May 16, 2024

Reliable, sustainable, affordable – these are the three pillars that must be achieved for the energy transition to be successful. Of course, we all know this is easier said than done as these pillars become increasingly at odds. The recently announced EPA regulations mandating emission reductions from coal and new gas-fired generators, for instance, come at a pivotal moment in our ongoing transition.

Energy Market Update

- Subdued global LNG prices, which have stayed at or below $10/MMBtu, have been met with solid demand in South America due to widespread drought conditions and in Asia due to coal-to-gas switching economics.

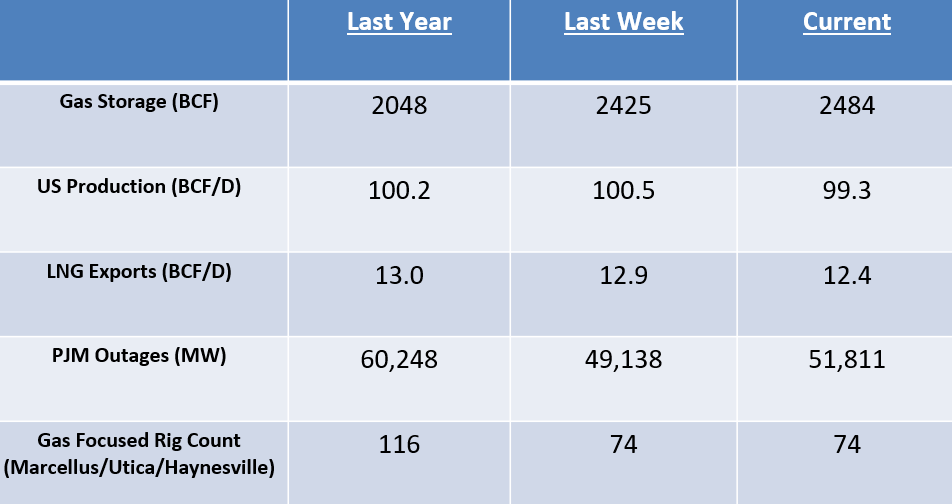

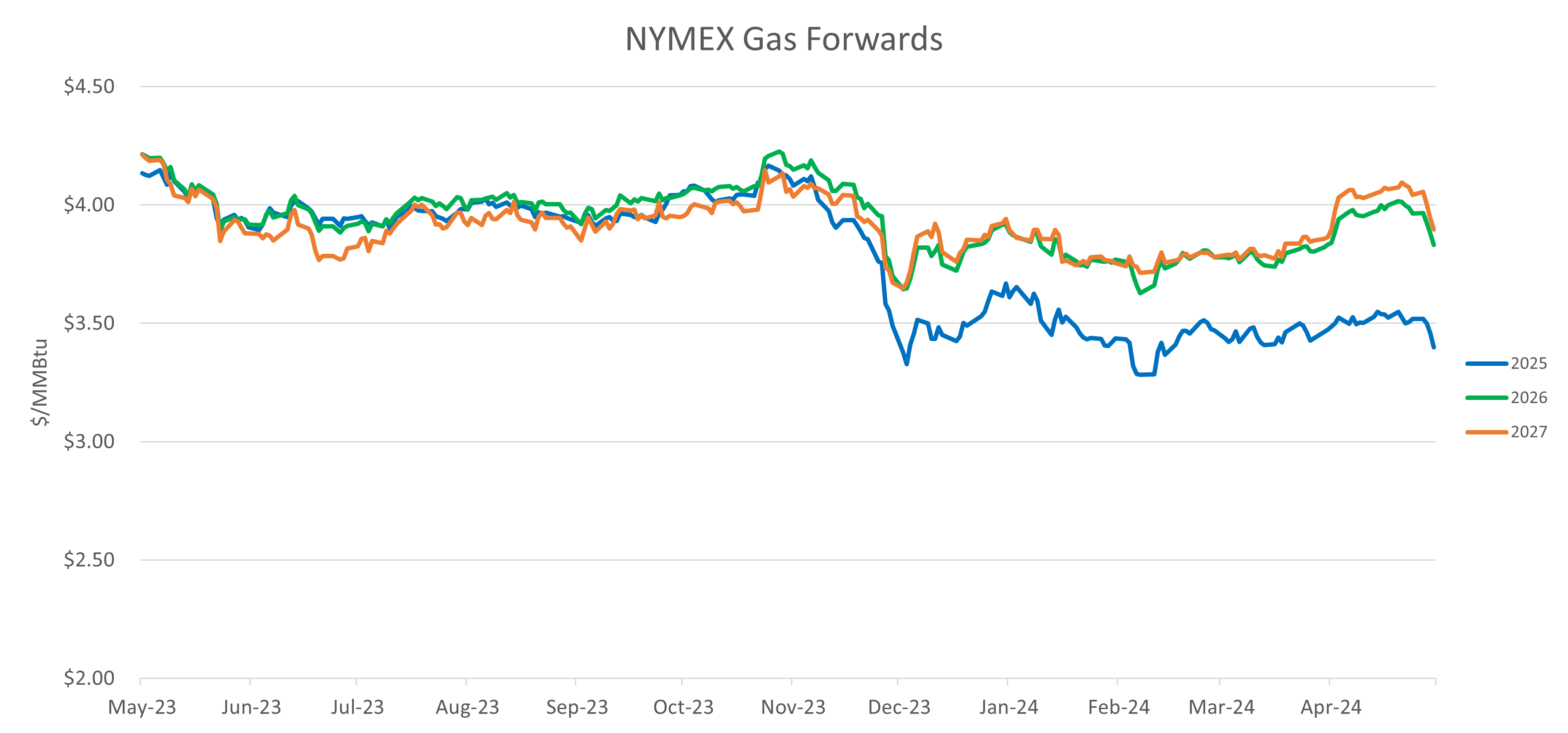

- NYMEX prices have now rebounded almost $0.30/MMBtu for the June contract after bottoming near $1.90/MMBtu last week. US production remains at or below 100 BCF/D and early signs of air-conditioning demand picking up in Texas and the southeast.

- Drilling activity in dry gas-focused basins remains subdued as producers re-allocate capital spending to more liquids-focused areas.

- Mountain Valley Pipeline’s final costs are expected to come in just under $8 billion, more than double the original estimate. The initial recourse rate came in around $0.97/MMBtu but will end up being closer to $2.0/MMBtu reflecting the doubling of the cost.

- Winter northeast basis has also been catching a bid lately, particularly up in New England as the Algonquin City-Gate basis for Jan/Feb-2025 has rallied from $6.20/MMBTU to $8.60/MMBtu.

- The oil price rally has taken a breather as inventory builds increased and demand projections out of China proved disappointing.

- Tanker traffic through the Panama Canal and the Red Sea continues to be almost non-existent forcing companies to pay much higher overall rates to compensate for the longer trips to deliver cargoes.