March 5, 2024

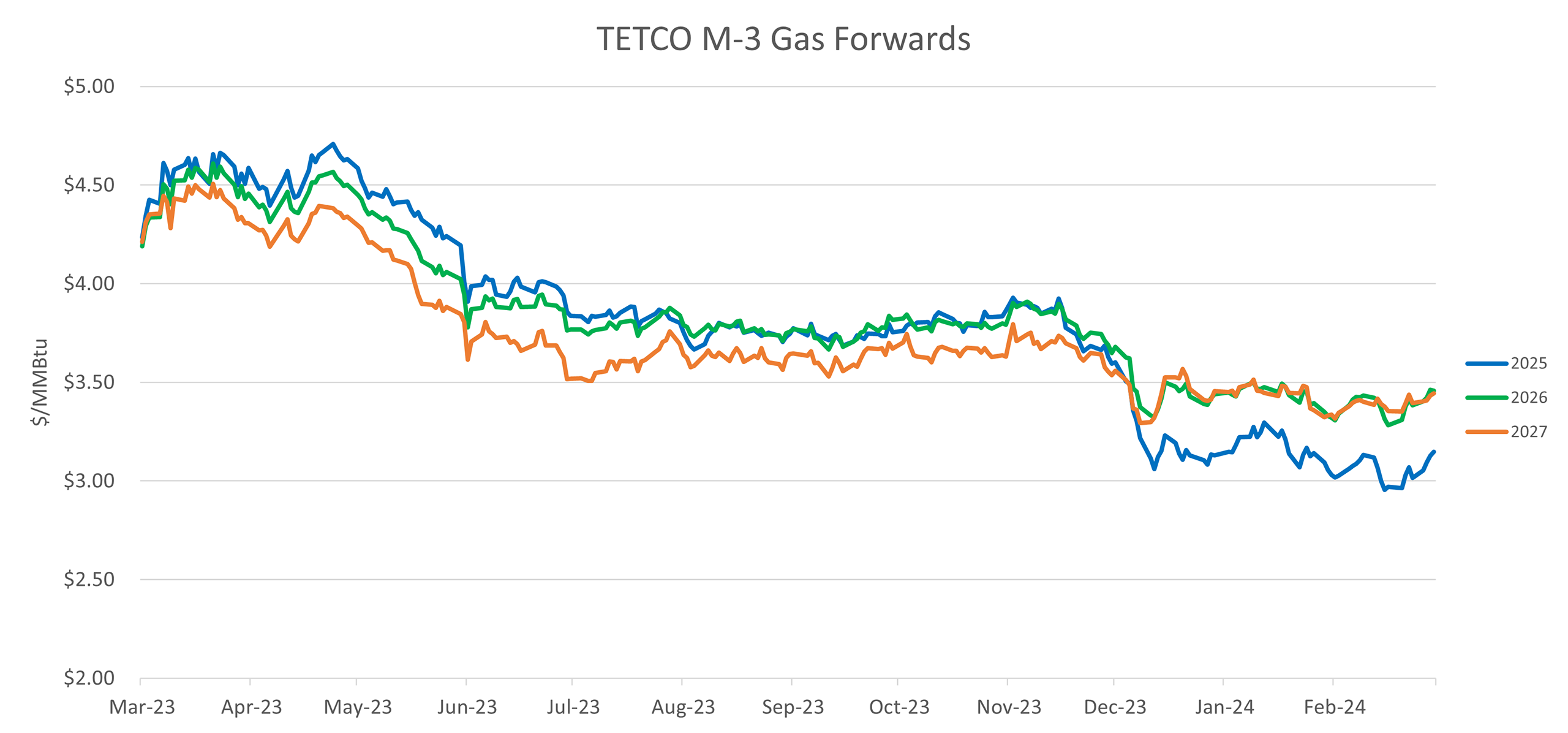

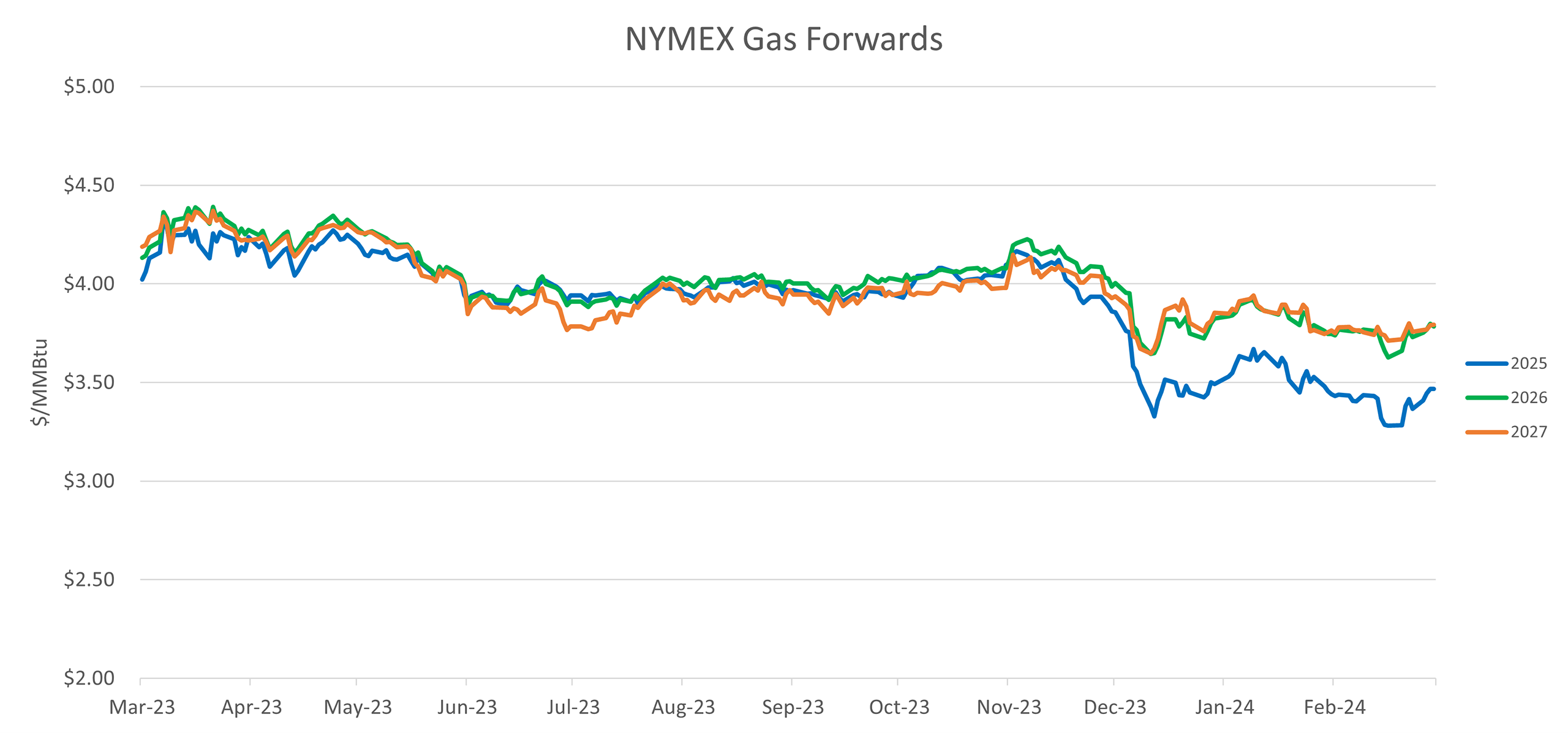

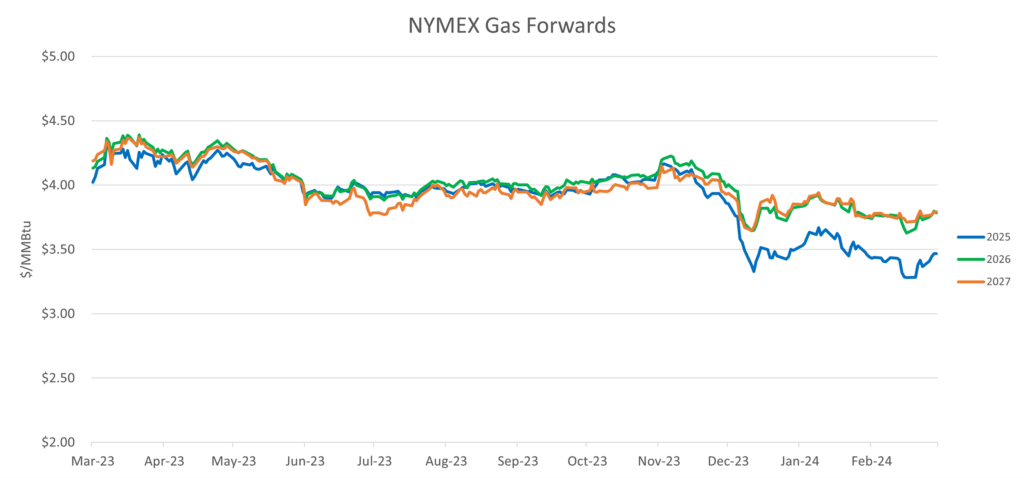

“Record low natural gas prices are currently being seen pretty much across the board in North America as the mild winter leaves storage inventories precariously high. However, it is not just the weather that has led us to this point…”

Market Drivers

Energy Market Update

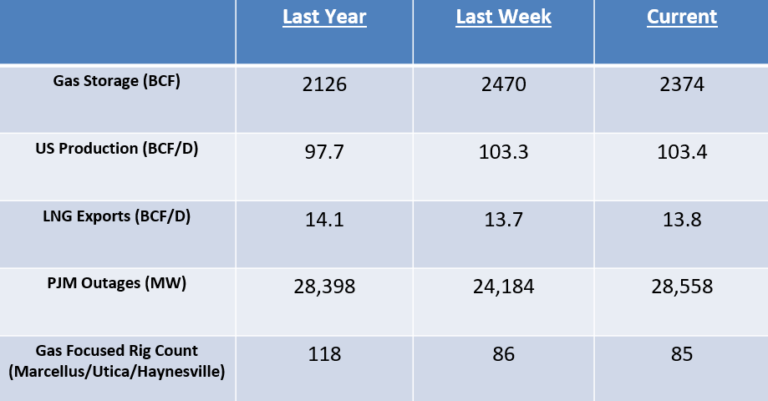

- US natural gas production averaged approximately 103 BCF/D over the past week as several producers announced production cuts/deferrals. EQT announced this morning that it would cut 1 BCF/D starting immediately which motivated a NYMEX rally led by April which is now trading just under $2.0/MMBTU, up 15 cents on the day.

- The March NYMEX contract settled last week at $1.615/MMBtu after setting multiple inflation-adjusted all-time lows heading into the last day of trading. With the EQT news today the April contract is now up almost $0.40/MMBtu after also hitting a low of $1.61/MMBtu.

- Oil prices have rallied back towards $80/BBL as product inventories like unleaded and distillates need to be re-built and the risk of an upset in the Middle East continues to percolate.

- Increased demand for spot LNG cargoes in Asia has helped reduce floating storage as prices below $9.00/MMBtu seemed to produce more aggressive bids.

- Mild weather is continuing to adversely impact pricing and normal storage injection/withdrawal patterns as injections are likely to be seen starting the week of March 15 instead of seasonal norms which are sometime in April. Prices will have to incentivize additional demand which means they stay lower for longer.