CPV Retail Website Redesign

We are excited to announce the redesign of the CPV Retail website. Our new site features the latest news, market trends, and insights from our CPV Retail experts. Learn about our innovative energy solutions and request your free carbon footprint report.

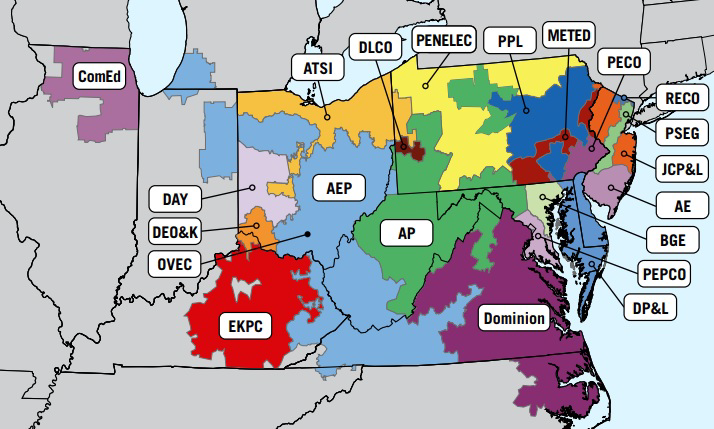

PJM Regulatory Review

Additional Agenda Items

- PJM continues to work closely with ISO-NE, MISO, and SPP and has put forward recommendations to improve gas-electric cooperation and coordination. Progress will only be made with regulators at the state and federal levels collaborating and working towards improved reliability and efficiency.

- These initiatives are focused on increasing gas market liquidity and allowing for additional scheduling flexibility, especially during long holiday weekends where static 4-day nominations have proven too restrictive.

- PJM received FERC approval for its recently filed request to further delay the next BRA by 35 days which means the 2025/2026 capacity auction will take place starting in mid-July.

