CPV Retail Website Redesign

We are excited to announce the redesign of the CPV Retail website. Our new site features the latest news, market trends, and insights from our CPV Retail experts. Learn about our innovative energy solutions and request your free carbon footprint report.

PJM Regulatory Review

Additional Agenda Items

- PJM has been asked by multiple interested parties to hire an independent consultant who would be tasked with evaluating capacity market alternatives, especially as it relates to a “more granular commitment period.”

- PJM has also reiterated its intent that the BRA is scheduled for June for the 2025/2026 delivery year. The auction is scheduled to open on June 12.

- Willie Phillips has been named Chairman of FERC by the White House. He crossed the word “Acting” from his title.

Market Drivers

Energy Market Update

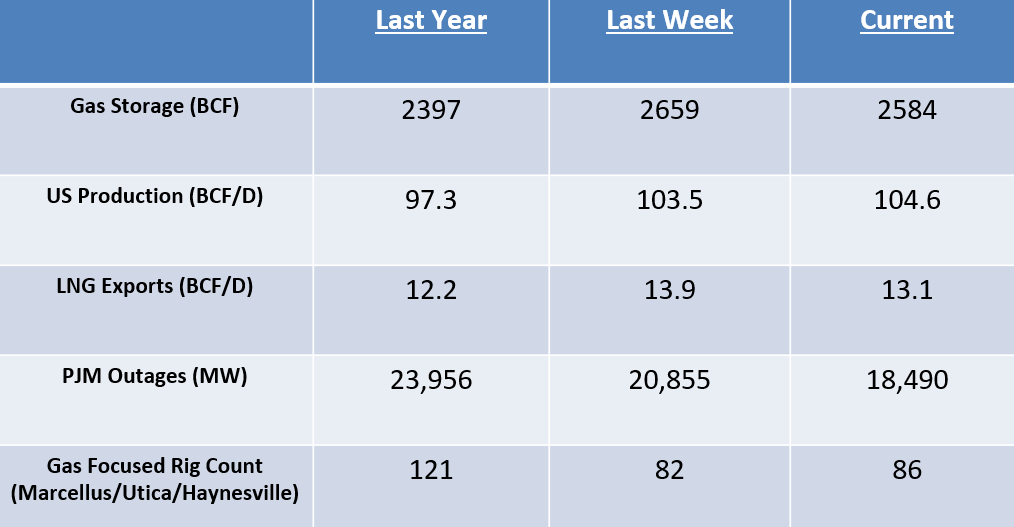

- Calls for colder weather continue to disappoint as the influence of Pacific Ocean air continues to block any significant intrusions of Arctic weather into the population centers along the east coast of the United States.

