CPV Retail Website Redesign

We are excited to announce the redesign of the CPV Retail website. Our new site features the latest news, market trends, and insights from our CPV Retail experts. Learn about our innovative energy solutions and request your free carbon footprint report.

PJM Regulatory Review

Additional Agenda Items

- PJM has petitioned FERC for a further delay in the previously scheduled June/2024 capacity auction for the 2025/2026 delivery year. The requested 35-day extension is meant to allow both PJM and affected constituents more time to review proposed modifications to the Effective Load Carrying Capabilities (ELCC) calculations. The market seems to be waiting patiently for this critical auction to occur, which will go a long way in determining whether new investments in thermal resources will be more likely.

- The New Jersey Board of Public Utilities issued an order demanding nuclear plant owners/operators cease charging customers for Zero Emissions Credits (ZECs) since federal subsidies are available.

- An updated informational filing discussing PJM’s interconnection process reforms indicated that as of December 31, 2023, PJM had almost 2800 active projects in the queue totaling 181 gigawatts of proposed new generation.

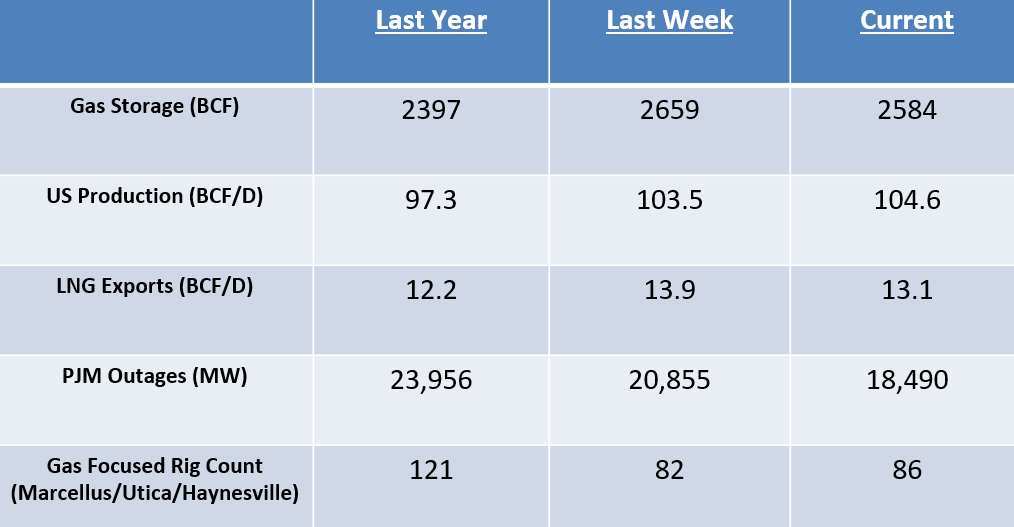

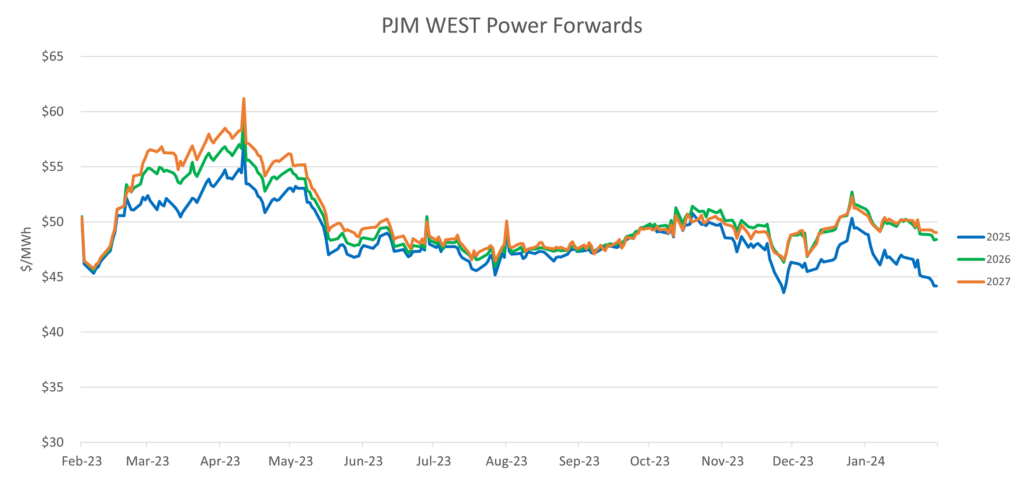

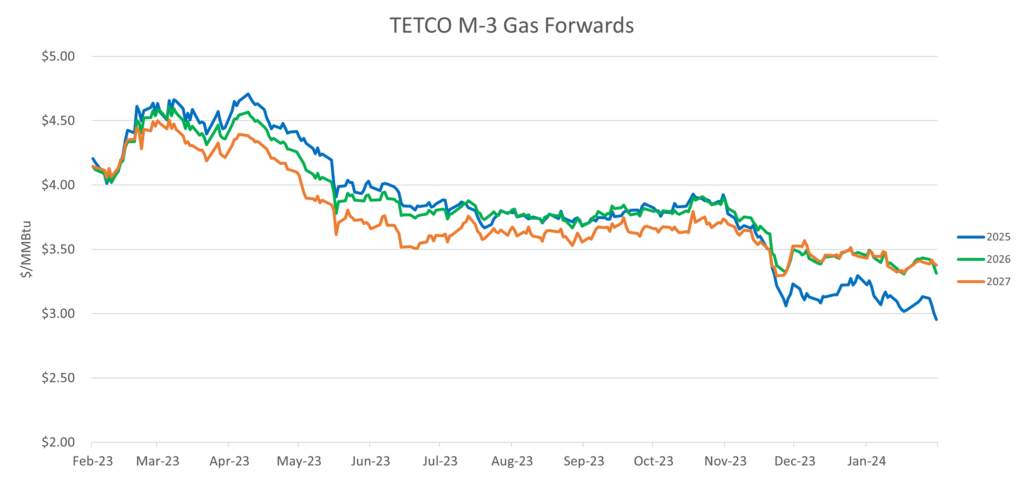

Market Drivers

Energy Market Update

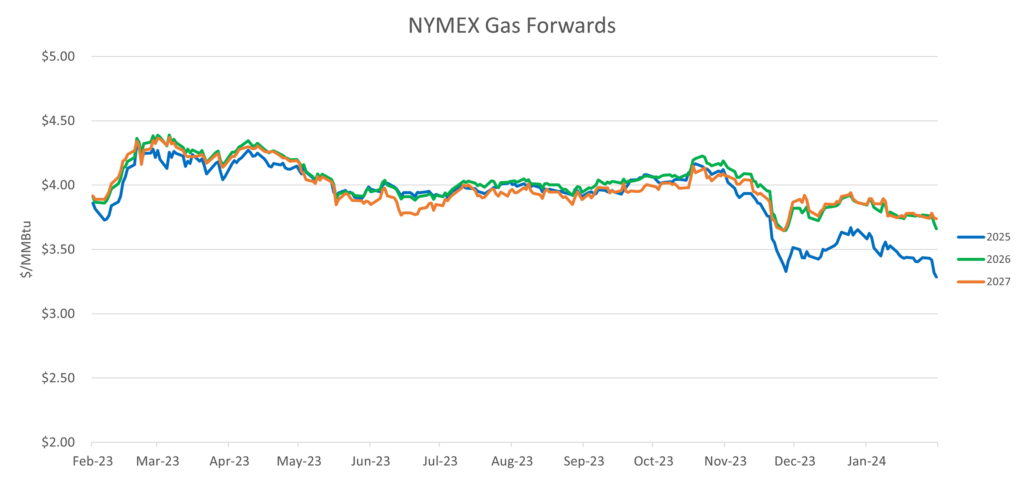

- In real dollar terms NYMEX prices are at all-time lows going back to the initial Henry Hub financial trades in 1990. The prompt month March/2024 contract is now trading below $1.60/MMBtu as the end of winter’s withdrawal season is right around the corner with very little optimism for enough cold weather apparent.

- Last week’s withdrawal of only 49 BCF continues the trend of historically weak storage utilization and leaves both Canada and the United States with a severe excess inventory overhang heading into the shoulder season. Even with maximum coal-to-gas switching the possibility of storage congestion occurring into the Fall continues to increase as delays in new LNG export terminal commercial operations and lack of production declines create a bearish confluence. Sub $1.00/MMBtu cash prices are likely at AECO, WAHA, and Marcellus.

- Refinery seasonal turnaround delays are helping crude inventories build while products like distillates and unleaded gas continue to see heavy draws which is helping support oil prices.

