’ extreme warmth.

We’re now questioning what a “normal” winter means and whether storage inventories will be sufficient to support a level of sustained demand both in the United States and globally. The global gas market has not been sufficiently tested by contemporaneous peaks and constrained LNG supplies.

In the wake of the Ukraine invasion, Europe must evaluate whether the swift transition from Russian pipeline supplies to US LNG will be effective, or if the system remains too fragile to endure a protracted period of cold. The tug-of-war between Asia and Europe for spot LNG cargoes has, so far, been a benign affair. Europe’s early filling of storage has allowed for additional available cargoes to be detoured to Asia and satisfy growing spot demand.

The paths are almost Monte Carlo simulation-like with endless possibilities. That’s what makes navigating the energy industry both challenging and exciting, especially as we prepare for the upcoming winter season. Weather and pricing can be unpredictable, making it essential to set up your portfolio to handle various outcomes. By anticipating fluctuations in demand and supply, especially in extreme weather conditions, you can mitigate risks and capitalize on opportunities.

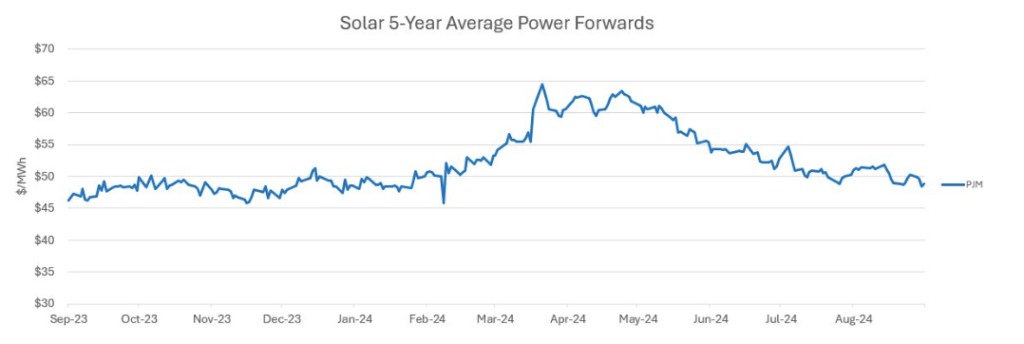

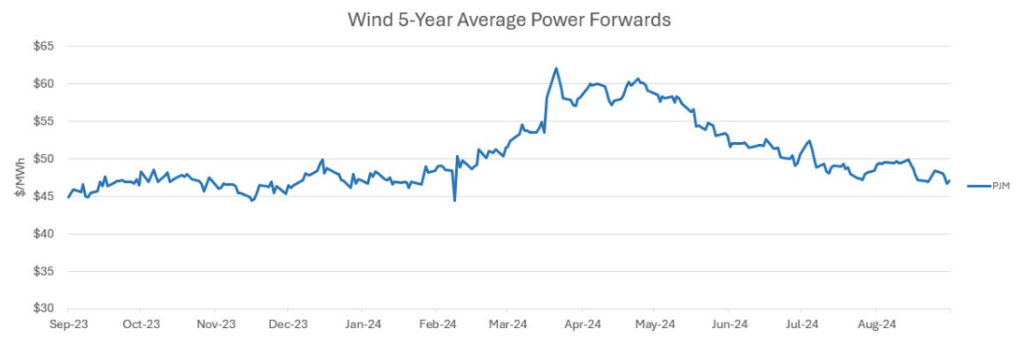

Longer-term pricing is significantly influenced by winter trends—think rising demand for heating fuels or shifts in renewable energy generation. This is where our expertise comes in. CPV Retail has the assets and seasoned professionals to help you tailor programs that align with your specific risk appetite and business goals.

Partnering with CPV Retail means you’ll have a dedicated team focused on developing strategies that not only weatherproof your portfolio but also position you for success in a dynamic market. Let’s embrace the challenges together and enjoy the benefits of a well-prepared energy strategy this winter and beyond.

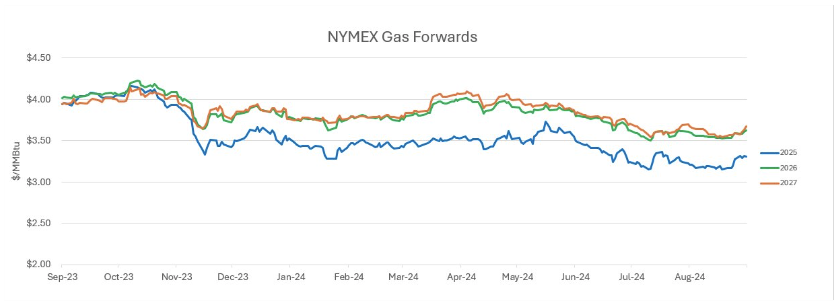

Energy Market Update

- Since reaching a low of about $2.0/MMBtu on August 28th, the expiring October NYMEX contract has surged to $2.65/MMBtu as producer’s economic shut-ins along with hurricane-related shut-ins have helped dramatically reduce the year-over-year storage differential which now sits at a manageable 160 BCF. Further compression is expected as we head into the final weeks of injections before cold weather arrives.

- Oil prices remain range-bound after nearly $70/BBL as traders appear to be having difficulty assessing the impact of low inventories, reduced Chinese demand, and potential supply disruptions in the Middle East.

- As data center demand discussions intensify, everyone is searching for effective solutions for hyperscale buyers. However, they are quickly realizing that finding a fast, comprehensive solution is proving to be quite challenging.

- LNG demand in Asia remains robust as inventories in Japan remain well below historical levels and China and India continue to actively buy spot cargoes. The spread between European prices and Asian prices continue to incent the movement of cargoes away from Europe as storage is basically full one month earlier than normal.

- Western Canadian storage (AECO) is at record levels and basically full which has pushed AECO prices down to barely above zero as producers await the startup of LNG Canada and/or the arrival of cold weather.