April 2, 2024

It is no secret that coal will continue to be the foundation of power supply in China and India as both countries subordinate climate concerns to supply availability and security. If the United States CO2 emissions suddenly dropped to zero the global impact, while welcomed, would not be enough to offset the projected growth in coal-generated emissions coming from Asia.

Market Drivers

Energy Market Update

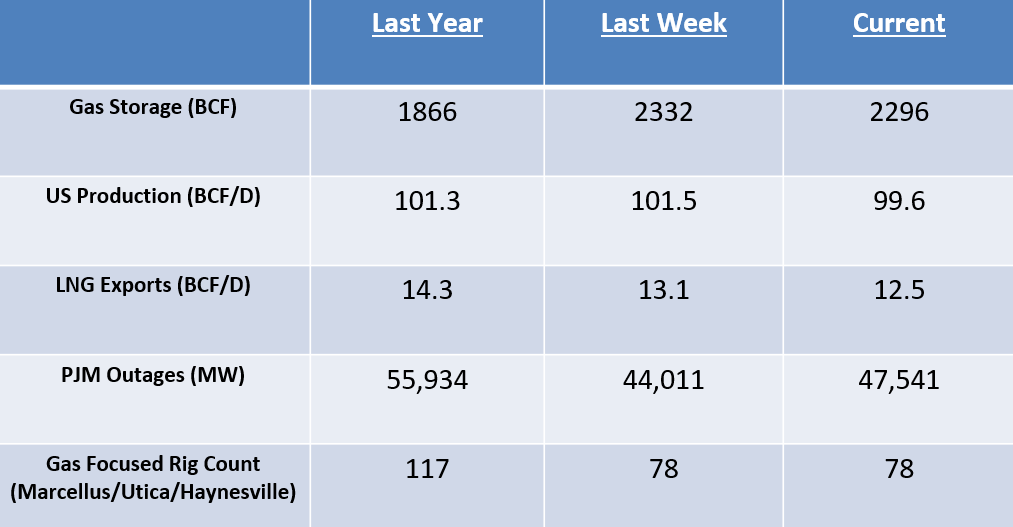

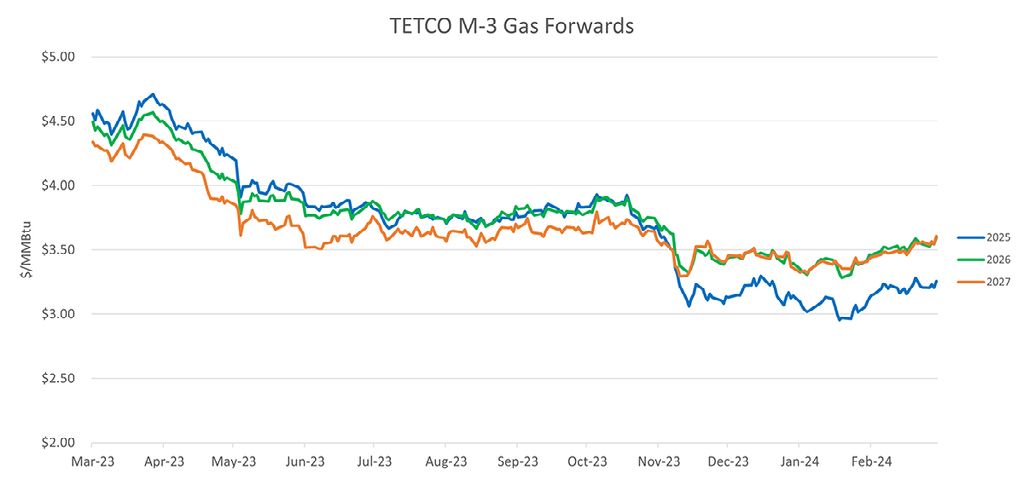

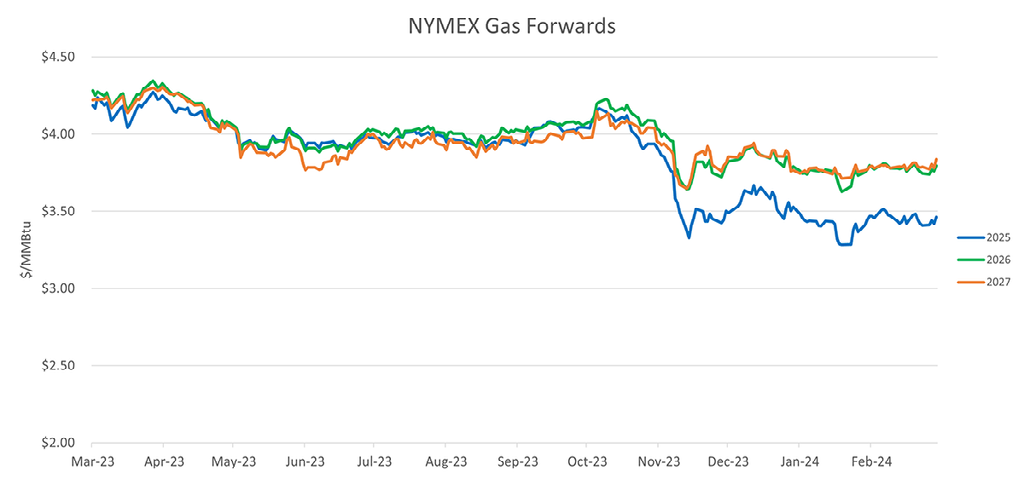

- US natural gas production reported for today has fallen below 100 BCF/D as producers try to choke back production during this low-price environment. Colder weather has provided a bit of a respite as there is enough around to defer injections and help minimize storage congestion risks later in the Fall.

- Oil prices continue to rally as global demand remains strong and product inventories are historically low heading into the US driving season.

- Global LNG demand remains robust as deliveries to Asia have increased 12% year-over-year primarily due to fuel switching economics. With sub $10/MMBTU delivered prices spot cargoes are having a much easier time finding a home.

- Haynesville active drilling continues to decline as break-even NYMEX prices for most operators in the basin are above $2.5/MMBTU. Natural field declines coupled with maintenance and field shut-ins will help keep the market better balanced while reducing (not yet eliminating) the possibility of storage congestion later in the Fall.

- The upcoming solar eclipse (April 8) will create some interesting power supply and hourly pricing volatility as it traverses across the US that afternoon.

- The recent White House driven pause in LNG permitting has been challenged by a group of 16 states who believe this delay will cause potential buyers to entertain contracting with non-US supplies.

- Smaller wind and solar generators may become subject to NERC reliability standards if approval from FERC is received as is sought in the recent March 19 filing.