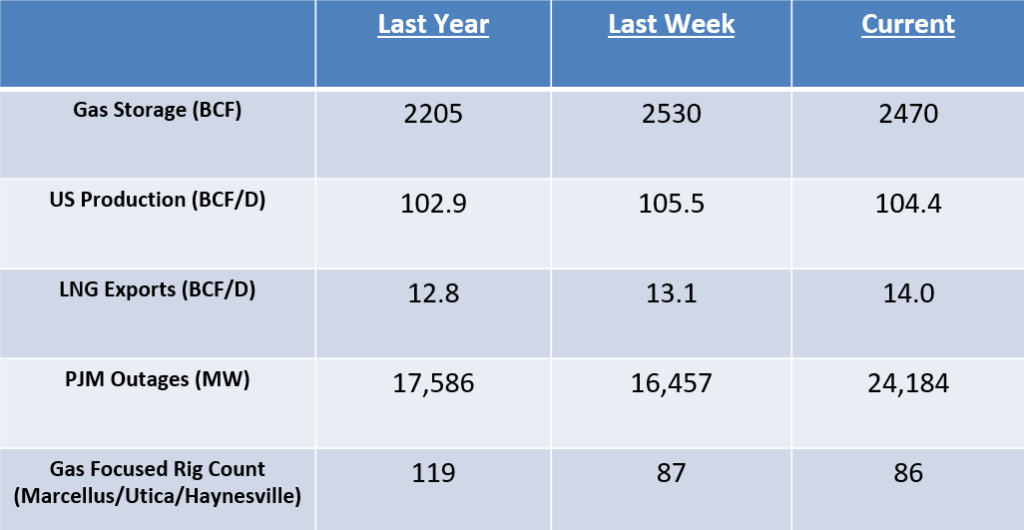

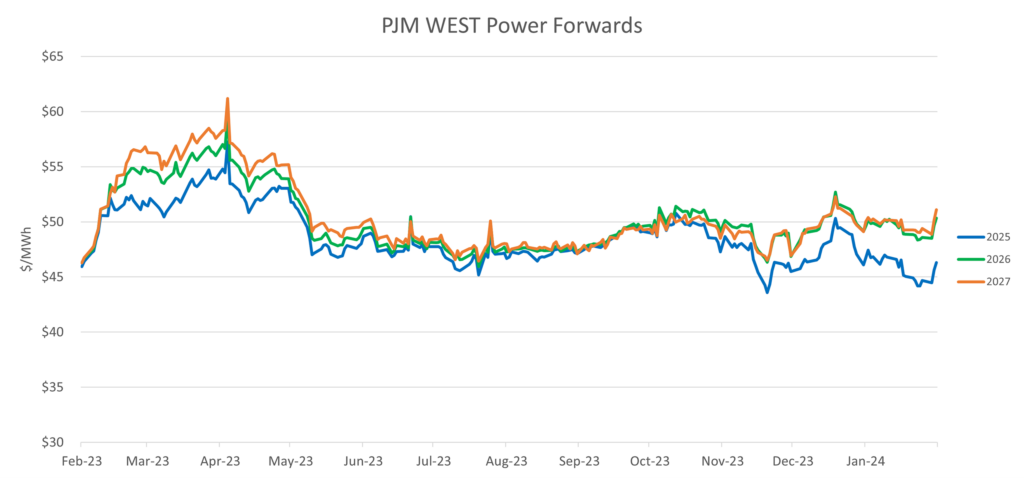

Market Drivers

Energy Market Update

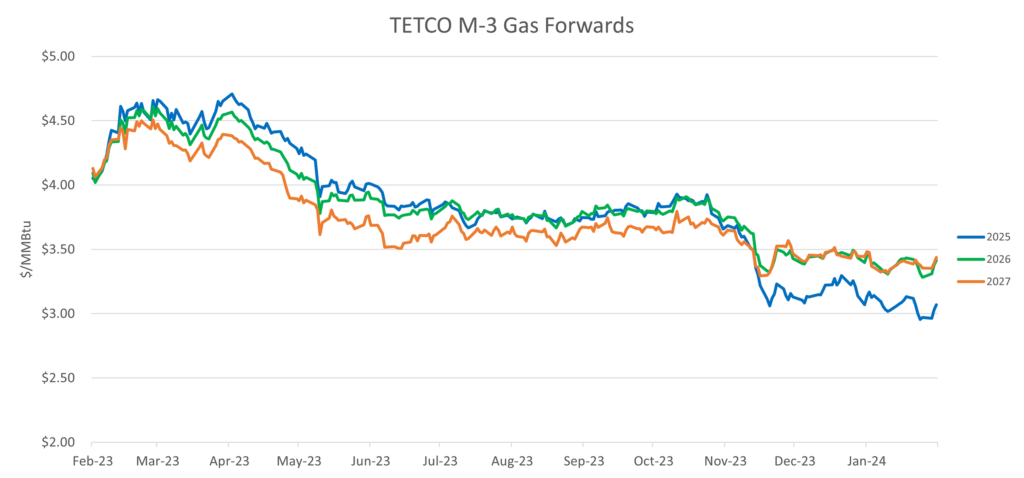

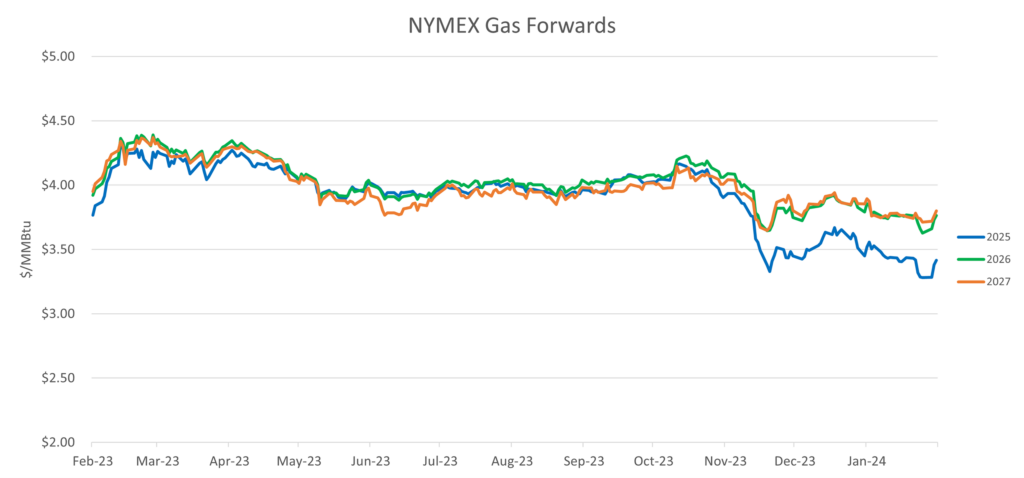

- US producers are finally starting to react to the recent sell-off in natural gas as the relentless bearishness exhibited by the forward market. Coterra, the former Cabot Oil and Gas, has reallocated capital from dry-gas-focused drilling in Northeast Pennsylvania to oil drilling in the Permian Basin. Coterra’s Marcellus gas production is expected to fall by 6% by the end of 2024.

- Qatar announced a further expansion of its LNG export capabilities which could add to a supply glut towards the end of this decade. With its initial expansion almost doubling its existing capacity, Qatar is betting on the continued acceleration of Asian demand for the super-cooled fuel and benefits by being the lowest-cost LNG supplier in the world.

- Oil prices continue to be supported by strong global demand as Brent prices sustain above $80/BBL and West Texas Intermediate (WTI) has stabilized above $75/BBL.

- The natural gas price sell-off has abated as March NYMEX traded below $1.60/MMBtu and cash prices remain even weaker with widespread warmer weather. Production has rebounded from the January freeze-offs and is now back to record levels above 105 BCF/D.

- Global LNG prices continue to suffer the same fate as US gas prices as they have sold off based on too much supply and not enough cold weather. European storage will exit winter at record levels leaving little room for flexibility during the upcoming injection season.

Potpourri Comments

The prognosticators have been out in full force predicting the end to the fossil fuel demand growth era given the expected expanded adoption of renewables in the power grid, as well as the growth of electric vehicles particularly in China.

Peak oil demand has been predicted for several years and continues to be debated by those with interest in seeing long-term demand sustained like OPEC, and those who have a special level of detestation for anything related to fossil fuels like the IEAE. Global demand for oil today is roughly 102 million B/D which interestingly enough is almost exactly how much oil the world is producing. Virtually all of the oil demand growth is coming from China, albeit they are slowing down, and India which is experiencing rapid demand growth as its economy continues to impress with its resiliency and flexibility.

China and India are clearly the growth engines for fossil fuel demand and they are also on a massive coal-fired generation expansion program. They are adding new coal capacity at a clip that far exceeds the US coal fleet retirement pace and look to continue to consume copious amounts of coal for many years.

When all of these factors are taken into account and the fact that modern civilization is only made possible by the efficient conversion of oil, natural gas, and coal into electric power and other critical consumables that the global community depends on. It does not seem likely that the end of fossil fuel demand is coming any time soon and this should give pause to those saying we need to stop investing in upstream assets that produce energy commodities. Please let CPV Retail help you develop a comprehensive procurement strategy in these challenging times.