- The FERC continues its efforts to support the growth and integration of offshore wind with the recent approval of rate incentives for a large transmission project to help the state of New Jersey’s de-carbonization goals. A new 230-kV substation will be required and owned by Jersey Central Power & Light.

- Global LNG prices are at risk of trading down to levels that could put US exports at risk over the coming summer unless low prices can incentivize a pick-up in demand.

- Consolidation continues in the Permian Basin as Diamondback announced the purchase of privately held Endeavor for roughly $26 billion to continue to add Tier I acreage to its existing portfolio of drilling locations. The combined company after merging will be producing just over 800,000 BOE.

Potpourri Comments

Current natural gas prices are at lows not seen in thirty years and on an inflation-adjusted basis are certainly at or near record lows. The stretch of above-normal temperatures seems unabated with even the weather forecasters are now reluctant to call for any cold that has failed to appear after multiple calls for colder and snowy conditions.

Canadian production remains at all-time highs in preparation for the start of Canada’s first LNG export terminal on the coast of British Columbia. US production has rebounded after the January freeze-offs and now seems like Secretariat at the Belmont where it is running unabated like a powerful engine. Haynesville active drilling rig count has dropped by 40% in a year, yet production has remained strong as producers have looked to their DUC (drilled/uncompleted) inventories to maintain production.

With West Texas Intermediate approaching $80/BBL the Permian Basin will continue to grow associated gas production at virtually any natural gas price given 60% returns from the oil. Have we once again drilled ourselves into poverty with unhedged production not economic at current levels? Gas-only producers have already started to conserve cash by suspending dividends on their stock which now appears as a luxury.

The current oversupply will not be solved quickly as there is simply too much-existing inventory which will need to be worked off to make any room for flowing gas supplies. Balance of summer Marcellus gas is selling for $1.20/MMBtu which is well below levels for sustained profitability. There will always be opportunities even in these bear market days so potential retail buyers will be able to selectively pick up longer-term supplies at advantageous prices. This is where close consultation with the CPV Retail Team provides advantages as we look to guide buyers through a variety of options. Let’s talk!