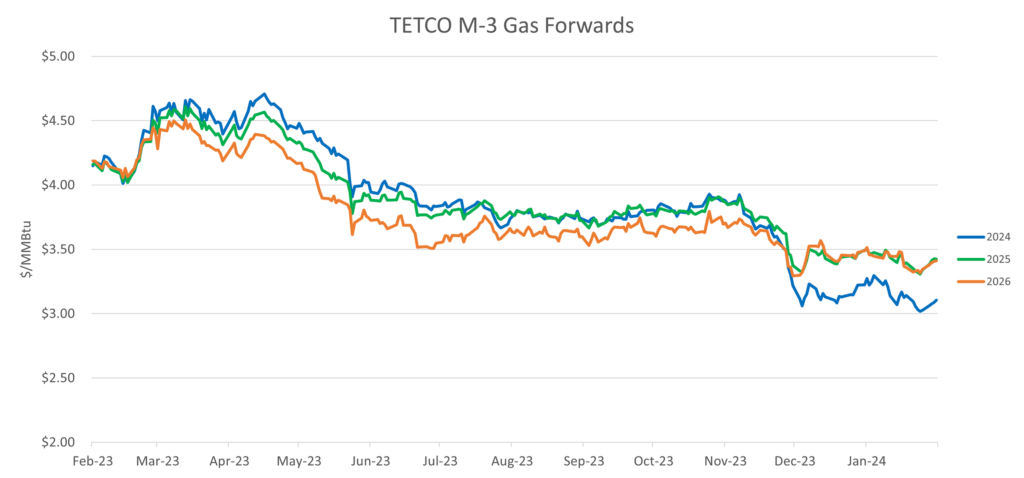

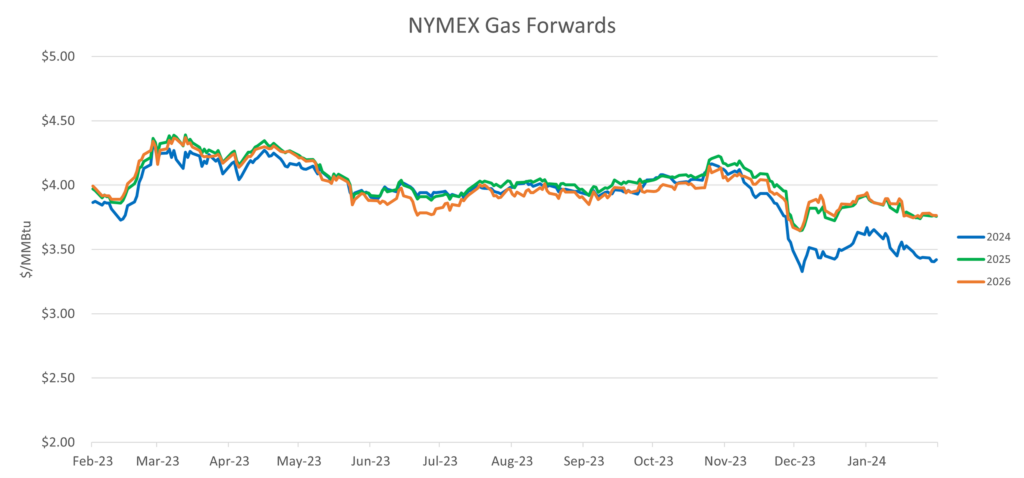

- NYMEX prices continue to sell off under pressure from virtually all segments of the industry as producers who came late to hedging participate in selling strips out through the balance of 2024. With the prompt month of March NYMEX now trading well below $2.0/MMBTU ($1.787/MMBTU), the severe contango continues to support the conviction of an over-supplied market with production at 105 BCF/D.

- Global LNG prices continue to languish as low demand and robust supply work together to contain both price and volatility in Europe and Asia. Even with Houthis missile threats and LNG tankers facing longer travel the lack of prolonged cold weather is the main driver of price declines.

- Consolidation continues in the Permian Basin as Diamondback announced the purchase of privately held Endeavor for roughly $26 billion to continue to add Tier I acreage to its existing portfolio of drilling locations. The combined company after merging will be producing just over 800,000 BOE.

Potpourri Comments

Global oil markets seem to most observers well supplied and prices look to be contained with Brent now trading around $81/BBL, while the US benchmark of West Texas Intermediate (WTI) trading around $77/BBL. Continued fears about a possible recession and associated weak demand have trumped pretty much all the bullish sentiment caused by the continued unrest in the Middle East. However, anecdotal evidence permeating out in the ether seems to point to continued robust demand with several of the more vocal prognosticators increasing their 2024 demand forecasts.

Given the 100 million BBL/D market, it only takes a small percentage increase in demand at the margin to effectively tighten inventories further and thus make any potential supply disruption even more impactful. There is also the seasonality factor which might be misunderstood as January manifests a normal tendency for looser supply which should not be mistaken for fundamental weakness.

As we exit the winter, we should expect to see demand increases and more pressure on inventories, especially given the low level of inventories at Cushing, Oklahoma which is the delivery point for NYMEX traded barrels. It is also problematic to expect the United States to add to the current 13.3 million B/D of production given the drilling rig count, and any type of supply disruption caused by international events could lead to a quick escalation in prices.

