March 12, 2024

“The shale revolution began roughly 14 years ago and since then drilling and completion technology has continued to advance to where today we have horizontal laterals, advancing 3 miles from a central pad thus unlocking more hydrocarbon-bearing rock and juicing production...”

Market Drivers

Energy Market Update

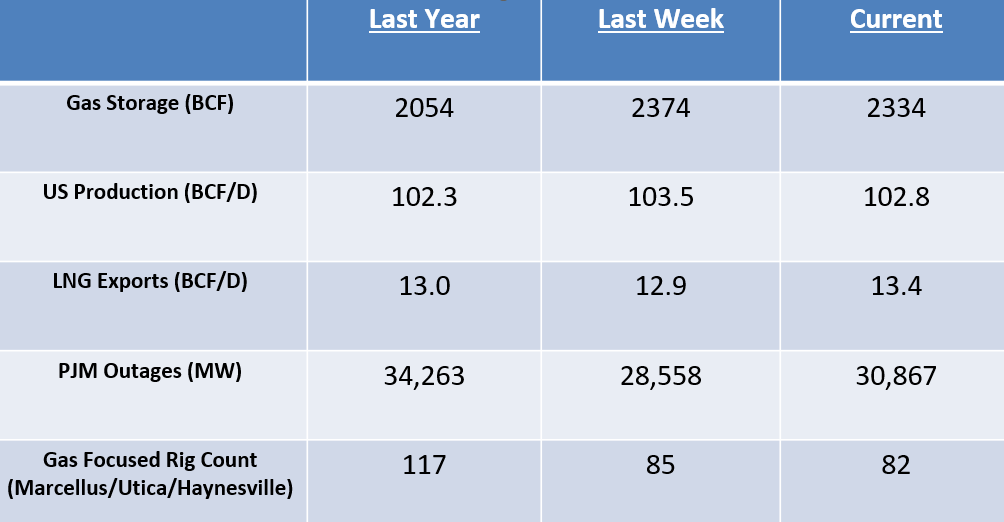

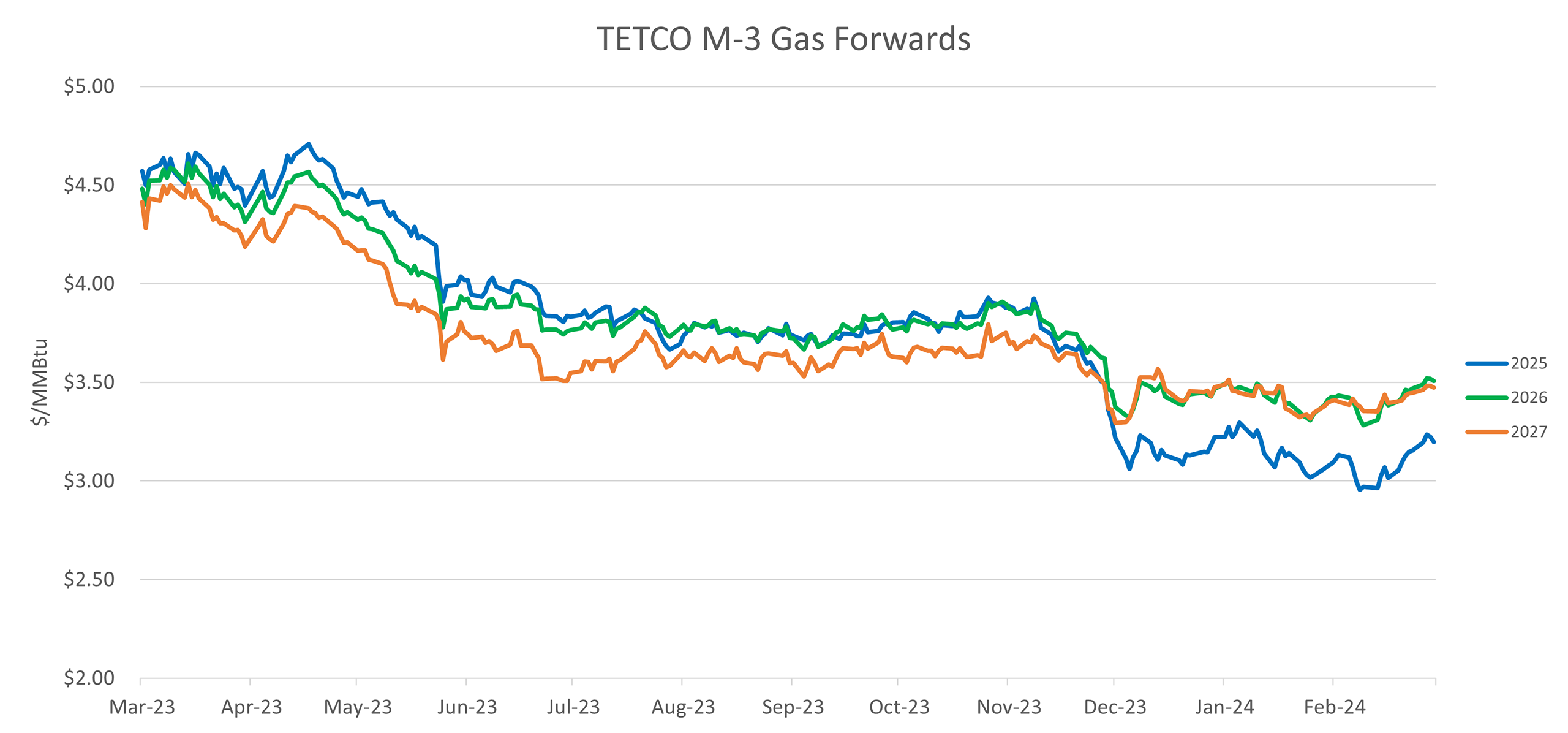

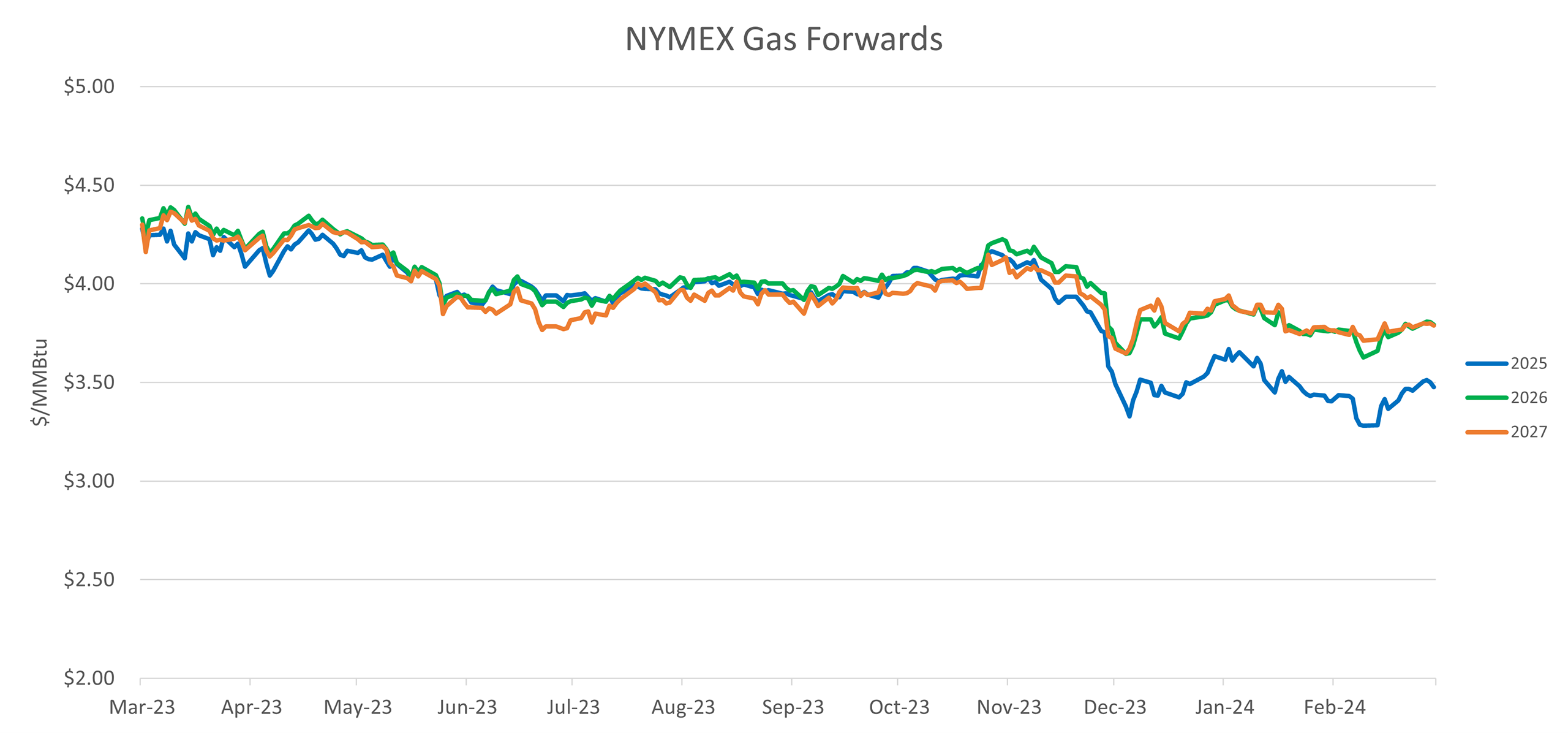

- US gas production continues to trend lower either through a combination of natural declines in shale deliverability and/or production curtailments from several large producers.

