March 27, 2024

I admit it! I am a Trekkie and love the old episodes of my youth, particularly the banter amongst and between the main characters. “We need more power” has probably been quoted millions of times under a plethora of unique contexts, which always seems to engender laughter. Recently, this need for more power has morphed well beyond the humorous warp engine analogy and into an uncomfortable reality of actually needing the power.

Market Drivers

Energy Market Update

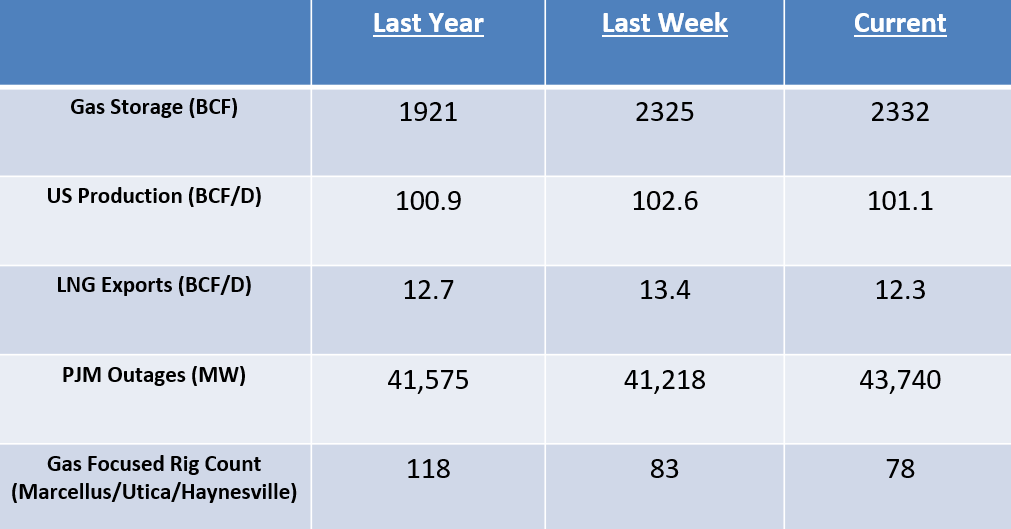

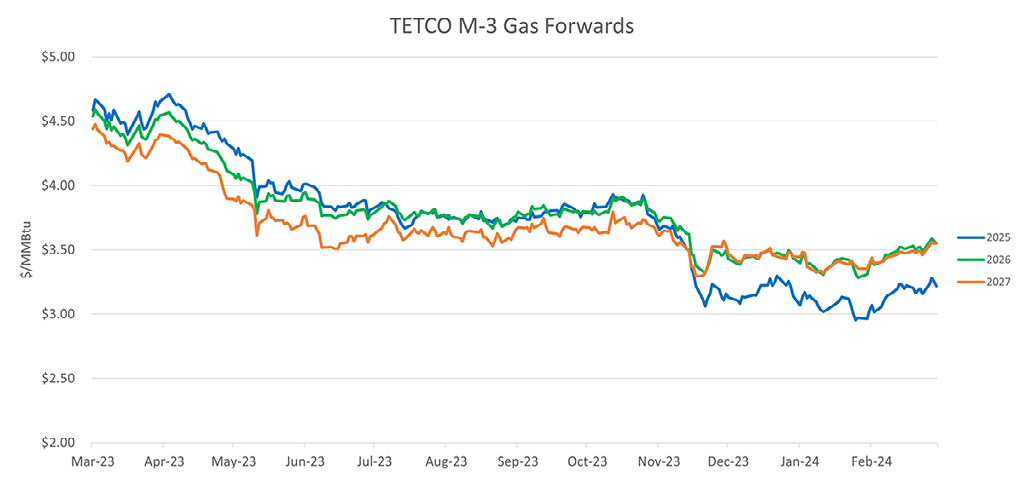

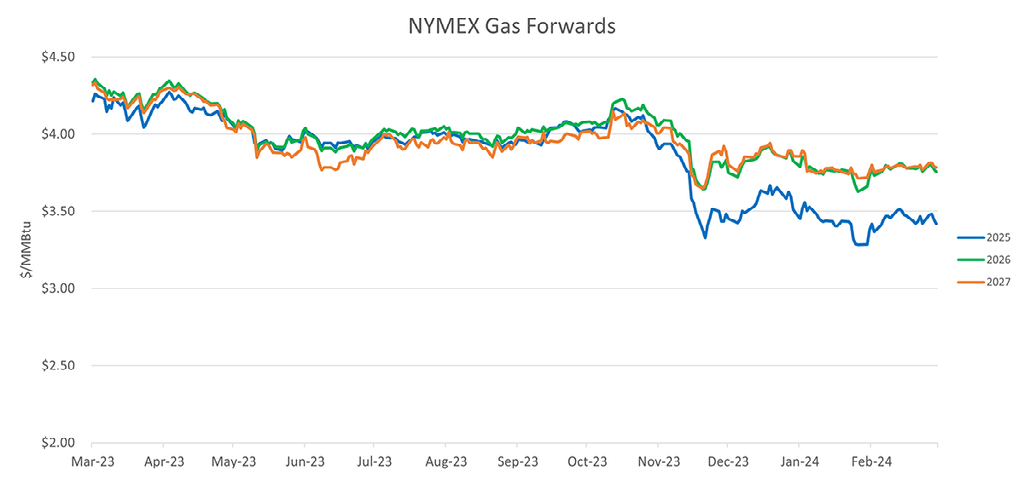

- Production has now dropped to levels seen a year ago through a combination of natural declines and choked-back production. Producers appear to be exhibiting the necessary discipline to mitigate the likelihood of storage congestion and Mother Nature is helping with just enough cold weather to defer large-scale injections.

- Oil price strength continues as global demand led by India and China remains robust while inventories led by unleaded gasoline continue to deplete. Both Brent and West Texas Intermediate are solidly above $80/BBL as global jet fuel demand is also supporting prices while OPEC spare capacity is seen as providing a soft cap should prices continue to extend past $90/BBL.