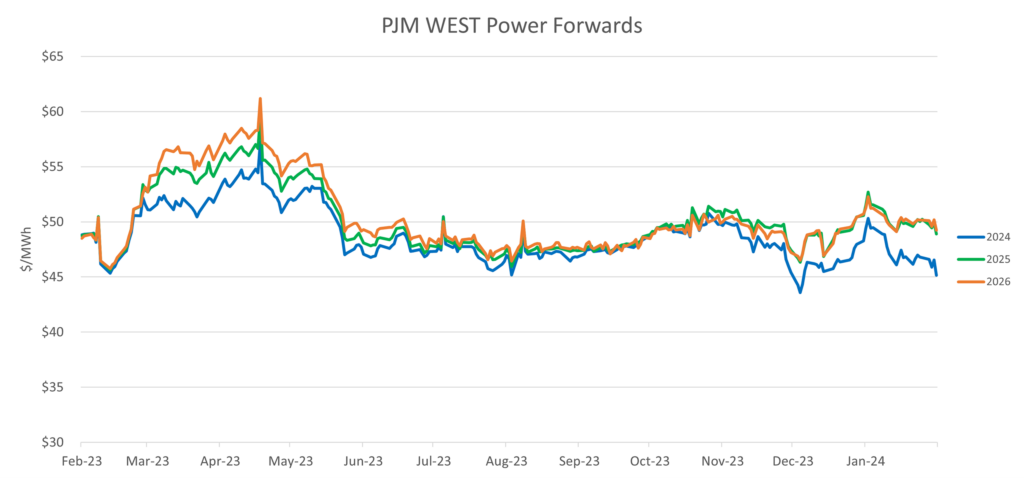

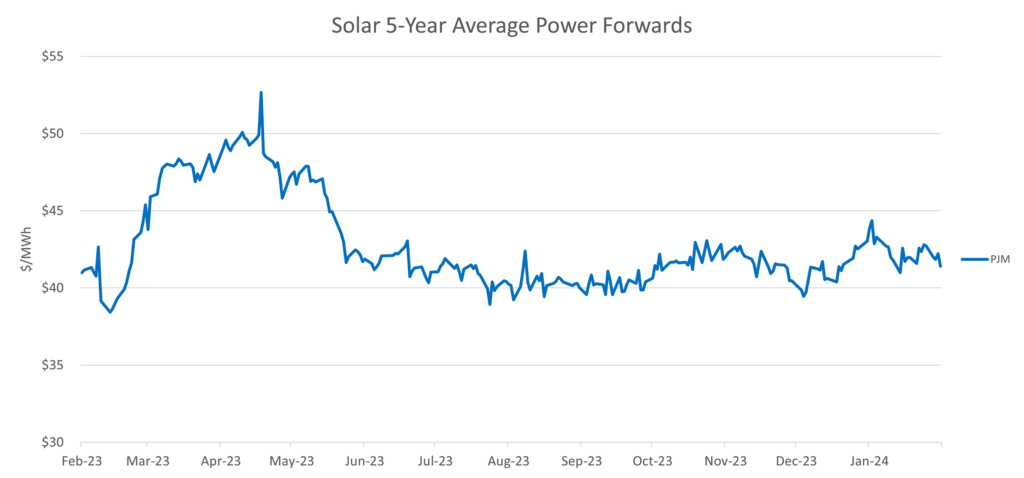

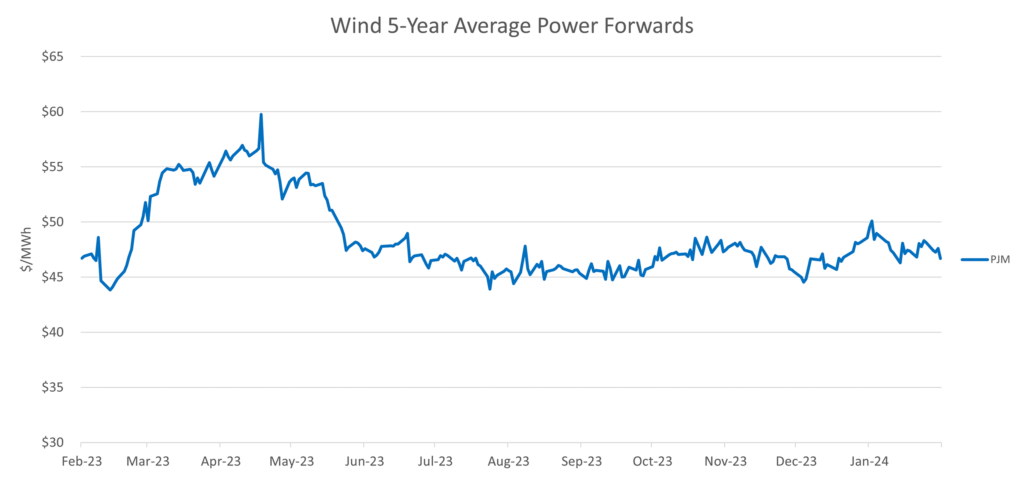

Complacency reigns supreme until it doesn’t and given all this potential volatility the bears should be careful and employ prudent risk management tools. CPV’s Retail Energy Team is ready to discuss pricing flexibility and options for your portfolio of assets, so let us help you take advantage of these lower power prices driven by a decline in Natural gas.