- Storage inventories are likely to end this season at or near record levels above 2.2 TCF. Exiting winter with this much gas still in storage will likely continue to keep prices in check and force producers to manage production growth to avoid congestion issues in October.

- After divesting Equitrans Midstream in 2018, EQT announced today it is re-acquiring the company for $5.8 billion. Equitrans is the owner/operator of the soon-to-be commercial Mountain Valley Pipeline along with other strategic pipeline assets in Appalachia which gather and transport a significant portion of EQT’s production.

- LNG demand over the summer could surprise to the upside given drought conditions in several key hydro-electric dominated and the current price competitiveness of LNG against alternate fuel sources.

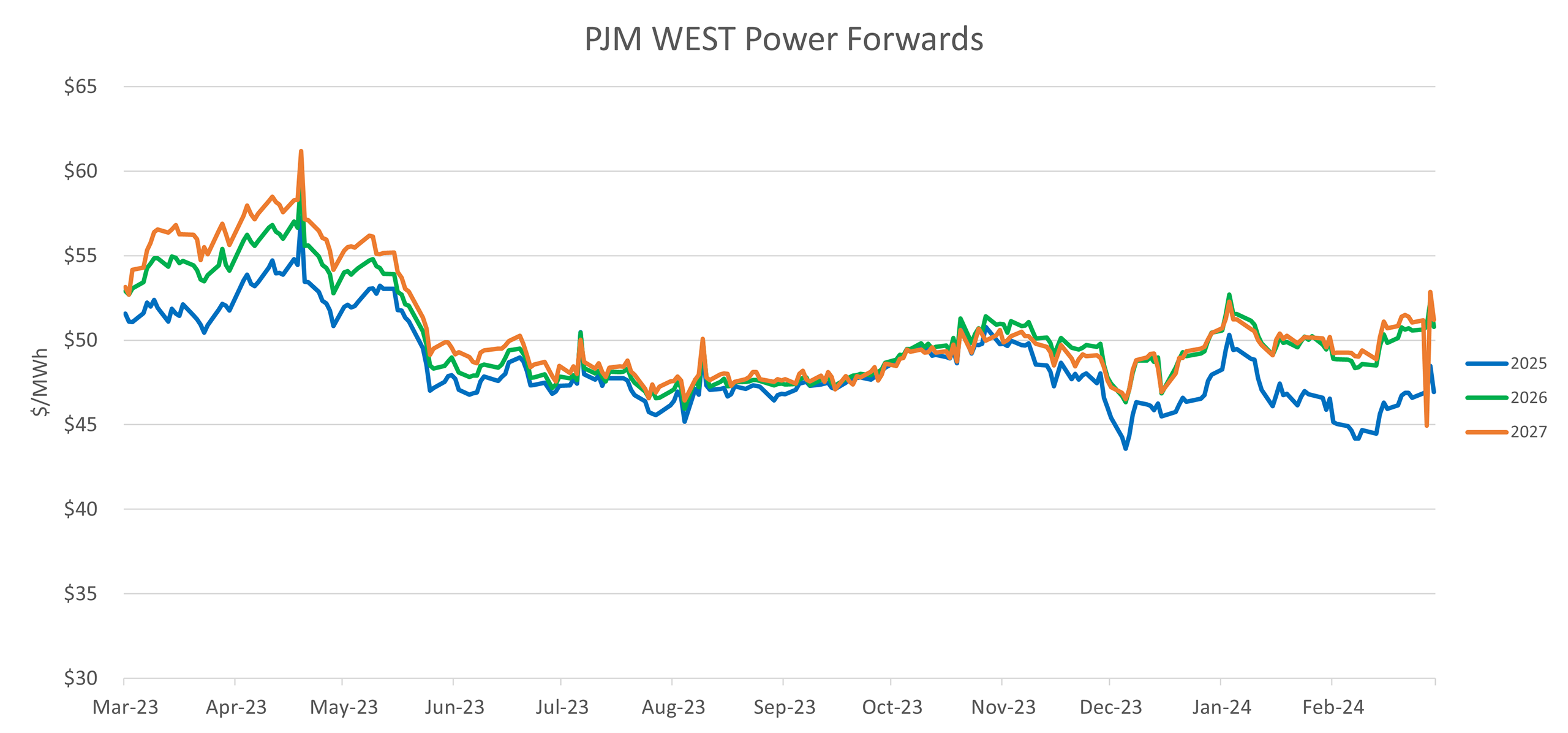

- Oil prices rallied this past week as West Texas Intermediate traded back above $80/BBL on the back of continued distillate and unleaded gasoline inventory withdrawals. With the expected growth in non-OPEC production, the market looks balanced between supply and demand although, with the continued unrest in the Middle East, the fear premium remains muted.