- Refinery issues/availability after recent disruptions due to the successful use of drone attacks by the Ukrainians has left diesel supplies particularly tight and is adding (no pun intended) fuel to the oil fire.

- In a previous summary I had incorrectly stated that Haynesville production had approached 15 BCF/D when in fact it had recently peaked at just over 12 BCF/D. The Haynesville rig count has continued to drop and production has reacted accordingly due to this and seasonal maintenance leaving production down closer to 10 BCF/D.

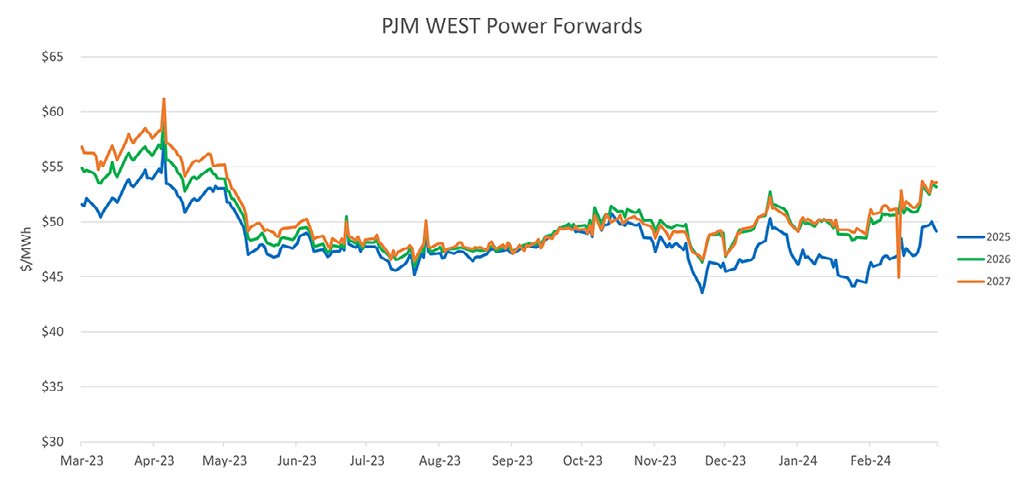

- Power demand forecasts recently seen in multiple utility IRP’s are being universally revised upward due to strong industrial demand (on-shoring), data center growth, and stronger GDP expectations.

- The EPA’s Good Neighbor Rule would require interstate pipelines to retrofit over 1000 large compressor stations to reduce nitrous oxide emissions. The potential impact on power/gas integration and reliability given the time constraints is being reviewed.